Question

Robo Ltd. On April 10, 2016, fire destroyed the office and warehouse of Robo, Ltd. Most of the accounting records were destroyed, but the following

Robo Ltd.

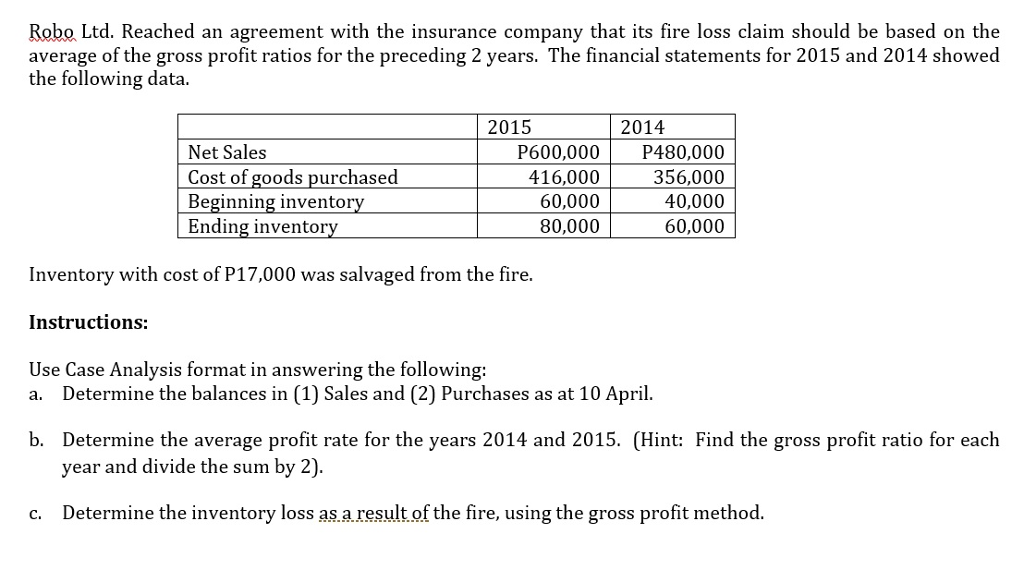

On April 10, 2016, fire destroyed the office and warehouse of Robo, Ltd. Most of the accounting records were destroyed, but the following account balances were determined as at 31 March 2016. Inventory, 1 January 2016, P80,000; Sales (1 January 31 March 2016), P180,000; Purchases (1 January 31 March 2016), P94,000. The companys financial year ends on 31 December. It uses a periodic inventory system. From an analysis of the April bank statement, you discover cancelled cheques of P4,200 for cash purchases during the period 1-10 April. Deposits during the same period totaled P18,500. Of that amount, 60% were collections on accounts receivable, and the balance was cash sales. Correspondence with the companys principal suppliers revealed P12,400 of purchases on account from 1 April to 10 April. Of that amount, P1,600 was for inventory in transit on 10 April that was shipped FOB destination. Correspondence with the companys principal customers produced acknowledgments of credit sales totaling P28,000 from 1 April to 10 April. It was estimated that P5,100 of credit sales will never be acknowledged or recovered from customers. Robo Ltd. Reached an agreement with the insurance company that its fire loss claim should be based on the average of the gross profit ratios for the preceding 2 years. The financial statements for 2015 and 2014 showed the following data.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started