Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert Corporation acquired a machine in the first week of August 2019 and paid the following amounts: invoice price of $86,400, freight-in of $2,160 and

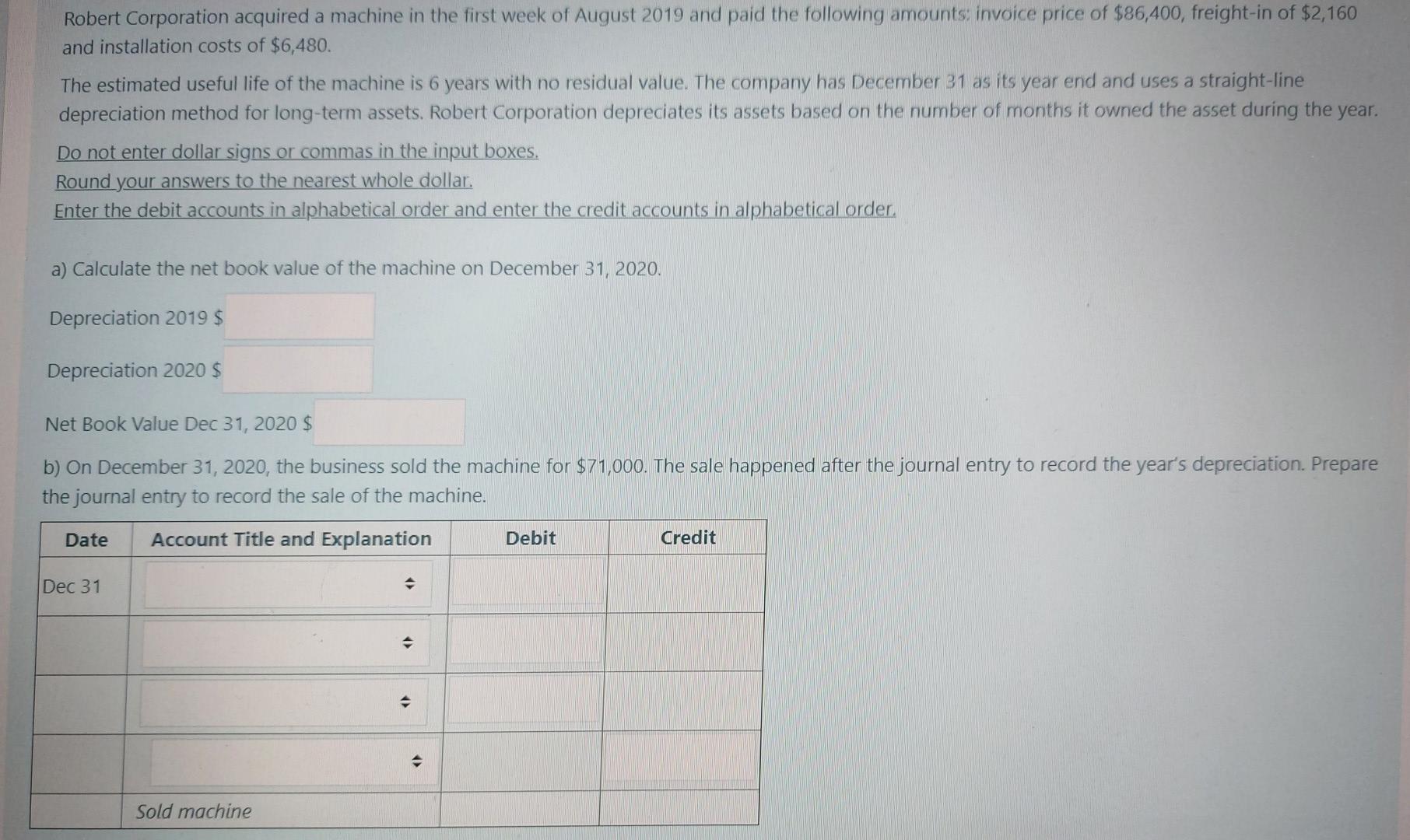

Robert Corporation acquired a machine in the first week of August 2019 and paid the following amounts: invoice price of $86,400, freight-in of $2,160 and installation costs of $6,480. The estimated useful life of the machine is 6 years with no residual value. The company has December 31 as its year end and uses a straight-line depreciation method for long-term assets. Robert Corporation depreciates its assets based on the number of months it owned the asset during the year. Do not enter dollar signs or commas in the input boxes. Round your answers to the nearest whole dollar. Enter the debit accounts in alphabetical order and enter the credit accounts in alphabetical order. a) Calculate the net book value of the machine on December 31, 2020. Depreciation 2019 $ Depreciation 2020 $ Net Book Value Dec 31, 2020 $ b) On December 31, 2020, the business sold the machine for $71,000. The sale happened after the journal entry to record the year's depreciation. Prepare the journal entry to record the sale of the machine. Date Account Title and Explanation Debit Credit Dec 31 Sold machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started