Answered step by step

Verified Expert Solution

Question

1 Approved Answer

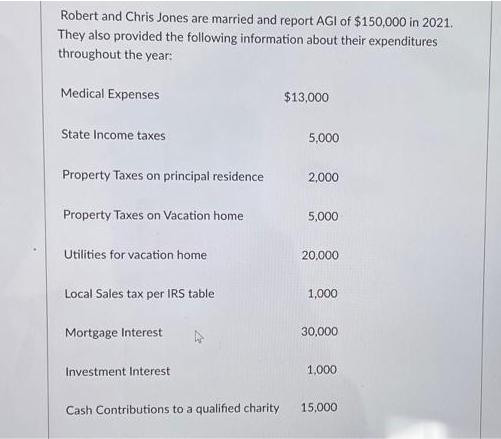

Robert and Chris Jones are married and report AGI of $150,000 in 2021. They also provided the following information about their expenditures throughout the

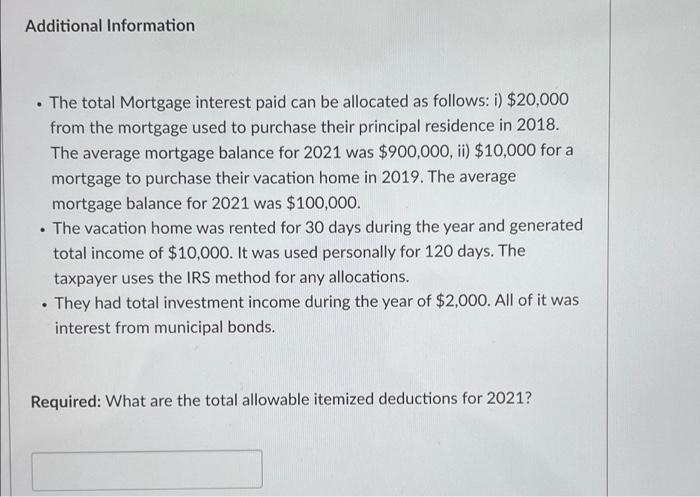

Robert and Chris Jones are married and report AGI of $150,000 in 2021. They also provided the following information about their expenditures throughout the year: Medical Expenses State Income taxes Property Taxes on principal residence Property Taxes on Vacation home Utilities for vacation home Local Sales tax per IRS table Mortgage Interest A Investment Interest. Cash Contributions to a qualified charity $13,000 5,000 2,000 5,000 20,000 1,000 30,000 1,000 15,000 Additional Information . . The total Mortgage interest paid can be allocated as follows: i) $20,000 from the mortgage used to purchase their principal residence in 2018. The average mortgage balance for 2021 was $900,000, ii) $10,000 for a mortgage to purchase their vacation home in 2019. The average mortgage balance for 2021 was $100,000. The vacation home was rented for 30 days during the year and generated total income of $10,000. It was used personally for 120 days. The taxpayer uses the IRS method for any allocations. They had total investment income during the year of $2,000. All of it was interest from municipal bonds. Required: What are the total allowable itemized deductions for 2021?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Total AGI 150000 Medical Expenses 13000 The Jones can deduct their medical expenses in excess of 75 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started