Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Roan is a student in Ontario who travelled to BC for his summer job. When in BC he worked in mining camps and his residence

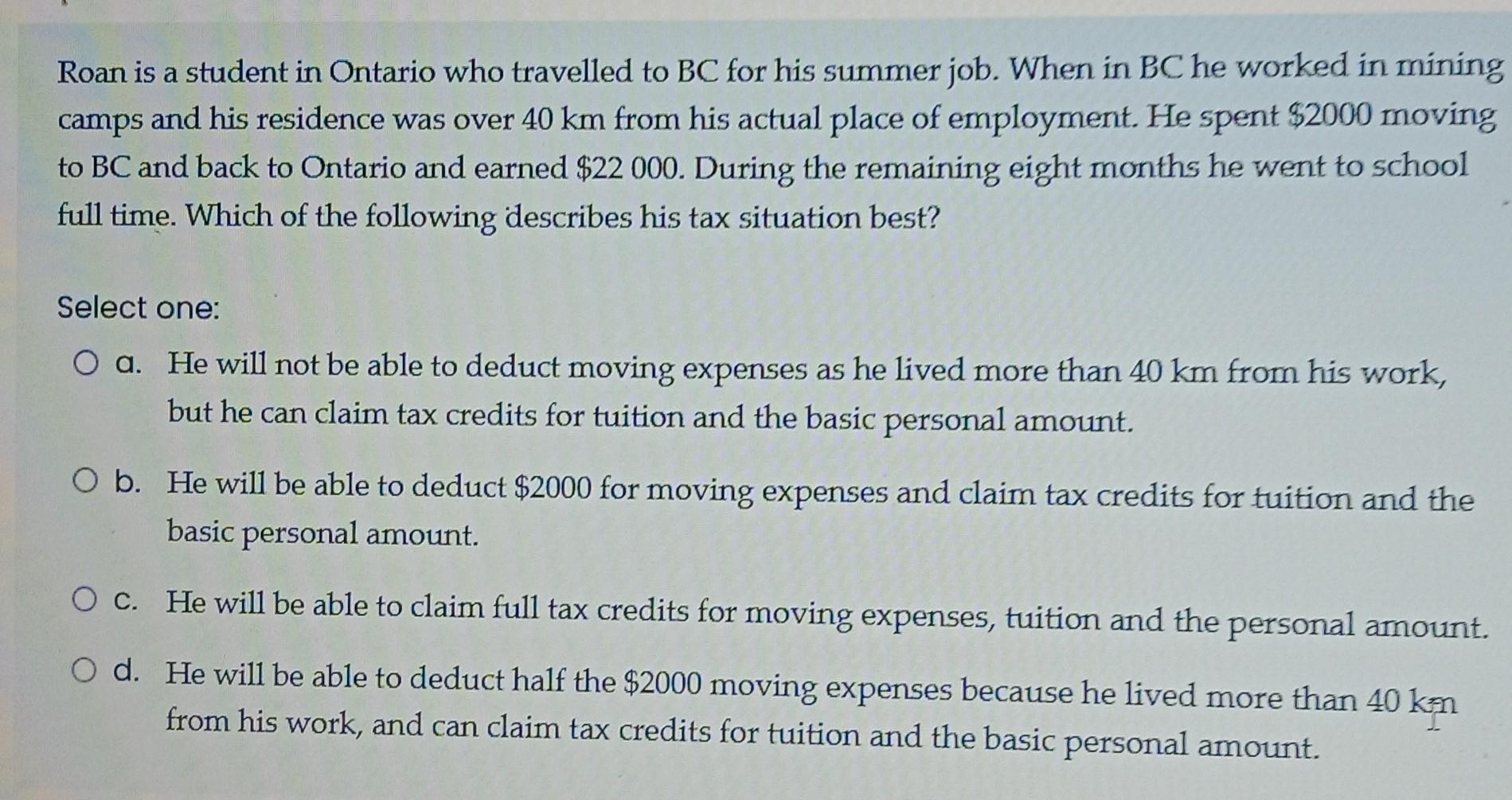

Roan is a student in Ontario who travelled to BC for his summer job. When in BC he worked in mining camps and his residence was over 40 km from his actual place of employment. He spent $2000 moving to BC and back to Ontario and earned $22 000. During the remaining eight months he went to school full time. Which of the following describes his tax situation best? Select one: O a. He will not be able to deduct moving expenses as he lived more than 40 km from his work, but he can claim tax credits for tuition and the basic personal amount. O b. He will be able to deduct $2000 for moving expenses and claim tax credits for tuition and the basic personal amount. O c. He will be able to claim full tax credits for moving expenses, tuition and the personal amount. Od. He will be able to deduct half the $2000 moving expenses because he lived more than 40 km from his work, and can claim tax credits for tuition and the basic personal amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started