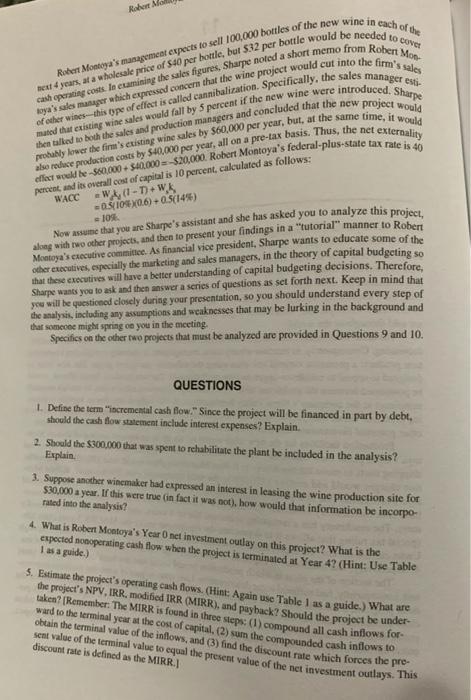

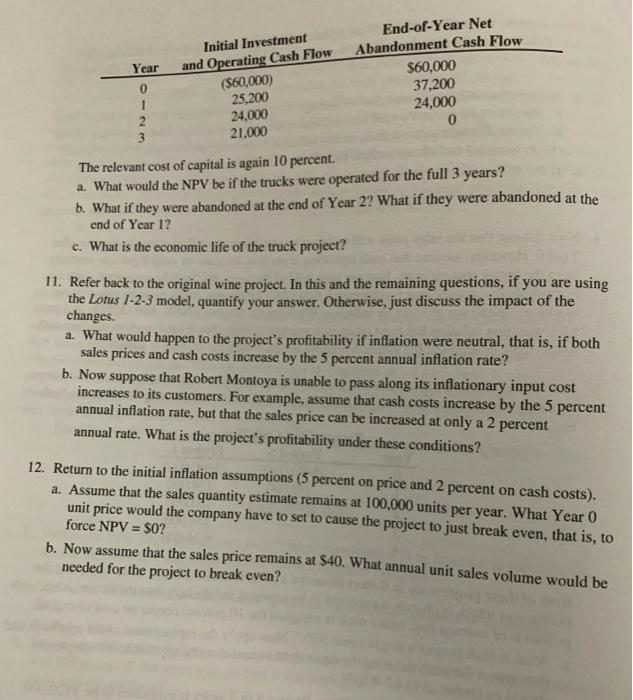

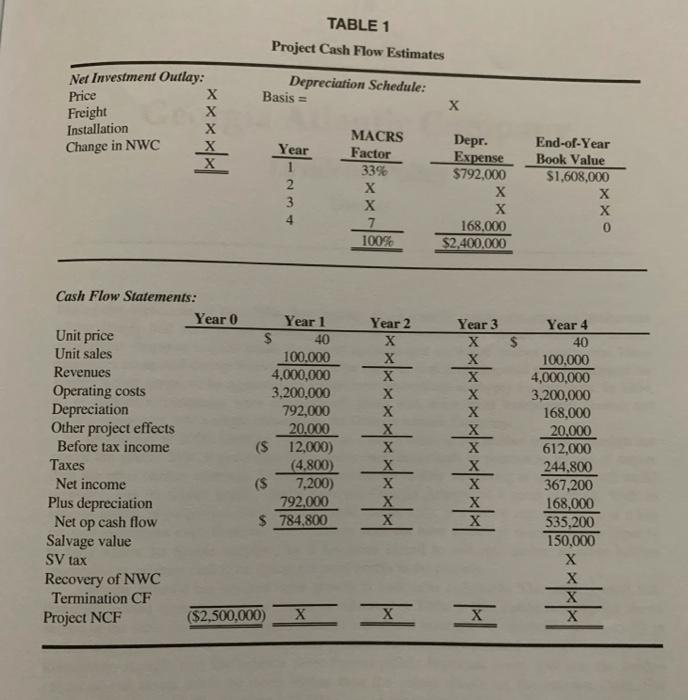

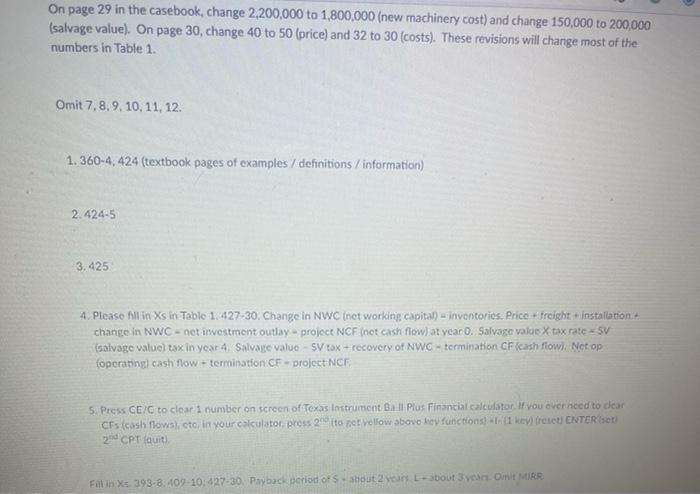

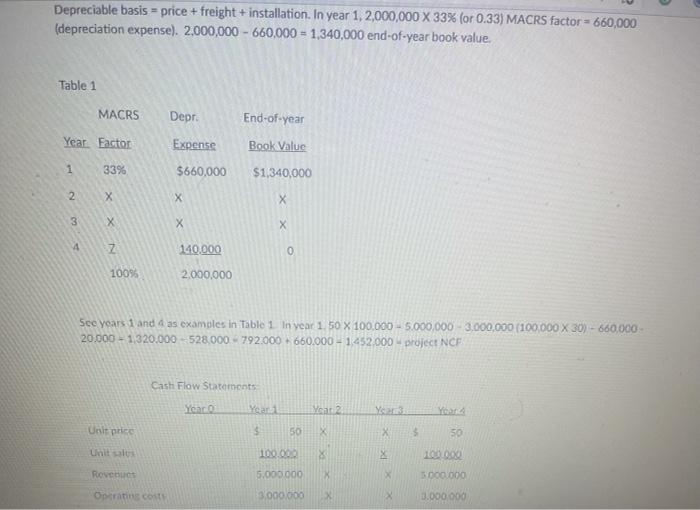

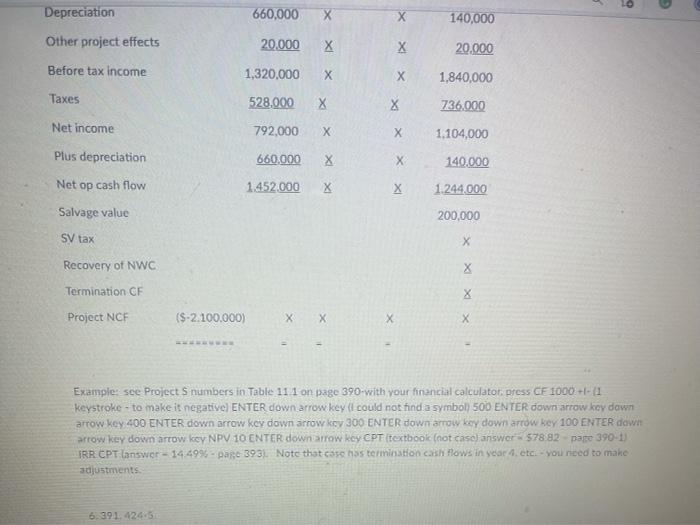

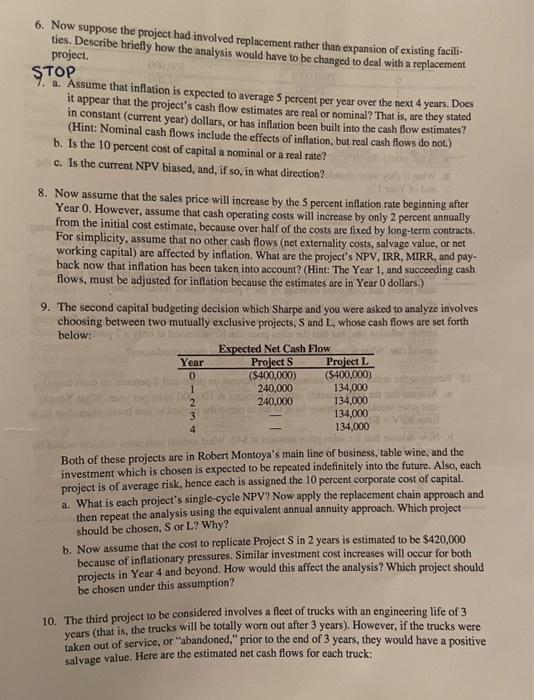

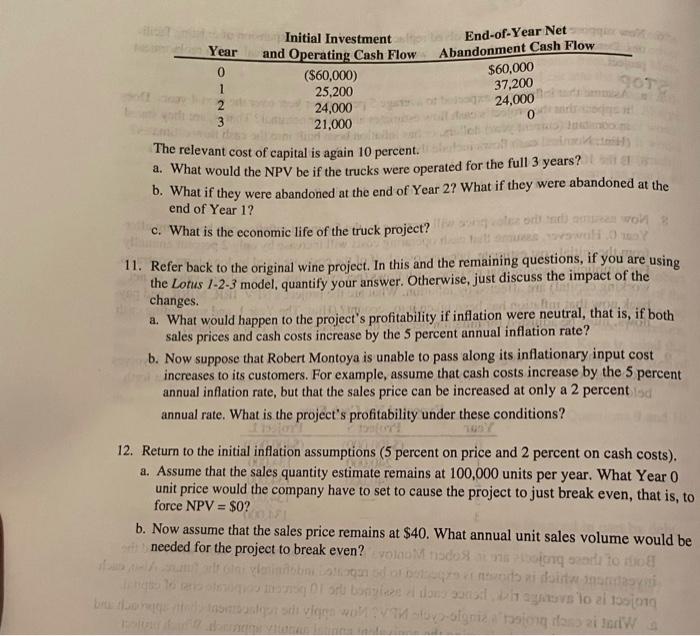

Robert Montoya, Inc., is a leading producer of wine in the United States. The firm was founded in 1950 by Robert Montoya, an Air Force veteran who had spent several years in France both before and after World War II. This experience convinced him that California could produce wines that were as good as or better than the best France had to offer. Originally, Robert Montoya sold his wine to wholesalers for distribution under their own brand names. Then in the early 1950s, when wine sales were expanding rapidly, he joined with his brother Marshall and several other producers to form Robert Montoya, Inc., which then began an aggressive promotion campaign. Today, its wines are sold throughout the world. The table wine market has matured and Robert Montoya's wine cooler sales have been steadily decreasing. Consequently, to increase winery sales, management is currently considering a potential new product: a premium varietal red wine using the cabernet sauvignon grape. The new wine is designed to appeal to middle-to-upper-income professionals. The new product, Suav Mauv, would be positioned between the traditional table wines and super premium table wines. In market research samplings at the company's Napa Valley headquarters, it was judged superior to various compet- ing products. Sarah Sharpe, the financial vice president, must analyze this project, along with two other potential investments, and then present her findings to the company's executive committee. Production facilities for the new wine would be set up in an unused section of Robert Mon- toya's main plant. New machinery with an estimated cost of $2,200,000 would be purchased, but shipping costs to move the machinery to Robert Montoya's plant would total $80,000, and installa- tion charges would add another $120,000 to the total equipment cost. Furthermore, Robert Mon- toya's inventories (the new product requires aging for 5 years in oak barrels made in France) would have to be increased by $100,000. This cash flow is assumed to occur at the time of the initial invest- ment. The machinery has a remaining economic life of 4 years, and the company has obtained a special tax ruling that allows it to depreciate the equipment under the MACRS 3-year class life. Under current tax law, the depreciation allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, respectively. The machinery is expected to have a salvage value of $150,000 after 4 years of use. The section of the plant in which production would occur had not been used for several years and consequently, had suffered some deterioration. Last year, as part of a routine facilities improve- ment program, $300,000 was spent to rehabilitate that section of the main plant. Earnie Jones, the chief accountant, believes that this outlay, which has already been paid and expensed for tax pur- poses, should be charged to the wine project. His contention is that if the rehabilitation had not taken place, the firm would have had to spend the $300,000 to make the plant suitable for the wine project. Robert M Robert Montoya's management expects to sell 100.000 bottles of the new wine in cach of the 4 years af a wholesale price of $40 per bottle, but 32 per bottle would be needed to COVE cash operating cost. In examining the sales figures, Sharpe noted a short memo from Robert Mon. of other wins--this type of effect is called cannibalization. Specifically, the sales manager esti- Roya's salesmaper which expressed concern that the wine project would cut into the firm's sales mated that existing wine sales would fall by 5 percent if the new wine were introduced. Sharpe probably lower the firm's cisting wine sales by 500,000 per year, but at the same time, it would then talked to both the sales and production managers and concluded that the new project would also reduce production costs by $10,000 per year, all on a pre-tax basis. Thus, the net externality effect he-560,000+ $40.000 $20,000. Robert Montoya's federal-plus-state tax rate is 40 percent and is overall cost of capital is 10 percent calculated as follows: WACC-W4 (1-1)+Wk 05105X06).0.5414) -10 Now assume that you are Sharpe's assistant and she has asked you to analyze this project, long with two other projects, and then to present your findings in a "tutorial" manner to Robert Montoya's executive committee. As financial vice president, Sharpe wants to educate some of the other executives, especially the marketing and sales managers, in the theory of capital budgeting so that these executives will have a better understanding of capital budgeting decisions. Therefore, Sharpe wants you to ask and then answer a series of questions as set forth next. Keep in mind that you will be questioned closely during your presentation, so you should understand every step of the analysis, including any assumptions and weaknesses that may be lurking in the background and that someone might spring on you in the meeting Specifics on the other two projects that must be analyzed are provided in Questions 9 and 10. QUESTIONS 1. Define the term "incremental cash flow." Since the project will be financed in part by debt, should the cash flow statement include interest expenses? Explain. 2. Should the $300,000 that was spent to rehabilitate the plant be included in the analysis? Explain. 3. Suppose another winemaker had expressed an interest in leasing the wine production site for $30,000 a year. If this were true (in fact it was not), how would that information be incorpo rated into the analysis? 4. What is Robert Montoya's Year Onet investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at Year 42 (Hint: Use Table I as a guide.) 5. Estimate the project's operating cash flows. (Hint: Again use Table I as a guide.) What are the project's NPV, IRR.modified IRR (MIRR), and pay back? Should the project be under- taken? [Remember. The MIRR is found in three steps: (1) compound all cash inflows for ward to the terminal year at the cost of capital. (2) sum the compounded cash inflows 10 obtain the terminal value of the inflows, and (3) find the discount rate which forces the pre- sent value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR. Year End-of-Year Net Abandonment Cash Flow $60,000 37,200 24,000 0 Initial Investment and Operating Cash Flow ($60,000) 25,200 24,000 21.000 0 1 2 3 The relevant cost of capital is again 10 percent. a. What would the NPV be if the trucks were operated for the full 3 years? b. What if they were abandoned at the end of Year 22 What if they were abandoned at the end of Year 12 c. What is the economic life of the truck project? 11. Refer back to the original wine project. In this and the remaining questions, if you are using the Lotus 1-2-3 model, quantify your answer. Otherwise, just discuss the impact of the changes. a. What would happen to the project's profitability if inflation were neutral, that is, if both sales prices and cash costs increase by the 5 percent annual inflation rate? b. Now suppose that Robert Montoya is unable to pass along its inflationary input cost increases to its customers. For example, assume that cash costs increase by the 5 percent annual inflation rate, but that the sales price can be increased at only a 2 percent annual rate. What is the project's profitability under these conditions? 12. Return to the initial inflation assumptions (5 percent on price and 2 percent on cash costs). a. Assume that the sales quantity estimate remains at 100,000 units per year. What Year 0 unit price would the company have to set to cause the project to just break even, that is, to force NPV = $0? b. Now assume that the sales price remains at $40. What annual unit sales volume would be needed for the project to break even? the financial press in recent months indicated that Georgia Atlantica possible Target of a takeover attempt. Since the family did not want to lose control of the company, they were the directors would hold a special meeting immediately after the annual meeting to consider Los 10 keep the firm's stockholders as happy as possible. Accordingly. Junior announced that whether the firm's dividend policy should be changed Junior instructed Abe Markowitz, Georgia Atlantic's financial vice-president, to identify and Markowitz to consider cash dividends, stock dividends, and stock splits. Markowitz then identified the evaluate alternative dividend policies in preparation for the special board meeting. He asked si proposals that he thought deserved further consideration (1) No Cash Dividends, No Stock Dividend or Split. This was the position Markowitz was certain that Junior and the family would support, both for the reasons given above and also because he thought the company, as evidenced by the balance sheet, was in no position to pay cash dividends. a) Immediate Cash Dividend, but No Stock Dividend or Split. This was simply the opposite of the no dividend policy. If a cash dividend policy were instituted, is sure would still be an issue. (3) Immediate Cash Dividend plus a Large Stock Split. The stock split would be designed to lower the price of the firm's stock from its current price of almost $2,000 per share to somewhere in the average price range of other large forest products stocks, or from $20 to $40 per share. (4) Immediate Cash Dividend plus a Large Stock Dividend. The reasoning underlying this policy would be essentially the same as that of Alternative 3. (5) Cash Dividend, Stock Split, and Periodic Stock Dividends. This policy would require the company to declare an immediate cash dividend and, simultaneously, to announce a sizable stock split. This policy would go further than Alternatives 3 and 4 in that after the cash dividend and stock split or large stock dividend, the company would periodically declare smaller stock dividends equal in value to the earnings retained during the period. In effect, if the firm earned $3 per share in any given period-quarter, semi-annual period, and so on-and retained $1.50 per share, the company would also declare a stock dividend of a percentage amount equal to $1.50 divided by the market price of the stock. Thus, if the firm's shares were selling for $30 when the cash dividend was paid, a 5 percent stock dividend would be declared. (6) Share Repurchase Plan. This plan is based on the premise that investors in the aggregate would like to see the company distribute some cash, but that some stockholders would not want to receive cash dividends because they want to minimize their taxes. Under the repurchase plan, individual stockholders could decide for themselves whether or not to sell some or all of their shares and thus to realize some cash and some capital gains, depending on their own situations. To begin his evaluation, Markowitz collected the data shown in Tables 2 and 3. As he was looking over these figures, Markowitz wondered what effect, if any, Georgia Atlantic's dividend policy had on the company's stock price as compared to the prices of other stocks. Markowitz is also aware of one other issue, but it is one that neither he nor anyone else has had the nerve to bring up. Junior is now 66 years old, which is hardly ancient; but he is in poor health, and in recent years he has been almost obsessed with the idea of avoiding taxes. Further, the federal estate tax rate is currently 60 percent, and additional state estate taxes would be due: so well over half of Junior's net worth as of the date of his death will have to be paid out in estate taxes. Since estate taxes are based on the value of the estate on the date of death, to minimize his estate's taxes, TABLE 1 Project Cash Flow Estimates Depreciation Schedule: Basis = X Ner Investment Outlay: Price Freight X Installation Change in NWC xxx Year 1 2 3 4 MACRS Factor 33% X X 7 100% Depr. Expense $792,000 X 168,000 $2,400,000 End-of-Year Book Value $1,608,000 X X 0 $ Cash Flow Statements: Year 0 Year 1 Unit price $ 40 Unit sales 100,000 Revenues 4,000,000 Operating costs 3,200,000 Depreciation 792,000 Other project effects 20.000 Before tax income (S 12,000) Taxes (4.800) Net income 7,200) Plus depreciation 792,000 Net op cash flow $ 784,800 Salvage value SV tax Recovery of NWC Termination CF Project NCF ($2,500,000 Year 2 X X X X X Year 3 X X X x xx xx xx xx xx H xxxxxxxxxxx Year 4 40 100.000 4,000,000 3,200,000 168,000 20.000 612,000 244,800 367,200 168,000 535,200 150,000 X ($ X X X On page 29 in the casebook, change 2,200,000 to 1,800,000 (new machinery cost) and change 150,000 to 200,000 (salvage value). On page 30, change 40 to 50 (price) and 32 to 30 (costs). These revisions will change most of the numbers in Table 1. Omit 7, 8, 9, 10, 11, 12 1.360-4,424 (textbook pages of examples / definitions /information) 2.424-5 3.425 4. Please fill in Xs in Table 1. 427-30. Change in NWC (net working capital) - inventories. Price + freight installation change in NWC - net investment outlay - projece NCF (not cash flow) at ycan 0. Salvage value X tax rate - SV salvage value) tax in year 4. Salvage value SV tax +recovery of NWC-termination CF (cash flow). Net op foperating cash flow-termination CF project NCR 5. Press CE/C to clear 1 number on screen of Texas Instrument Ball Plus Financial calculator. If you ever need to dear Cts cash flows), etoin your calculator press 2 ito pietvellow above key functions) +-t kereset ENTER 2 CPT lauit) Fatin Xs. 393-8.409-10: 427-30. Payback period of s-about 2 ans. Labout 3ycan O MIRR Depreciable basis - price + freight + installation. In year 1, 2,000,000 X 33% (or 0.33) MACRS factor - 660,000 (depreciation expense). 2,000,000 - 660,000 = 1,340,000 end-of-year book value Table 1 MACRS Depr. End-of-year Year Factor Expense Book Value 1 33% $660,000 $1,340,000 2 X X 3 X 7 140.000 0 100% 2.000.000 See years 1 and 4 as examples in Table 1 In year 1.50 X 100.000 - 5.000,000 3,000,000 (100,000 X 30) - 660,000 20.000 - 1.320.000 - 528,000 - 792.000 660.000 - 1452.000 project NCF Cash Flow Statements Year Year Year 2 Yan Unit price $ 50 X 3 50 Unita 100.000 LO1000 Rovcu 5.000.000 X 5000 000 Operating cost 3.000.000 3.000.000 Depreciation 660,000 140,000 Other project effects 20.000 X X 20.000 Before tax income 1,320,000 X 1,840,000 Taxes 528,000 736.000 Net income 792,000 X X 1.104,000 Plus depreciation 660,000 X 140.000 Net op cash flow 1.452.000 XI 1.244,000 Salvage value 200,000 SV tax Recovery of NWC Termination CF X Project NCF ($-2.100.000) X Example: see Project S numbers in Table 111 on page 390 with your financial calculator, press CE 1000 +- 11 keystroke - to make it negative ENTER down arrow key (l could not find a symbol) 500 ENTER down arrow key down arrow key 400 ENTER down arrow key down arrow key 300 ENTER down arrow kay down arrow key 100 ENTER dewi Arrow key down arrow key NPV 10 ENTER down arrow key CPT (textboolc (not case) answer - 578 82 - page 390-1) IRR CPT lanswer - 14.499 - page 393. Note that case has termination cash flows in year etc. - you need to make adjustments 6.391.424.5 Robert Montoya, Inc. (A) Capital Budgeting ats Directed Robert Montoya, Inc., is a leading producer of wine in the United States. The firm was founded in 1950 by Robert Montoya, an Air Force veteran who had spent several years in France both before and after World War II. This experience convinced him that California could produce wines that were as good as or better than the best France had to offer. Originally, Robert Montoya sold his wine to wholesalers for distribution under their own brand names. Then in the early 1950s, when wine sales were expanding rapidly, he joined with his brother Marshall and several other producers to form Robert Montoya, Inc., which then began an aggressive promotion campaign. Today, its wines are sold throughout the world. The table wine market has matured and Robert Montoya's wine cooler sales have been steadily decreasing. Consequently, to increase winery sales management is currently considering a potential new product: a premium varietal red wine using the cabernet sauvignon grape. The new wine is designed to appeal to middle-to-upper-income professionals. The new product, Suav Mauv, would be positioned between the traditional table wines and super premium table wines. In market research samplings at the company's Napa Valley headquarters, it was judged superior to various compet- ing products. Sarah Sharpe, the financial vice president, must analyze this project, along with two other potential investments, and then present her findings to the company's executive committee. Production facilities for the new wine would be set up in an unused section of Robert Mon- toya's main plant. New machinery with an estimated cost of $2.200.000 would be purchased, but shipping costs to move the machinery to Robert Montoya's plan? would total $80,000, and installa- tion charges would add another $120,000 to the total equipment cost. Furthermore, Robert Mon- toya's inventories (the new product requires aging for 5 years in oak barrels made in France) would have to be increased by $100,000. This cash flow is assumed to occur at the time of the initial invest- ment. The machinery has a remaining economic life of 4 years, and the company has obtained a special tax ruling that allows it to depreciate the equipment under the MACRS 3-year class life. Under current tax law, the depreciation allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, respectively. The machinery is expected to have a salvage value of $150,000 after 4 years of use. The section of the plant in which production would occur had not been used for several years and, consequently, had suffered some deterioration. Last year, as part of a routine facilities improve- ment program, $300,000 was spent to rehabilitate that section of the main plant. Earnie Jones, the chief accountant, believes that this outlay, which has already been paid and expensed for tax pur- poses, should be charged to the wine project. His contention is that if the rehabilitation had not taken place, the firm would have had to spend the $300,000 to make the plant suitable for the wine project. >!,800,000 -$200,000 $50 $30 Robert Montoya's management expect to sell 100.000 pottles of the new wine in each of the next 4 years, at a wholesale price of $40 per bottle, but $32 per bottle would be needed to cover cash operating costs. In examining the sales figures, Sharpe noted a short memo from Robert Mon toya's sales manager which expressed concern that the wine project would cut into the firm's sales of other wines-this type of effect is called cannibalization. Specifically, the sales manager esti. mated that existing wine sales would fall by 5 percent if the new wine were introduced. Sharpe then talked to both the sales and production managers and concluded that the new project would probably lower the firm's existing wine sales by $60,000 per year, but, at the same time, it would also reduce production costs by $40,000 per year, all on a pre-tax basis. Thus, the net externality effect would be -560,000+ $40,000-$20,000, Robert Montoya's federal-plus-state tax rate is 40 percent, and its overall cost of capital is 10 percent, calculated as follows: WACC = Wika (1-1)+W. -0.5(1096X0.6) +0.5(14%) Now assume that you are Sharpe's assistant and she has asked you to analyze this project, along with two other projects, and then to present your findings in a "tutorial manner to Robert Montoya's executive committee. As financial vice president, Sharpe wants to educate some of the other executives, especially the marketing and sales managers, in the theory of capital budgeting so that these executives will have a better understanding of capital budgeting decisions. Therefore, Sharpe wants you to ask and then answer a series of questions as set forth next. Keep in mind that you will be questioned closely during your presentation, so you should understand every step of the analysis, including any assumptions and weaknesses that may be lurking in the background and that someone might spring on you in the meeting. Specifics on the other two projects that must be analyzed are provided in Questions 9 and 10. 10%. QUESTIONS 1. Define the term "incremental cash flow. Since the project will be financed in part by debt, should the cash flow statement include interest expenses? Explain. 2. Should the $300,000 that was spent to rehabilitate the plant be included in the analysis? Explain. 3. Suppose another winemaker had expressed an interest in leasing the wine production site for $30,000 a year. If this were true (in fact it was not), how would that information be incorpo- rated into the analysis? 4. What is Robert Montoya's Year 0 net investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at Year 42 (Hint: Use Table 1 as a guide.) 5. Estimate the project's operating cash flows. (Hint: Again use Table 1 as a guide.) What are the project's NPV, IRR, modified IRR (MIRR), and payback? Should the project be under- taken? (Remember. The MIRR is found in three steps: (1) compound all cash inflows for ward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the pre- sent value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.) STOP 6. Now suppose the project had involved replacement rather than expansion of existing facili- ties. Describe briefly how the analysis would have to be changed to deal with a replacement project 1. Assume that inflation is expected to average 5 percent per year over the next 4 years. Does it appear that the project's cash flow estimates are real or nominal? That is, are they stated in constant (current year) dollars, or has inflation been built into the cash flow estimates? (Hint: Nominal cash flows include the effects of inflation, but real cash flows do not.) b. Is the 10 percent cost of capital a nominal or a real rate? c. Is the current NPV biased, and, if so, in what direction? 8. Now assume that the sales price will increase by the 5 percent inflation rate beginning after Year 0. However, assume that cash operating costs will increase by only 2 percent annually from the initial cost estimate, because over half of the costs are fixed by long-term contracts. For simplicity, assume that no other cash flows (net externality costs, salvage value, or net working capital) are affected by inflation. What are the project's NPV, IRR, MIRR, and pay- back now that inflation has been taken into account? (Hint: The Year 1, and succeeding cash flows, must be adjusted for inflation because the estimates are in Year O dollars.) 9. The second capital budgeting decision which Sharpe and you were asked to analyze involves choosing between two mutually exclusive projects, and I whose cash flows are set forth below: Expected Net Cash Flow Year Projects Project L 0 ($400,000) ($400.000) 240,000 134,000 240,000 134,000 3 134,000 134,000 4 Both of these projects are in Robert Montoya's main line of business, table wine, and the investment which is chosen is expected to be repeated indefinitely into the future. Also, cach project is of average risk, hence each is assigned the 10 percent corporate cost of capital. a. What is cach project's single-cycle NPV? Now apply the replacement chain approach and then repeat the analysis using the equivalent annual annuity approach. Which project should be chosen, Sor L? Why? b. Now assume that the cost to replicate Project Sin 2 years is estimated to be $420,000 because of inflationary pressures. Similar investment cost increases will occur for both projects in Year 4 and beyond. How would this affect the analysis? Which project should be chosen under this assumption? 10. The third project to be considered involves a fleet of trucks with an engineering life of 3 years (that is the trucks will be totally worn out after 3 years). However, if the trucks were taken out of service, or "abandoned," prior to the end of 3 years, they would have a positive salvage value. Here are the estimated net cash flows for each truck: End-of-Year Net Abandonment Cash Flow $60,000 37,200 24,000 0 JOT ON- Initial Investment Year and Operating Cash Flow 0 ($60,000) 1 25,200 24,000 3 21,000 The relevant cost of capital is again 10 percent. a. What would the NPV be if the trucks were operated for the full 3 years? b. What if they were abandoned at the end of Year 2? What if they were abandoned at the end of Year 1? zoral) en won c. What is the economic life of the truck project? 11. Refer back to the original wine project. In this and the remaining questions, if you are using the Lotus 1-2-3 model, quantify your answer. Otherwise, just discuss the impact of the changes. a. What would happen to the project's profitability if inflation were neutral, that is, if both sales prices and cash costs increase by the 5 percent annual inflation rate? b. Now suppose that Robert Montoya is unable to pass along its inflationary input cost increases to its customers. For example, assume that cash costs increase by the 5 percent annual inflation rate, but that the sales price can be increased at only a 2 percent annual rate. What is the project's profitability under these conditions? 12. Return to the initial inflation assumptions (5 percent on price and 2 percent on cash costs). a. Assume that the sales quantity estimate remains at 100,000 units per year. What Year 0 unit price would the company have to set to cause the project to just break even, that is, to force NPV = $0? b. Now assume that the sales price remains at $40. What annual unit sales volume would be needed for the project to break even? Mnados de tot Glanna tidig Oru bangla TV'lo 1500 Side view toolgiz aniongozi wa