Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ROCE Analysis Level A: ROCE computation Share price for the last /5/ years Dividends for the last /5/ years Risk Analysis: Quick Ratio (Acid Test

- ROCE Analysis

- Level A: ROCE computation

- Share price for the last /5/ years

- Dividends for the last /5/ years

- Risk Analysis:

- Quick Ratio (Acid Test Ratio)

- Working capital Activity ratio

- Long-Term Solvency Risk- Debt Ratios

- L.T. Debt Ratio

- Debt/Equity Ratio

- L.T. Debt/Asset Ratio

- Multiple Discriminant Analysis

- Altman's Z-Score

please solve question No 1+ 2+ 3+4 because must send today .. Thanks

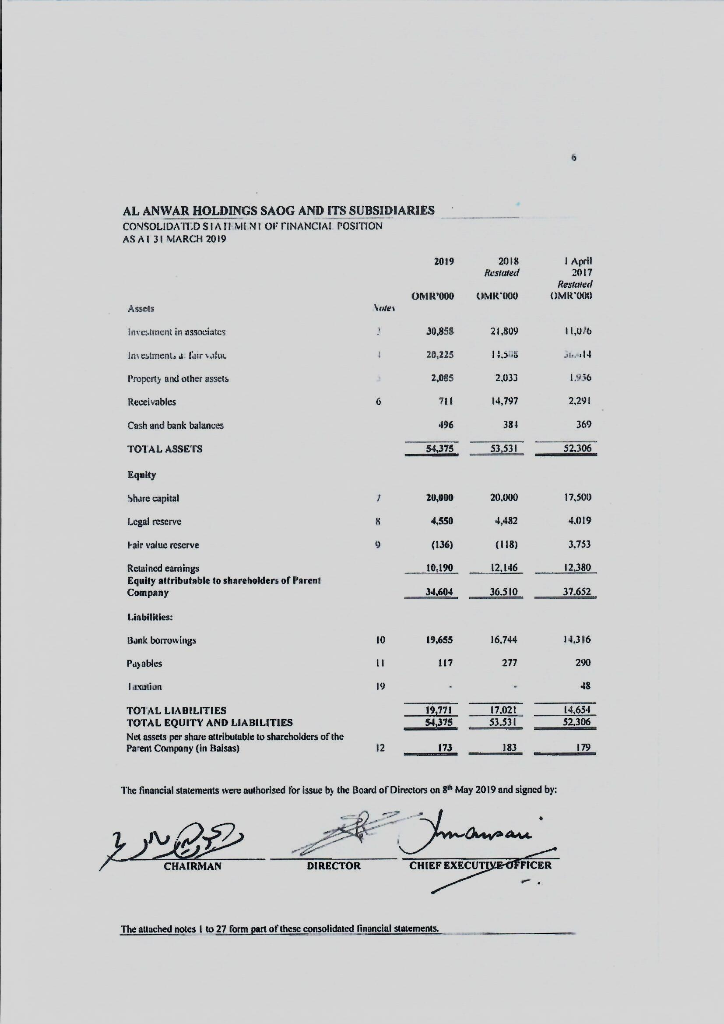

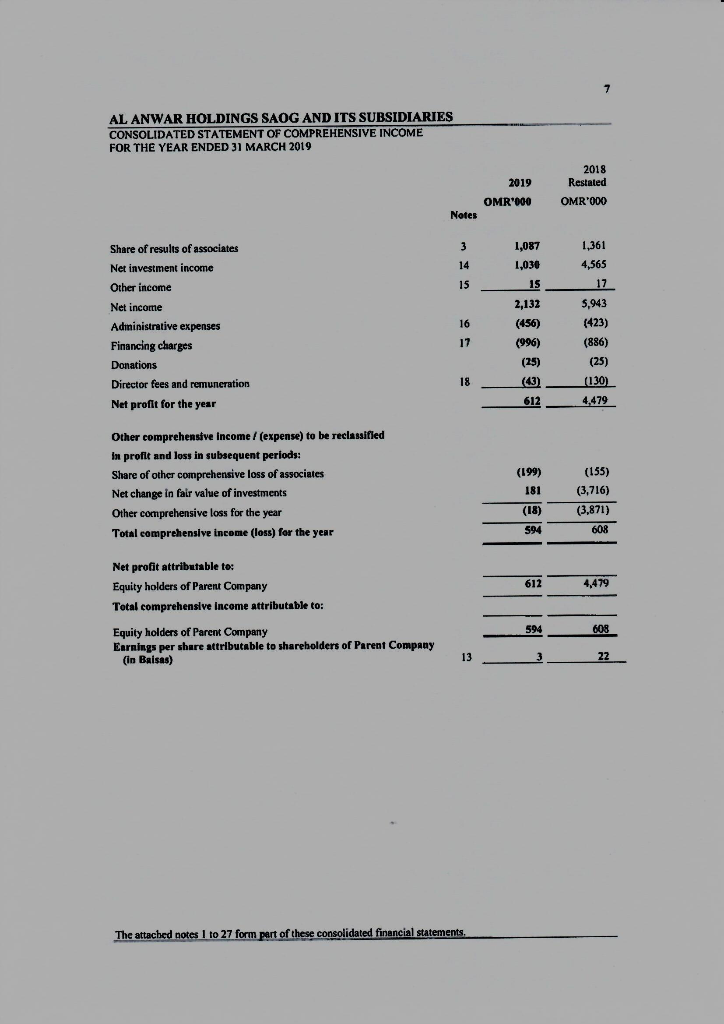

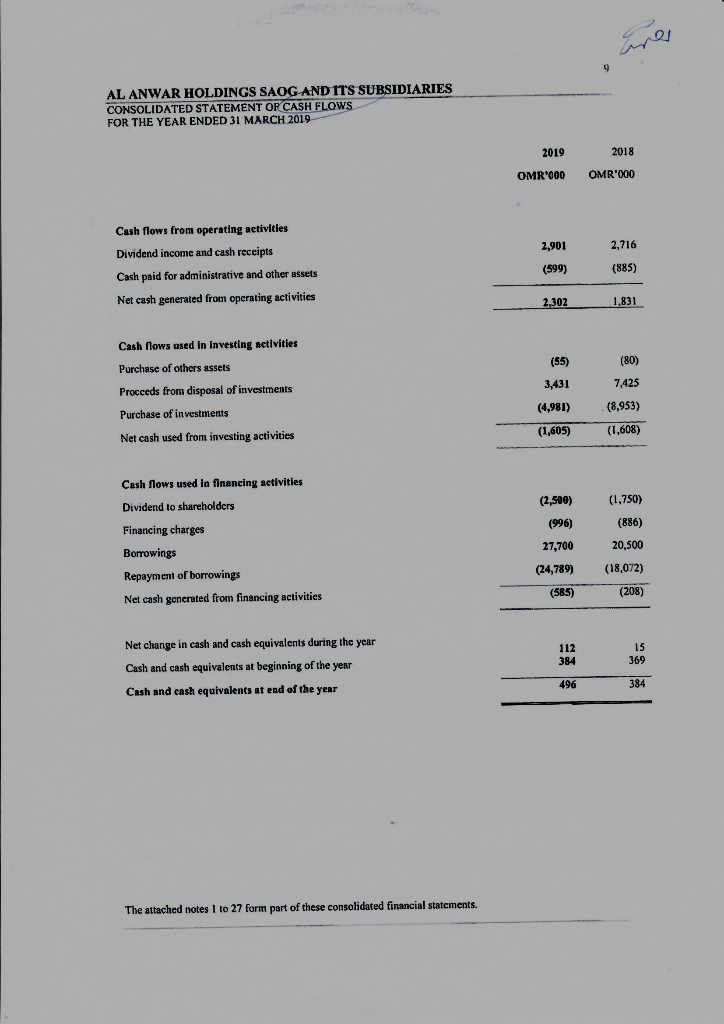

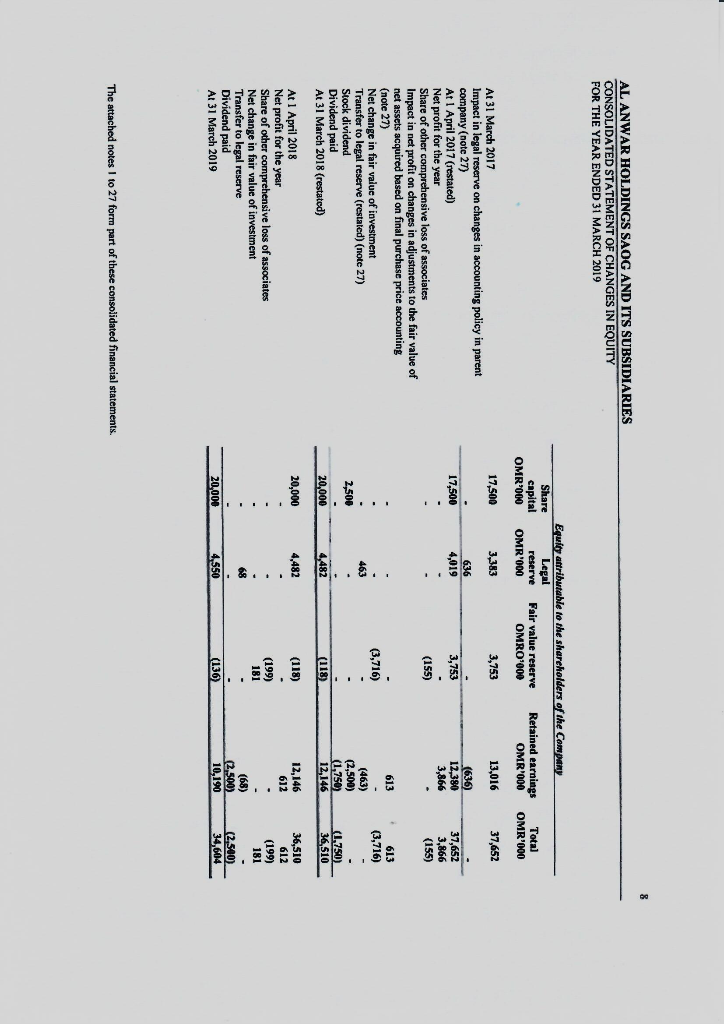

AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATUD SIATMENT OF FINANCIAL POSITION AS AT 31 MARCH 2019 2019 2018 Restored April 2017 Restened OMR) OMR000 OMR000 Assets Vaves Investment in associates 30,858 21,809 11,0/6 *** 20,225 11.55 Investments fair valul Property and other assets 2,085 2,033 1.956 Receivables 6 711 14,797 2.291 496 381 369 Cash and bank balances TOTAL ASSETS 54,375 53,531 52.306 Equity Share capital 1 20,000 20.00 17,500 Legal reserve 4,550 4,482 4.019 Fair value reserve 9 (136) (118) 3.733 10,190 12,146 12,380 34,604 36,510 37.652 Retained earnings Equity attributable to shareholders of Parent Company Linbilities: Bunk borrowings Puyables 10 19,655 16,744 14.316 1 117 277 290 Taxation 19 48 19,771 54,375 17,021 53.531 14,654 52,306 TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES Not assets per share attributable to shareholders of the Parent Company (in Balsas) 12 173 183 179 The financial statements were authorised for issue by the Board of Directors on 3* May 2019 and signed by: Ihmansare CHAIRMAN DIRECTOR CHIEF EXECUTIVE OFFICER The aluched notes I to 27 form part of these consolidated financial statements. 7 AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2019 2018 Restated 2019 OMR'000 OMR'000 Notes 3 14 15 Share of results of associates Net investment income Other income Net income Adininistrative expenses Financing charges Donations Director fees and remuneration Net profit for the year 1,087 1,036 15 2,132 (456) (996) (25) 16 17 1,361 4,565 17 5,943 (423) (886) (25) (130) 4,479 18 (43) 612 Other comprehensive Income / (expense) to be reclassified In profit and loss in subsequent periods: Share of other comprehensive loss of associates Net change in fair value of investments Other comprehensive loss for the year Total comprehensive income (loss) for the year (199) 181 (18) (155) (3,716) (3,871) 594 608 612 4,479 Net profit attributable to: Equity holders of Parent Company Total comprehensive Income attributable to: Equity holders of Parent Company Earnings per share attributable to shareholders of Parent Company (in Baisas) 594 608 13 3 22 The attached notes 1 to 27 form part of these consolidated financial statements. 9 AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 2019 2018 OMR'000 OMR'000 Cash flows from operating activities Dividend income and cash receipts 2,901 2,716 (599) (885) Cash paid for administrative and other assets Net cash generated from operating activities 2,302 1,831 Cash flows used in investing activities Purchase of others assets Proceeds from disposal of investments (55) (80) 3,431 7,425 (4,981) (8,953) Purchase of investments (1,605) (1.608) Net cash used from investing activities Cash flows used in financing activities Dividend to shareholders (1,750) (2,500) (996) 27,700 (886) 20.500 Financing charges Borrowings Repayment of borrowings Net cash generated from financing activities (24,789) (18.072) (585) (208) 112 384 15 369 Net change in cash and cash equivalents during the year Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year 496 384 The attached notes 1 to 27 form part of these consolidated financial statements. AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 Share capital OMR'000 Equity attributable to the shareholders of the Company Legal reserve Fair value reserve Retained earnings OMR'000 OMRO'000 OMR'000 Tota) OMR'000 17,500 3,383 3,753 13,016 37,652 17,500 636 4,019 3,753 (636) 12,380 3,866 37,652 3,866 (155) (155) At 31 March 2017 Impact in legal reserve on changes in accounting policy in parent company (note 27) At 1 April 2017 (restated) Net profit for the year Share of other comprehensive loss of associates Impact in net profit on changes in adjustments to the fair value of net assets acquired based on final purchase price accounting (note 27) Net change in fair value of investment Transfer to legal reserve (restated) (note 27) Stock dividend Dividend paid At 31 March 2018 (restated) 613 (3,716) 613 (3,716) 463 2,500 (463) (2,500) (1.750) 12,146 (1.750) 36,510 20,000 4.482 (118) 20,000 4,482 (118) 12,146 612 At 1 April 2018 Net profit for the year Share of other comprehensive loss of associates Net change in fair value of investment Transfer to legal reserve Dividend paid At 31 March 2019 36,510 612 (199) 181 (199) 181 69 (68) 2.500) 10,190 (2.500 20,000 4,550 (136) 34,604 The attached notes i to 27 form part of these consolidated financial statements. AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATUD SIATMENT OF FINANCIAL POSITION AS AT 31 MARCH 2019 2019 2018 Restored April 2017 Restened OMR) OMR000 OMR000 Assets Vaves Investment in associates 30,858 21,809 11,0/6 *** 20,225 11.55 Investments fair valul Property and other assets 2,085 2,033 1.956 Receivables 6 711 14,797 2.291 496 381 369 Cash and bank balances TOTAL ASSETS 54,375 53,531 52.306 Equity Share capital 1 20,000 20.00 17,500 Legal reserve 4,550 4,482 4.019 Fair value reserve 9 (136) (118) 3.733 10,190 12,146 12,380 34,604 36,510 37.652 Retained earnings Equity attributable to shareholders of Parent Company Linbilities: Bunk borrowings Puyables 10 19,655 16,744 14.316 1 117 277 290 Taxation 19 48 19,771 54,375 17,021 53.531 14,654 52,306 TOTAL LIABILITIES TOTAL EQUITY AND LIABILITIES Not assets per share attributable to shareholders of the Parent Company (in Balsas) 12 173 183 179 The financial statements were authorised for issue by the Board of Directors on 3* May 2019 and signed by: Ihmansare CHAIRMAN DIRECTOR CHIEF EXECUTIVE OFFICER The aluched notes I to 27 form part of these consolidated financial statements. 7 AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH 2019 2018 Restated 2019 OMR'000 OMR'000 Notes 3 14 15 Share of results of associates Net investment income Other income Net income Adininistrative expenses Financing charges Donations Director fees and remuneration Net profit for the year 1,087 1,036 15 2,132 (456) (996) (25) 16 17 1,361 4,565 17 5,943 (423) (886) (25) (130) 4,479 18 (43) 612 Other comprehensive Income / (expense) to be reclassified In profit and loss in subsequent periods: Share of other comprehensive loss of associates Net change in fair value of investments Other comprehensive loss for the year Total comprehensive income (loss) for the year (199) 181 (18) (155) (3,716) (3,871) 594 608 612 4,479 Net profit attributable to: Equity holders of Parent Company Total comprehensive Income attributable to: Equity holders of Parent Company Earnings per share attributable to shareholders of Parent Company (in Baisas) 594 608 13 3 22 The attached notes 1 to 27 form part of these consolidated financial statements. 9 AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 MARCH 2019 2019 2018 OMR'000 OMR'000 Cash flows from operating activities Dividend income and cash receipts 2,901 2,716 (599) (885) Cash paid for administrative and other assets Net cash generated from operating activities 2,302 1,831 Cash flows used in investing activities Purchase of others assets Proceeds from disposal of investments (55) (80) 3,431 7,425 (4,981) (8,953) Purchase of investments (1,605) (1.608) Net cash used from investing activities Cash flows used in financing activities Dividend to shareholders (1,750) (2,500) (996) 27,700 (886) 20.500 Financing charges Borrowings Repayment of borrowings Net cash generated from financing activities (24,789) (18.072) (585) (208) 112 384 15 369 Net change in cash and cash equivalents during the year Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year 496 384 The attached notes 1 to 27 form part of these consolidated financial statements. AL ANWAR HOLDINGS SAOG AND ITS SUBSIDIARIES CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2019 Share capital OMR'000 Equity attributable to the shareholders of the Company Legal reserve Fair value reserve Retained earnings OMR'000 OMRO'000 OMR'000 Tota) OMR'000 17,500 3,383 3,753 13,016 37,652 17,500 636 4,019 3,753 (636) 12,380 3,866 37,652 3,866 (155) (155) At 31 March 2017 Impact in legal reserve on changes in accounting policy in parent company (note 27) At 1 April 2017 (restated) Net profit for the year Share of other comprehensive loss of associates Impact in net profit on changes in adjustments to the fair value of net assets acquired based on final purchase price accounting (note 27) Net change in fair value of investment Transfer to legal reserve (restated) (note 27) Stock dividend Dividend paid At 31 March 2018 (restated) 613 (3,716) 613 (3,716) 463 2,500 (463) (2,500) (1.750) 12,146 (1.750) 36,510 20,000 4.482 (118) 20,000 4,482 (118) 12,146 612 At 1 April 2018 Net profit for the year Share of other comprehensive loss of associates Net change in fair value of investment Transfer to legal reserve Dividend paid At 31 March 2019 36,510 612 (199) 181 (199) 181 69 (68) 2.500) 10,190 (2.500 20,000 4,550 (136) 34,604 The attached notes i to 27 form part of these consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started