Question

RN Temps has 10 million shares of common stock outstanding, which are traded in the over-the-counter market. The current share price is $1.20, so the

RN Temps has 10 million shares of common stock outstanding, which are traded in the over-the-counter market. The current share price is $1.20, so the total market value of the firms equity is $12 million. The book value of equity is also $12 million, so the stock now sells at its book value. The firms federalplus- state tax rate is 40 percent. Tiffany owns 20 percent of the outstanding stock, and others in the management group own an additional 10 percent. Although RN Tempss earnings before interest and taxes (EBIT) is expected to be $3 million in 2018, there is some uncertainty in the estimate, as indicated by the following probability distribution: Probability EBIT 0.25 $2,500,000 0.50 3,000,000 0.25 3,500,000 To address Tiffanys first concern, Paul plans to construct partial income statements (beginning with EBIT) for four levels of debt as measured by the book value Total debt/Total assets ratio: zero, 25 percent, 50 percent, and 75 percent. For this analysis, which will not be used to make the actual capital structure decision, Paul intends to use a cost of debt of 10 percent regardless of the amount of debt financing used. Furthermore, any risk implications to stockholders must be identified.

Tiffanys third concern is potential changes in the healthcare industry and how they might affect the basic business risk of RN Temps should they occur. To address this concern, Paul produced exhibit 18.3, which contains leverage/cost estimates at alternative business risk levels. Note that the values in exhibit 18.3 are for the purposes of what-if analysis only. The best current estimates of the financing costs at alternative debt levels are given in exhibit 18.1. Tiffanys final concern is whether industry averages have any implications for the level of debt financing of RN Temps. Paul uncovered the following

additional industry data: (1) The average healthcare franchise business has a TIE (times interest earned) ratio of 4.0, and (2) RN Temps has cash and marketable securities of $500,000. The average healthcare franchise business has cash and marketable securities on hand equal to 70 percent of its annual interest payment. Paul knows that Tiffany is familiar with capital structure theory and will want to know the value of the firm according to the Modigliani-Miller with corporate taxes model and the Miller model. To ease comparisons, Paul assumes that the value of RN Temps, with zero debt financing, is $12 million in both models. He also assumes that the personal tax rates are 15 percent on stock income and 30 percent on debt income. Put yourself in Pauls shoes and convince Tiffany that the business should use debt financing.

mount Borrowed Cost of Debt Cost of Equity $ 0 15.0% 2,500,000 10.0% 15.5 5,000,000 11.0 16.5 7,500,000 13.0 18.0 10,000,000 16.0 20.0 12,500,000 20.0 25.0 EXHIBIT 18.1 RN Temps, Inc.: Estimated Cost of Debt and Equity at Different Amounts of Debt Financing Percentile Debt Ratio Debt Rating 10th 10% AAA 25th 25 AA 40th 35 A Median 50 BBB 60th 65 BB 75th 75 B 90th 82 C EXHIBIT 18.2 Healthcare Franchise Industry Data: Debt Ratings at Different Levels of Debt Ratio (Total Debt/Total Assets

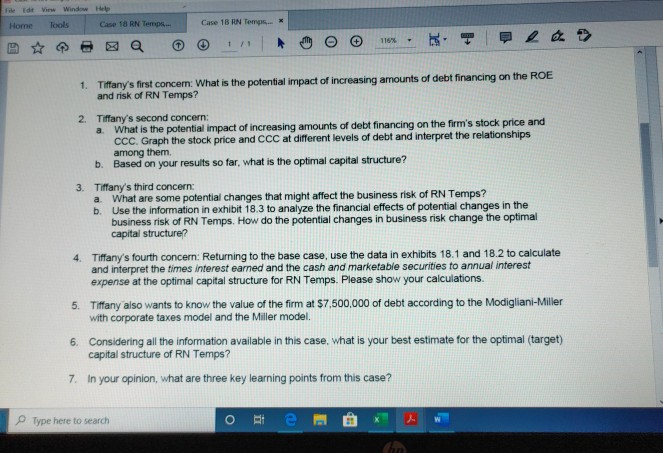

de Vir Winde Tools Home Case 18 RN temps... Case 18 AN Temps...* a ILO 1 . > 1. Tiffany's first concern: What is the potential impact of increasing amounts of debt financing on the ROE and risk of RN Temps? 2 Tiffany's second concern: a. What is the potential impact of increasing amounts of debt financing on the firm's stock price and CCC. Graph the stock price and CCC at different levels of debt and interpret the relationships among them b. Based on your results so far, what is the optimal capital structure? 3. Tiffany's third concern: a. What are some potential changes that might affect the business risk of RN Temps? b. Use the information in exhibit 18.3 to analyze the financial effects of potential changes in the business risk of RN Temps. How do the potential changes in business risk change the optimal capital structure? 4 Tiffany's fourth concern: Returning to the base case, use the data in exhibits 18.1 and 18.2 to calculate and interpret the times interest earned and the cash and marketable securities to annual interest expense at the optimal capital structure for RN Temps. Please show your calculations 5. Tiffany also wants to know the value of the firm at $7,500,000 of debt according to the Modigliani-Miller with corporate taxes model and the Miller model. 6. Considering all the information available in this case, what is your best estimate for the optimal (target) capital structure of RN Temps? 7. In your opinion, what are three key learning points from this case? Type here to search O text de Vir Winde Tools Home Case 18 RN temps... Case 18 AN Temps...* a ILO 1 . > 1. Tiffany's first concern: What is the potential impact of increasing amounts of debt financing on the ROE and risk of RN Temps? 2 Tiffany's second concern: a. What is the potential impact of increasing amounts of debt financing on the firm's stock price and CCC. Graph the stock price and CCC at different levels of debt and interpret the relationships among them b. Based on your results so far, what is the optimal capital structure? 3. Tiffany's third concern: a. What are some potential changes that might affect the business risk of RN Temps? b. Use the information in exhibit 18.3 to analyze the financial effects of potential changes in the business risk of RN Temps. How do the potential changes in business risk change the optimal capital structure? 4 Tiffany's fourth concern: Returning to the base case, use the data in exhibits 18.1 and 18.2 to calculate and interpret the times interest earned and the cash and marketable securities to annual interest expense at the optimal capital structure for RN Temps. Please show your calculations 5. Tiffany also wants to know the value of the firm at $7,500,000 of debt according to the Modigliani-Miller with corporate taxes model and the Miller model. 6. Considering all the information available in this case, what is your best estimate for the optimal (target) capital structure of RN Temps? 7. In your opinion, what are three key learning points from this case? Type here to search O textStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started