Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rob and Roy use standing journals, and prepare statements monthly. Annual insurance premium of $2,700 (excluding GST) was paid on 15 August 2018, and

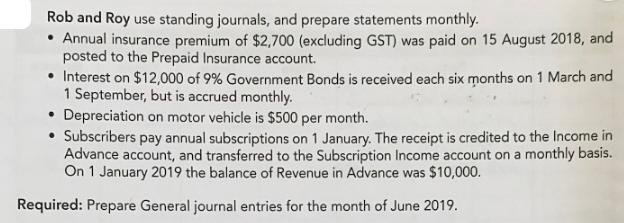

Rob and Roy use standing journals, and prepare statements monthly. Annual insurance premium of $2,700 (excluding GST) was paid on 15 August 2018, and posted to the Prepaid Insurance account. Interest on $12,000 of 9% Government Bonds is received each six months on 1 March and 1 September, but is accrued monthly. Depreciation on motor vehicle is $500 per month. Subscribers pay annual subscriptions on 1 January. The receipt is credited to the Income in Advance account, and transferred to the Subscription Income account on a monthly basis. On 1 January 2019 the balance of Revenue in Advance was $10,000. Required: Prepare General journal entries for the month of June 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the general journal entries for the month of June 2019 To record the mon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started