Answered step by step

Verified Expert Solution

Question

1 Approved Answer

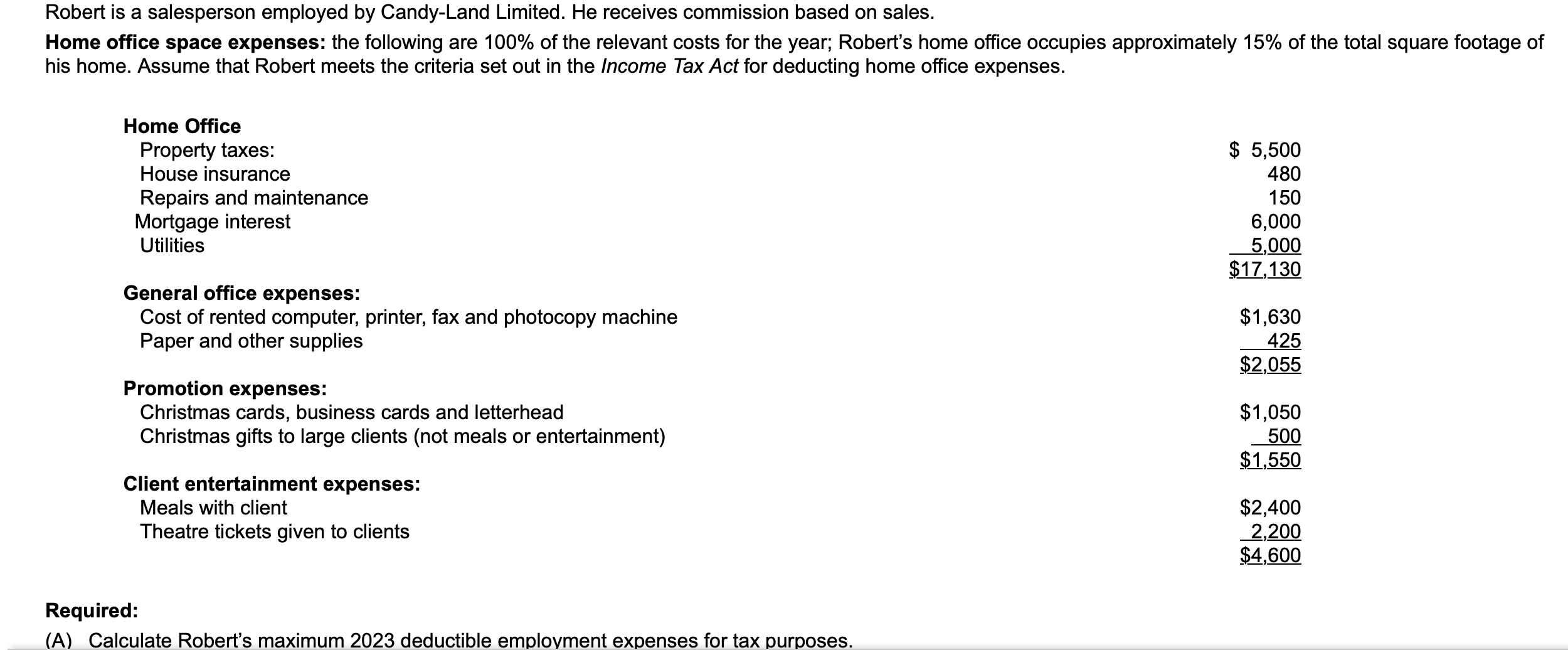

Robert is a salesperson employed by Candy - Land Limited. He receives commission based on sales. Home office space expenses: the following are 1 0

Robert is a salesperson employed by CandyLand Limited. He receives commission based on sales.

Home office space expenses: the following are of the relevant costs for the year; Robert's home office occupies approximately of the total square footage of

his home. Assume that Robert meets the criteria set out in the Income Tax Act for deducting home office expenses.

Home Office

Property taxes:

House insurance

Repairs and maintenance

Mortgage interest

Utilities

General office expenses:

Cost of rented computer, printer, fax and photocopy machine

Paper and other supplies

Promotion expenses:

Christmas cards, business cards and letterhead

Christmas gifts to large clients not meals or entertainment

Client entertainment expenses:

Meals with client

Theatre tickets given to clients

$$

$

$

$

$

Required:

A Calculate Robert's maximum deductible emplovment expenses for tax purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started