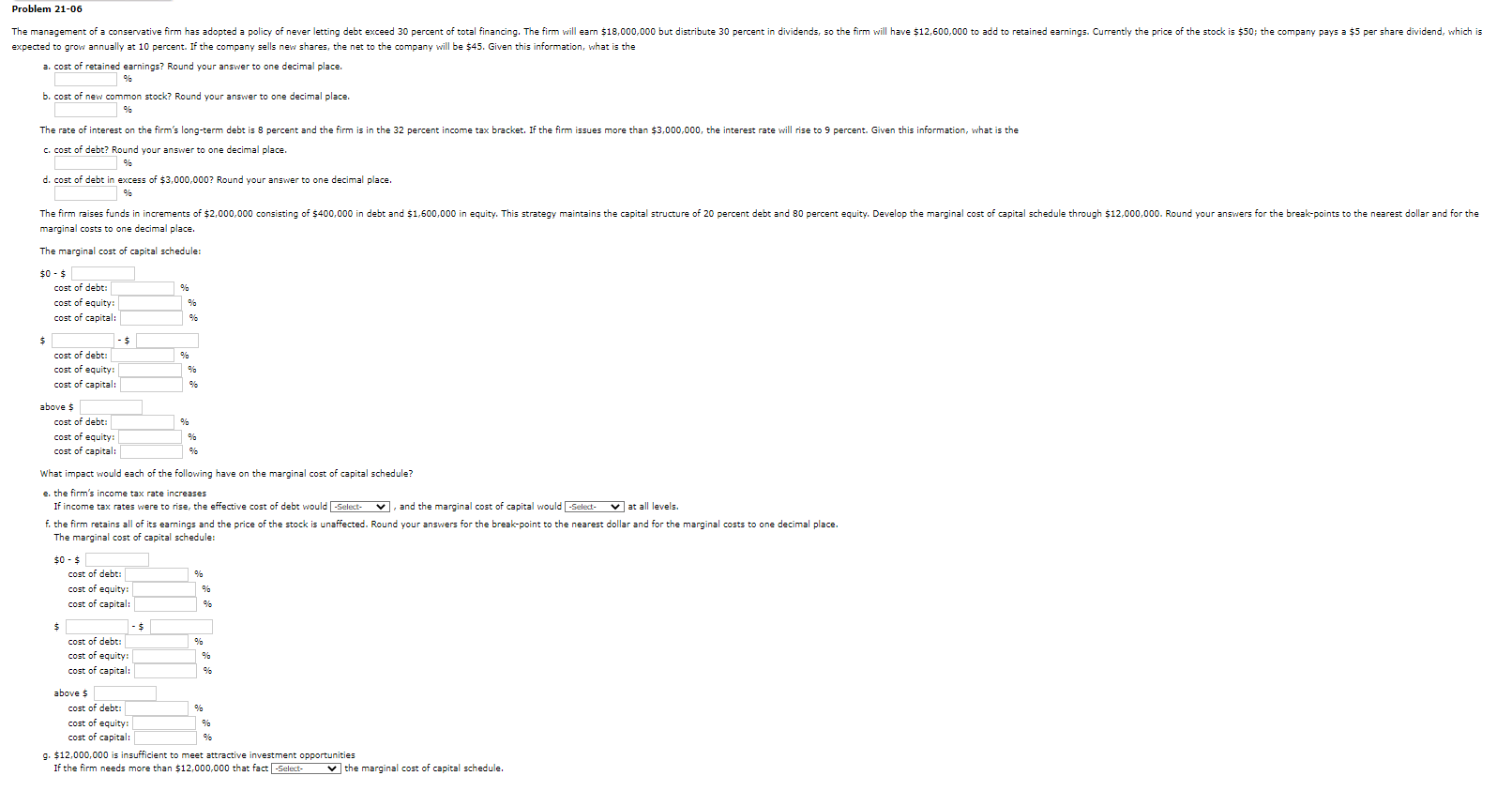

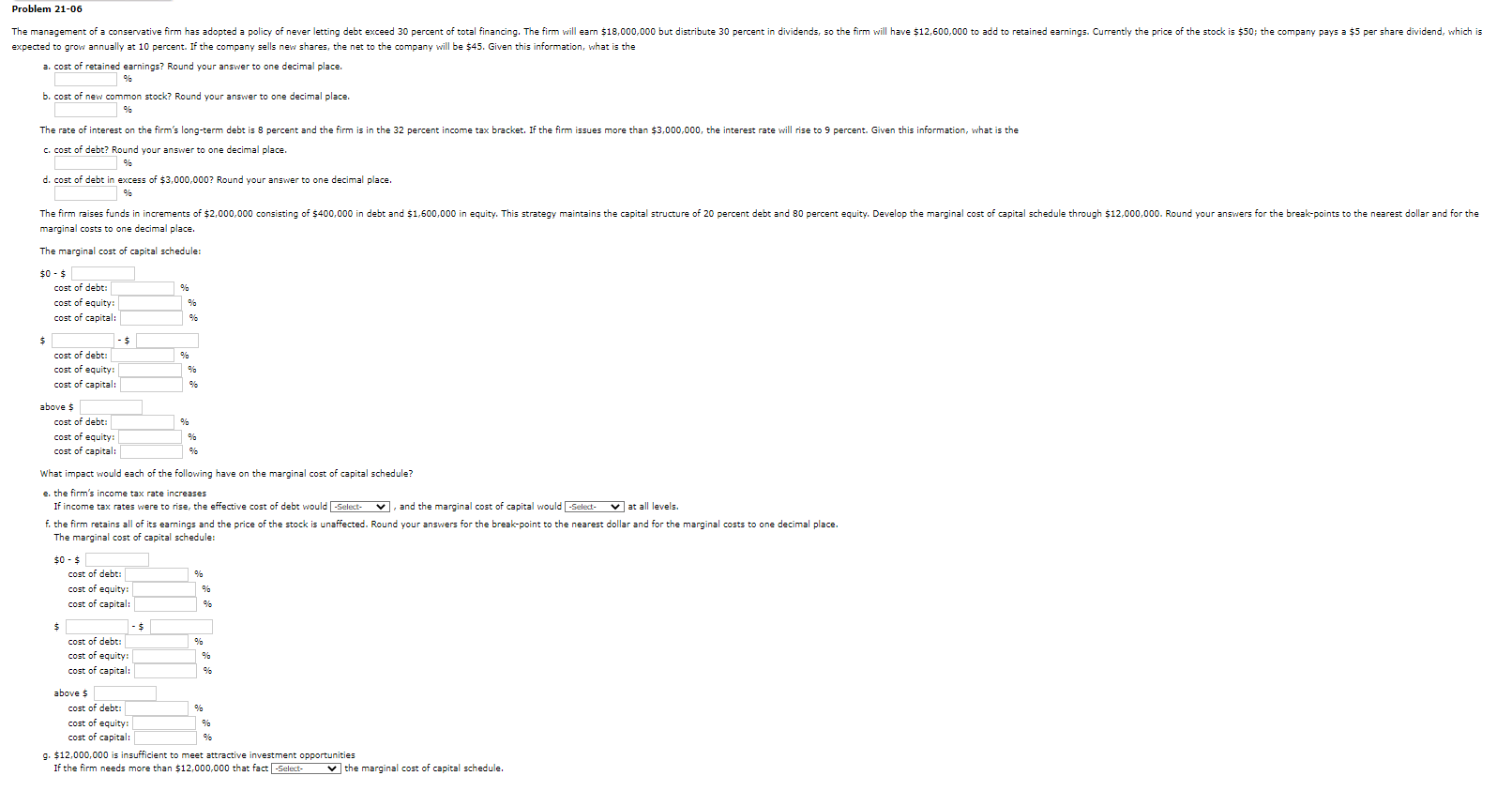

roblem 21-06 xpected to grow annually at 10 percent. If the company sells new shares, the net to the company will be $45. Given this information, what is the a. - - an:- earnings? Round your answer to one decimal place. c. man a dahms Dound your answer to one decimal place. d. rnst af Heht in excess of $3,000,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: What impact would each of the following have on the marginal cost of capital schedule? e. the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would 1 , and the marginal cost of capital would all levels, The marginal cost of capital schedule: $0$ cost of debt: cost of equity: cost of capital: $ cost of debt: cost of equity: cost of capital: above $ cost of debt: cost of equity: cost of capital: g. $12,000,000 is insufficient to meet attractive investment opportunities If the firm needs more than $12,000,000 that fact [ the marginal cost of capital schedule. roblem 21-06 xpected to grow annually at 10 percent. If the company sells new shares, the net to the company will be $45. Given this information, what is the a. - - an:- earnings? Round your answer to one decimal place. c. man a dahms Dound your answer to one decimal place. d. rnst af Heht in excess of $3,000,000 ? Round your answer to one decimal place. marginal costs to one decimal place. The marginal cost of capital schedule: What impact would each of the following have on the marginal cost of capital schedule? e. the firm's income tax rate increases If income tax rates were to rise, the effective cost of debt would 1 , and the marginal cost of capital would all levels, The marginal cost of capital schedule: $0$ cost of debt: cost of equity: cost of capital: $ cost of debt: cost of equity: cost of capital: above $ cost of debt: cost of equity: cost of capital: g. $12,000,000 is insufficient to meet attractive investment opportunities If the firm needs more than $12,000,000 that fact [ the marginal cost of capital schedule