Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RMI homework 3. (10 points) Margaret is starting a life insurance company. She wants to insure only those people who would be very highly rated

RMI homework

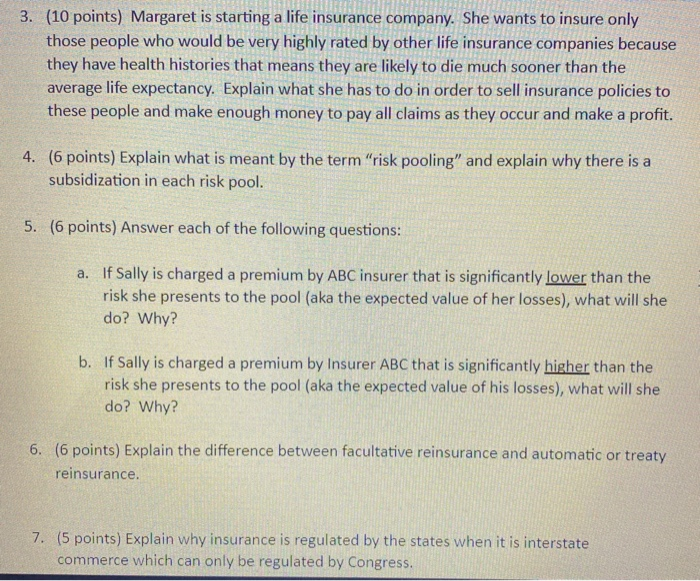

3. (10 points) Margaret is starting a life insurance company. She wants to insure only those people who would be very highly rated by other life insurance companies because they have health histories that means they are likely to die much sooner than the average life expectancy. Explain what she has to do in order to sell insurance policies to these people and make enough money to pay all claims as they occur and make a profit. 4. (6 points) Explain what is meant by the term "risk pooling" and explain why there is a subsidization in each risk pool. 5. (6 points) Answer each of the following questions: a. If Sally is charged a premium by ABC insurer that is significantly lower than the risk she presents to the pool (aka the expected value of her losses), what will she do? Why? b. If Sally is charged a premium by Insurer ABC that is significantly higher than the risk she presents to the pool (aka the expected value of his losses), what will she do? Why? 6. (6 points) Explain the difference between facultative reinsurance and automatic or treaty reinsurance. 7. (5 points) Explain why insurance is regulated by the states when it is interstate commerce which can only be regulated by Congress Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started