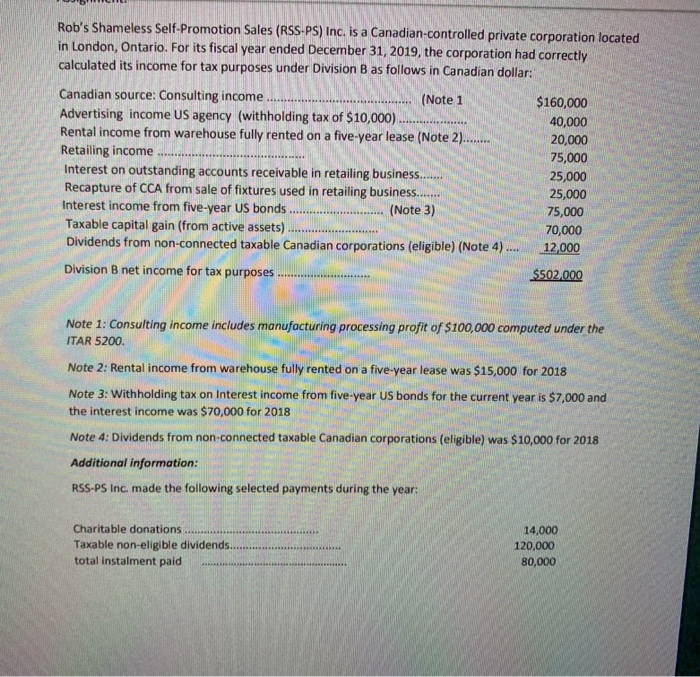

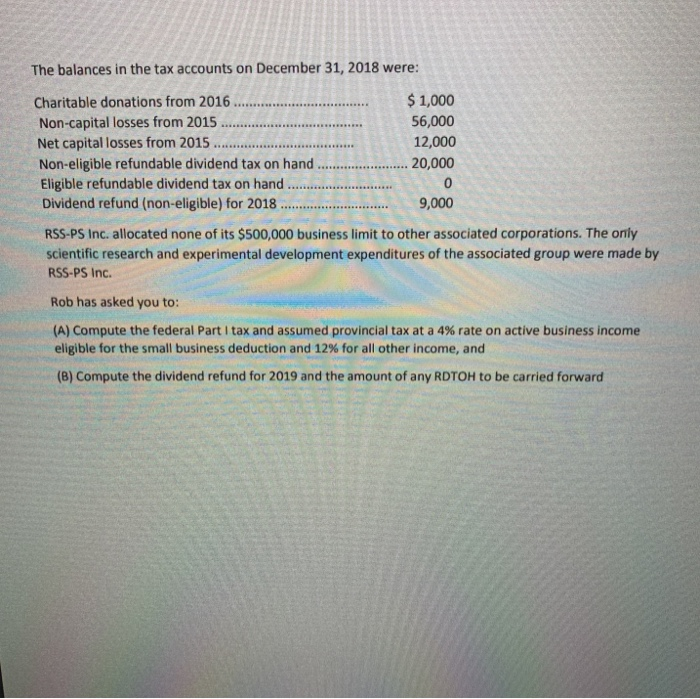

Rob's Shameless Self-Promotion Sales (RSS-PS) Inc. is a Canadian-controlled private corporation located in London, Ontario. For its fiscal year ended December 31, 2019, the corporation had correctly calculated its income for tax purposes under Division B as follows in Canadian dollar: ***** Canadian source: Consulting income (Note 1 Advertising income US agency (withholding tax of $10,000) Rental income from warehouse fully rented on a five-year lease (Note 2)........ Retailing income Interest on outstanding accounts receivable in retailing business... Recapture of CCA from sale of fixtures used in retailing business....... Interest income from five-year US bonds (Note 3) Taxable capital gain (from active assets) Dividends from non-connected taxable Canadian corporations (eligible) (Note 4) $160,000 40,000 20,000 75,000 25,000 25,000 75,000 70,000 12,000 Division B net income for tax purposes $502.000 Note 1: Consulting income includes manufacturing processing profit of $100,000 computed under the ITAR 5200. Note 2: Rental income from warehouse fully rented on a five-year lease was $15,000 for 2018 Note 3: Withholding tax on Interest income from five-year US bonds for the current year is $7,000 and the interest income was $70,000 for 2018 Note 4: Dividends from non-connect taxable Canadian corporations (eligible) was $10,000 for 2018 Additional information: RSS-PS Inc. made the following selected payments during the year: Charitable donations Taxable non-eligible dividends. total instalment paid 14,000 120,000 80,000 The balances in the tax accounts on December 31, 2018 were: Charitable donations from 2016... $ 1,000 Non-capital losses from 2015 56,000 Net capital losses from 2015 12,000 Non-eligible refundable dividend tax on hand 20,000 Eligible refundable dividend tax on hand. 0 Dividend refund (non-eligible) for 2018 9,000 RSS-PS Inc. allocated none of its $500,000 business limit to other associated corporations. The only scientific research and experimental development expenditures of the associated group were made by RSS-PS Inc. Rob has asked you to: (A) Compute the federal Part I tax and assumed provincial tax at a 4% rate on active business income eligible for the small business deduction and 12% for all other income, and (B) Compute the dividend refund for 2019 and the amount of any RDTOH to be carried forward Canada federal tax law Rob's Shameless Self-Promotion Sales (RSS-PS) Inc. is a Canadian-controlled private corporation located in London, Ontario. For its fiscal year ended December 31, 2019, the corporation had correctly calculated its income for tax purposes under Division B as follows in Canadian dollar: ***** Canadian source: Consulting income (Note 1 Advertising income US agency (withholding tax of $10,000) Rental income from warehouse fully rented on a five-year lease (Note 2)........ Retailing income Interest on outstanding accounts receivable in retailing business... Recapture of CCA from sale of fixtures used in retailing business....... Interest income from five-year US bonds (Note 3) Taxable capital gain (from active assets) Dividends from non-connected taxable Canadian corporations (eligible) (Note 4) $160,000 40,000 20,000 75,000 25,000 25,000 75,000 70,000 12,000 Division B net income for tax purposes $502.000 Note 1: Consulting income includes manufacturing processing profit of $100,000 computed under the ITAR 5200. Note 2: Rental income from warehouse fully rented on a five-year lease was $15,000 for 2018 Note 3: Withholding tax on Interest income from five-year US bonds for the current year is $7,000 and the interest income was $70,000 for 2018 Note 4: Dividends from non-connect taxable Canadian corporations (eligible) was $10,000 for 2018 Additional information: RSS-PS Inc. made the following selected payments during the year: Charitable donations Taxable non-eligible dividends. total instalment paid 14,000 120,000 80,000 The balances in the tax accounts on December 31, 2018 were: Charitable donations from 2016... $ 1,000 Non-capital losses from 2015 56,000 Net capital losses from 2015 12,000 Non-eligible refundable dividend tax on hand 20,000 Eligible refundable dividend tax on hand. 0 Dividend refund (non-eligible) for 2018 9,000 RSS-PS Inc. allocated none of its $500,000 business limit to other associated corporations. The only scientific research and experimental development expenditures of the associated group were made by RSS-PS Inc. Rob has asked you to: (A) Compute the federal Part I tax and assumed provincial tax at a 4% rate on active business income eligible for the small business deduction and 12% for all other income, and (B) Compute the dividend refund for 2019 and the amount of any RDTOH to be carried forward Canada federal tax law