Answered step by step

Verified Expert Solution

Question

1 Approved Answer

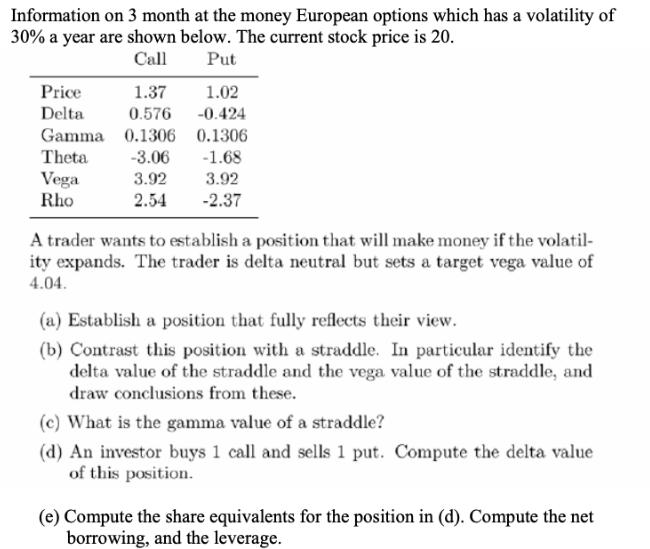

Information on 3 month at the money European options which has a volatility of 30% a year are shown below. The current stock price

Information on 3 month at the money European options which has a volatility of 30% a year are shown below. The current stock price is 20. Call Put Price Delta 1.37 1.02 0.576 -0.424 Gamma 0.1306 0.1306 Theta -3.06 -1.68 Vega Rho 3.92 3.92 2.54 -2.37 A trader wants to establish a position that will make money if the volatil- ity expands. The trader is delta neutral but sets a target vega value of 4.04. (a) Establish a position that fully reflects their view. (b) Contrast this position with a straddle. In particular identify the delta value of the straddle and the vega value of the straddle, and draw conclusions from these. (c) What is the gamma value of a straddle? (d) An investor buys 1 call and sells 1 put. Compute the delta value of this position. (e) Compute the share equivalents for the position in (d). Compute the net borrowing, and the leverage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To establish a position that reflects the traders view they should buy 1 call option and buy 1 put ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started