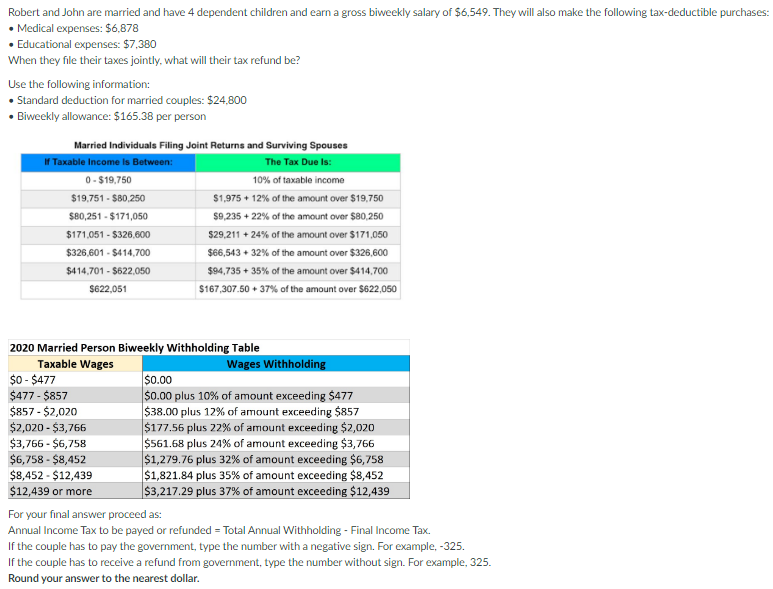

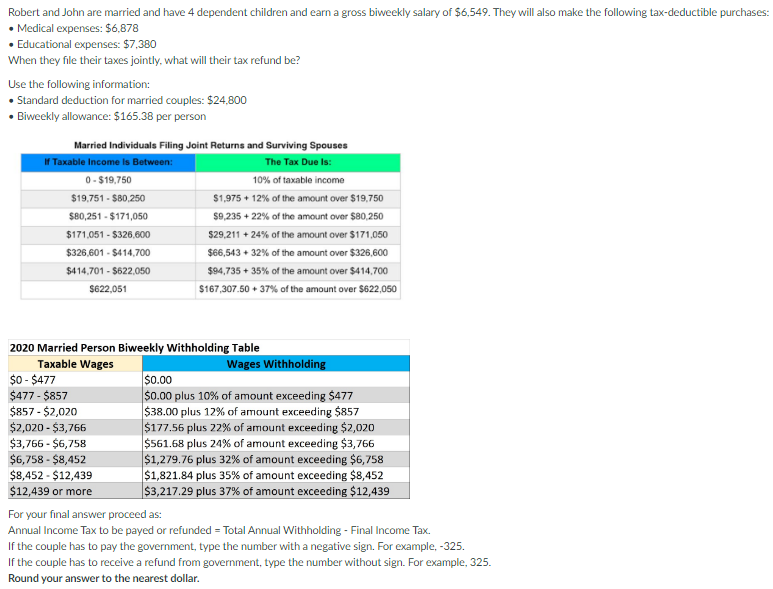

Robert and John are married and have 4 dependent children and earn a gross biweekly salary of $6,549. They will also make the following tax-deductible purchases: Medical expenses: $6,878 Educational expenses: $7,380 When they file their taxes jointly, what will their tax refund be? Use the following information: Standard deduction for married couples: $24.800 Biweekly allowance: $165.38 per person Married Individuals Filing Joint Returns and Surviving Spouses 1 Taxable income Is Between: The Tax Due is: 0 - $19,750 10% of taxable income $19.751 - $80.250 $1,975 + 12% of the amount over $19,750 $80,251 - $171,050 $9,235 + 22% of the amount over $80,250 $171,051 - $326,600 $29,211 +24% of the amount over $171,050 $326,601 - $414,700 $66,543 + 32% of the amount over $326,600 $414,701 - $622,050 $94,735 + 35% of the amount over $414,700 $622,051 $167,307.50 + 37% of the amount over $622,050 2020 Married Person Biweekly Withholding Table Taxable Wages Wages Withholding $0-$477 $0.00 $477 - $857 $0.00 plus 10% of amount exceeding $477 $857 - $2,020 $38.00 plus 12% of amount exceeding $857 $2,020 - $3,766 $177.56 plus 22% of amount exceeding $2,020 $3,766 - $6,758 $561.68 plus 24% of amount exceeding $3,766 $6,758 - $8,452 $1,279.76 plus 32% of amount exceeding $6,758 $8,452 - $12,439 $1,821.84 plus 35% of amount exceeding $8,452 $12,439 or more $3,217.29 plus 37% of amount exceeding $12,439 For your final answer proceed as: Annual Income Tax to be payed or refunded = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example, -325. If the couple has to receive a refund from government, type the number without sign. For example, 325. Round your answer to the nearest dollar. Robert and John are married and have 4 dependent children and earn a gross biweekly salary of $6,549. They will also make the following tax-deductible purchases: Medical expenses: $6,878 Educational expenses: $7,380 When they file their taxes jointly, what will their tax refund be? Use the following information: Standard deduction for married couples: $24.800 Biweekly allowance: $165.38 per person Married Individuals Filing Joint Returns and Surviving Spouses 1 Taxable income Is Between: The Tax Due is: 0 - $19,750 10% of taxable income $19.751 - $80.250 $1,975 + 12% of the amount over $19,750 $80,251 - $171,050 $9,235 + 22% of the amount over $80,250 $171,051 - $326,600 $29,211 +24% of the amount over $171,050 $326,601 - $414,700 $66,543 + 32% of the amount over $326,600 $414,701 - $622,050 $94,735 + 35% of the amount over $414,700 $622,051 $167,307.50 + 37% of the amount over $622,050 2020 Married Person Biweekly Withholding Table Taxable Wages Wages Withholding $0-$477 $0.00 $477 - $857 $0.00 plus 10% of amount exceeding $477 $857 - $2,020 $38.00 plus 12% of amount exceeding $857 $2,020 - $3,766 $177.56 plus 22% of amount exceeding $2,020 $3,766 - $6,758 $561.68 plus 24% of amount exceeding $3,766 $6,758 - $8,452 $1,279.76 plus 32% of amount exceeding $6,758 $8,452 - $12,439 $1,821.84 plus 35% of amount exceeding $8,452 $12,439 or more $3,217.29 plus 37% of amount exceeding $12,439 For your final answer proceed as: Annual Income Tax to be payed or refunded = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example, -325. If the couple has to receive a refund from government, type the number without sign. For example, 325. Round your answer to the nearest dollar