Answered step by step

Verified Expert Solution

Question

1 Approved Answer

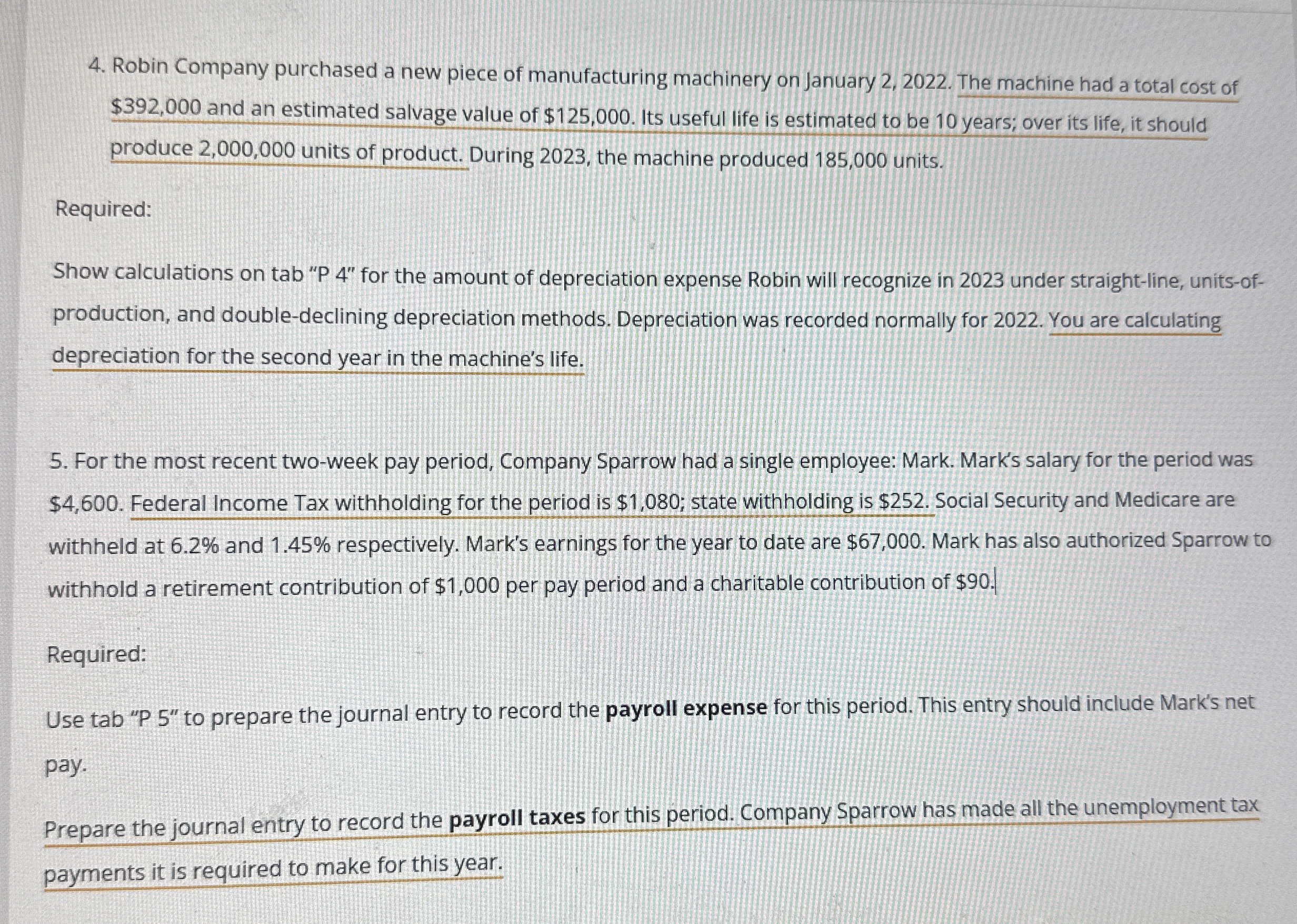

Robin Company purchased a new piece of manufacturing machinery on January 2 , 2 0 2 2 . The machine had a total cost of

Robin Company purchased a new piece of manufacturing machinery on January The machine had a total cost of $ and an estimated salvage value of $ Its useful life is estimated to be years; over its life, it should produce units of product. During the machine produced units.

Required:

Show calculations on tab P for the amount of depreciation expense Robin will recognize in under straightline, unitsofproduction, and doubledeclining depreciation methods. Depreciation was recorded normally for You are calculating depreciation for the second year in the machine's life.

For the most recent twoweek pay period, Company Sparrow had a single employee: Mark. Mark's salary for the period was $ Federal Income Tax withholding for the period is $; state withholding is $ Social Security and Medicare are withheld at and respectively. Mark's earnings for the year to date are $ Mark has also authorized Sparrow to withhold a retirement contribution of $ per pay period and a charitable contribution of $

Required:

Use tab P to prepare the journal entry to record the payroll expense for this period. This entry should include Mark's net pay.

Prepare the journal entry to record the payroll taxes for this period. Company Sparrow has made all the unemployment tax payments it is required to make for this year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started