Question

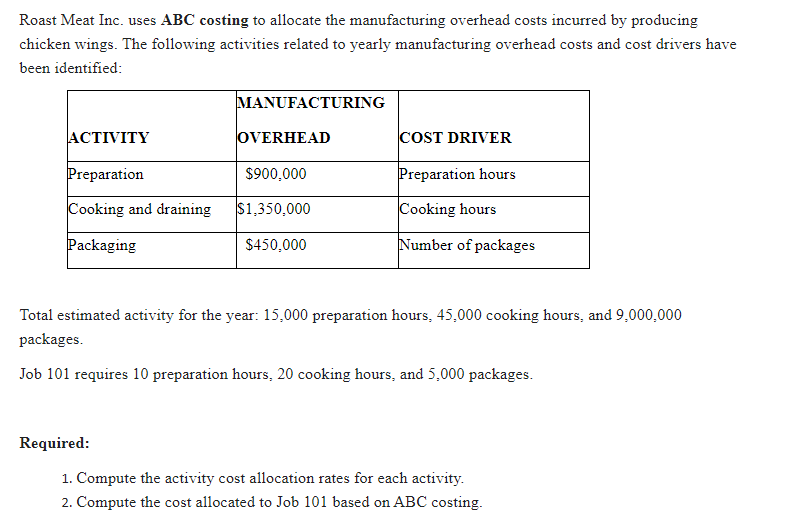

Roast Meat Inc. uses ABC costing to allocate the manufacturing overhead costs incurred by producing chicken wings. The following activities related to yearly manufacturing

Roast Meat Inc. uses ABC costing to allocate the manufacturing overhead costs incurred by producing chicken wings. The following activities related to yearly manufacturing overhead costs and cost drivers have been identified: ACTIVITY MANUFACTURING OVERHEAD COST DRIVER Preparation $900,000 Preparation hours Cooking and draining $1,350,000 Cooking hours Packaging $450,000 Number of packages Total estimated activity for the year: 15,000 preparation hours, 45,000 cooking hours, and 9,000,000 packages. Job 101 requires 10 preparation hours, 20 cooking hours, and 5,000 packages. Required: 1. Compute the activity cost allocation rates for each activity. 2. Compute the cost allocated to Job 101 based on ABC costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

4th edition

978-0133428469, 013342846X, 133428370, 978-0133428377

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App