Answered step by step

Verified Expert Solution

Question

1 Approved Answer

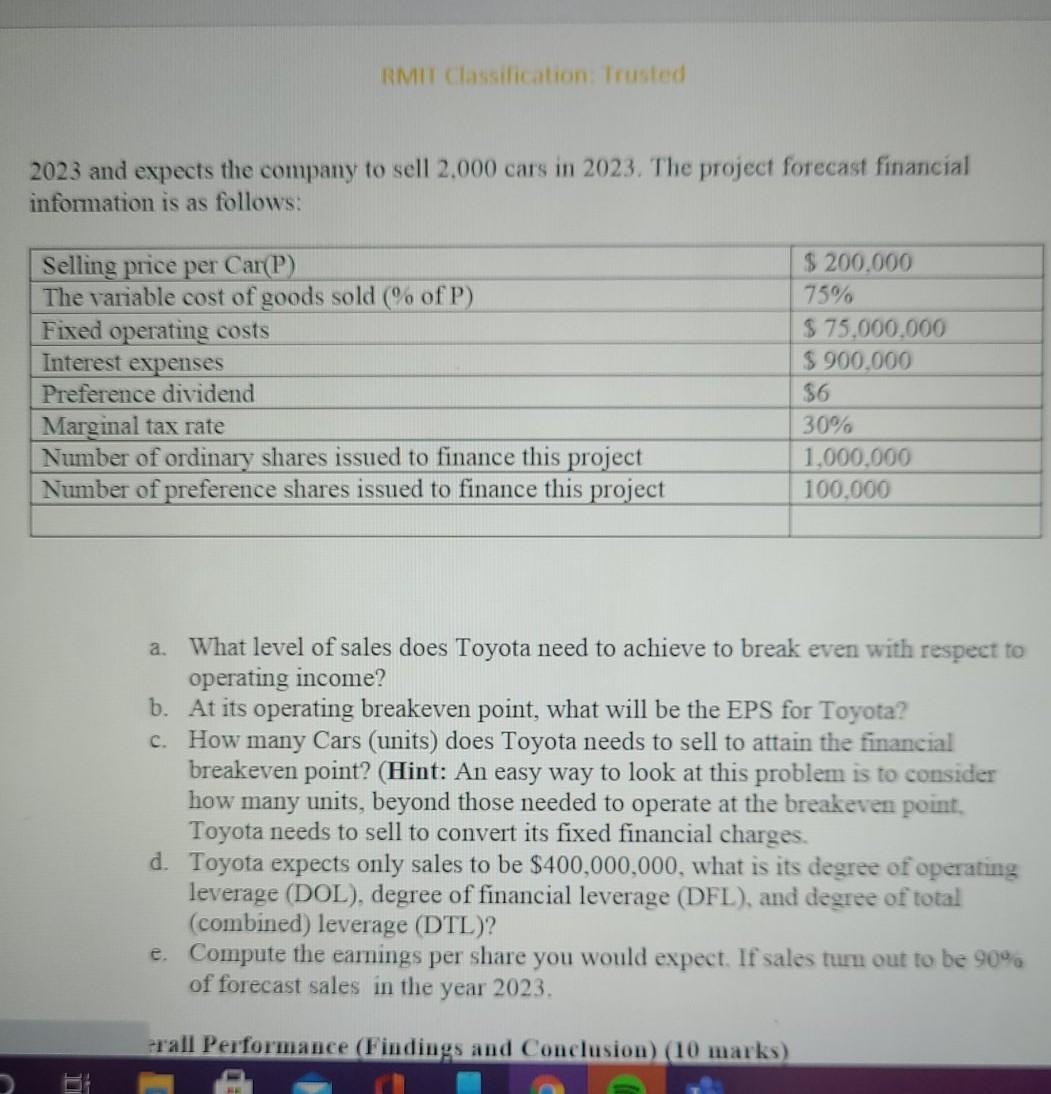

RMIT Classification Trusted 2023 and expects the company to sell 2.000 cars in 2023. The project forecast financial information is as follows: Selling price per

RMIT Classification Trusted 2023 and expects the company to sell 2.000 cars in 2023. The project forecast financial information is as follows: Selling price per Car(P) The variable cost of goods sold (% of P) Fixed operating costs Interest expenses Preference dividend Marginal tax rate Number of ordinary shares issued to finance this project Number of preference shares issued to finance this project $ 200.000 75% $75.000.000 $ 900.000 $6 30% 1,000,000 100,000 a. What level of sales does Toyota need to achieve to break even with respect to operating income? b. At its operating breakeven point, what will be the EPS for Toyota? c. How many Cars (units) does Toyota needs to sell to attain the financial breakeven point? (Hint: An easy way to look at this problem is to consider how many units, beyond those needed to operate at the breakeven point. Toyota needs to sell to convert its fixed financial charges. d. Toyota expects only sales to be $400,000,000, what is its degree of operating leverage (DOL), degree of financial leverage (DFL), and degree of total (combined) leverage (DTL)? e. Compute the earnings per share you would expect. If sales turn out to be 90% of forecast sales in the year 2023. rall Performance (Findings and Conclusion) (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started