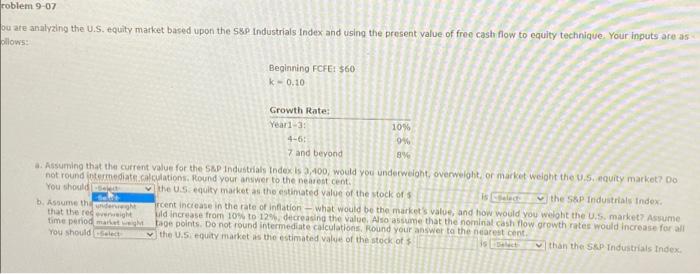

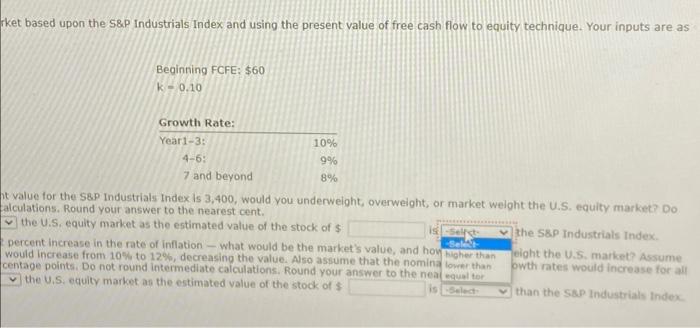

roblem 9-07 ou are analyzing the U.S. equity market based upon the S&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as ollows: Beginning FCFE: $60 k-0.10 b. Assume thunderweight that the recevenight time period market weight You should Select Growth Rate: Year1-3: 4-6: 7 and beyond 10% 9% 8% a. Assuming that the current value for the S&P Industrials Index is 3,400, would you underweight, overweight, or market weight the U.S. equity market? Do not round intermediate calculations. Round your answer to the nearest cent. You should select the U.S: equity market as the estimated value of the stock of s is-Select the S&P Industrials Index. rcent increase in the rate of inflation - what would be the market's value, and how would you weight the U.S. market? Assume uld increase from 10% to 12%, decreasing the value. Also assume that the nominal cash flow growth rates would increase for all tage points. Do not round intermediate calculations. Round your answer to the nearest cent. the U.S. equity market as the estimated value of the stock of $ is elect than the S&P Industrials Index. rket based upon the S&P Industrials Index and using the present value of free cash flow to equity technique. Your inputs are as Beginning FCFE: $60 k - 0.10 Growth Rate: Year1-3: 4-6: 7 and beyond 10% 9% 8% ht value for the S&P Industrials Index is 3,400, would you underweight, overweight, or market weight the U.S. equity market? Do calculations. Round your answer to the nearest cent. the U.S. equity market as the estimated value of the stock of $ is-Selfct -Selet percent increase in the rate of inflation - what would be the market's value, and how higher than would increase from 10% to 12%, decreasing the value. Also assume that the nomina lower than centage points. Do not round intermediate calculations. Round your answer to the neat equal tor the U.S. equity market as the estimated value of the stock of $ is-Select the S&P Industrials Index. eight the U.S. market? Assume owth rates would increase for all than the S&P Industrials Index