Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Roces and Sales, who are engaged in the same type of business, agree to combine their resources and form a partnership on January 1,

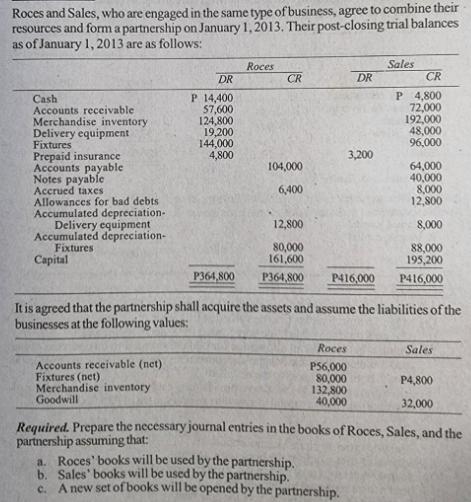

Roces and Sales, who are engaged in the same type of business, agree to combine their resources and form a partnership on January 1, 2013. Their post-closing trial balances as of January 1, 2013 are as follows: Cash Accounts receivable Merchandise inventory Delivery equipment Fixtures Prepaid insurance Accounts payable Notes payable Accrued taxes Allowances for bad debts Accumulated depreciation- Delivery equipment Accumulated depreciation- Fixtures Capital DR P 14,400 57,600 124,800 19,200 144,000 4,800 Accounts receivable (net) Fixtures (net) Merchandise inventory Goodwill P364,800 Roces CR 104,000 6,400 DR 3,200 12,800 80,000 161,600 P364,800 P416,000 Roces P56,000 80,000 132,800 40,000 a. Roces' books will be used by the partnership. b. Sales' books will be used by the partnership. c. A new set of books will be opened by the partnership. Sales CR P 4,800 72,000 192,000 48,000 96,000 It is agreed that the partnership shall acquire the assets and assume the liabilities of the businesses at the following values: 64,000 40,000 8,000 12,800 8,000 88,000 195,200 P416,000 Sales P4,800 32,000 Required. Prepare the necessary journal entries in the books of Roces, Sales, and the partnership assuming that:

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A Roces DR Cash 124800 DR Capital 48000 CR Accounts Receivable 56000 CR Fixtures 12800 CR Merchandise Inventory 8000 CR Goodwill 32000 CR Accounts Pay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started