Answered step by step

Verified Expert Solution

Question

1 Approved Answer

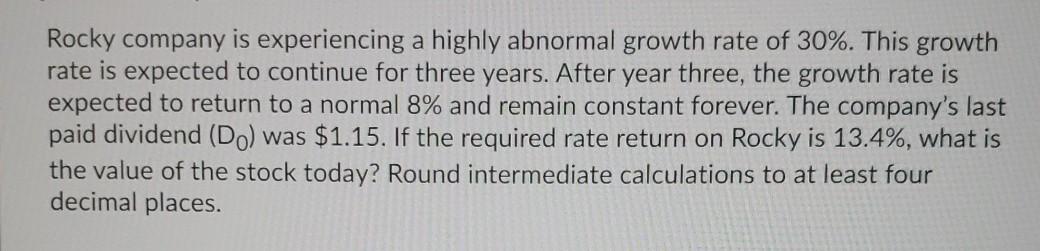

Rocky company is experiencing a highly abnormal growth rate of 30%. This growth rate is expected to continue for three years. After year three, the

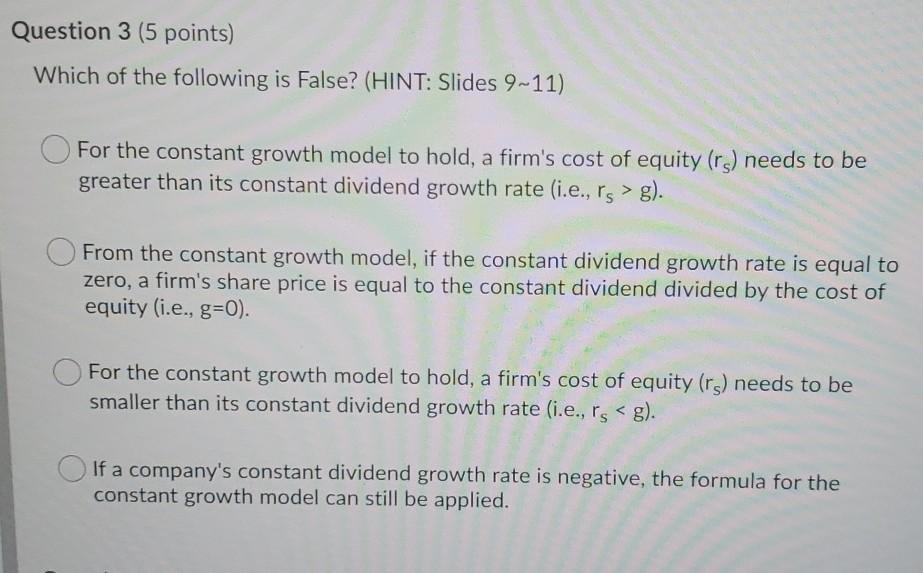

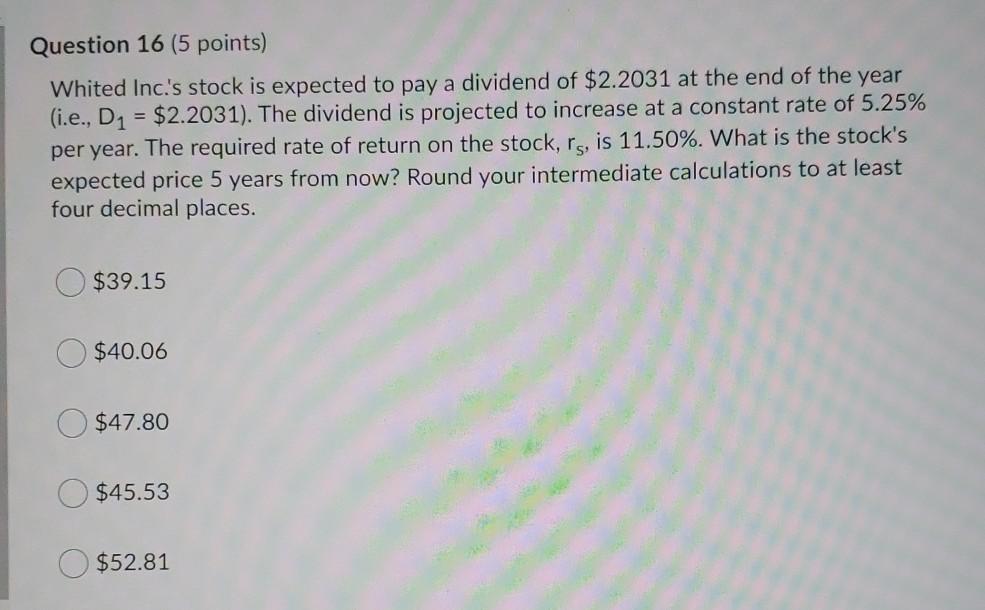

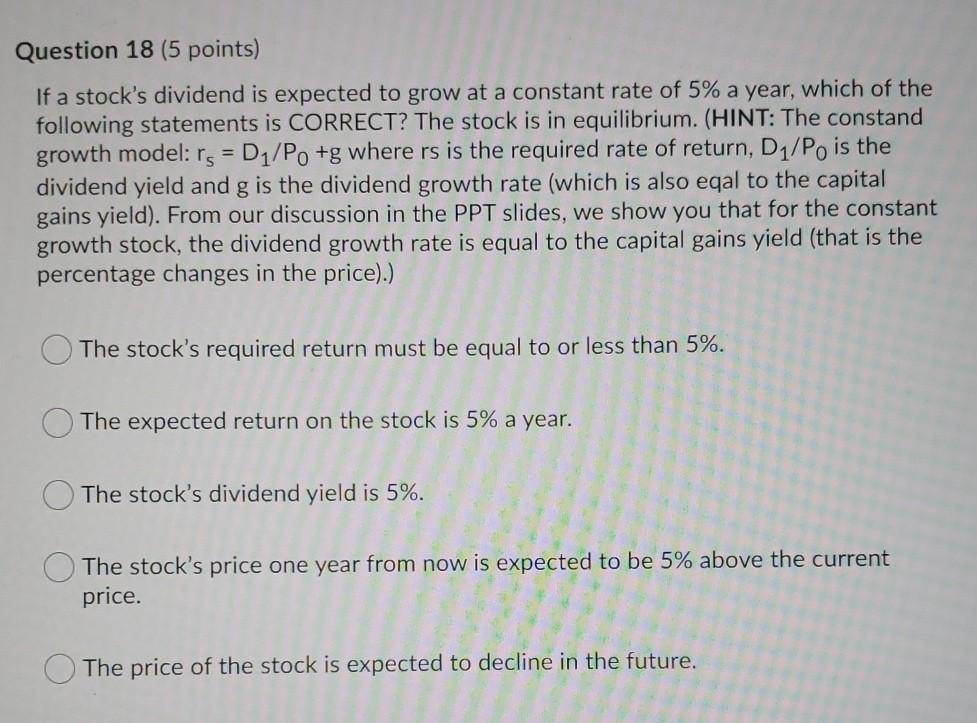

Rocky company is experiencing a highly abnormal growth rate of 30%. This growth rate is expected to continue for three years. After year three, the growth rate is expected to return to a normal 8% and remain constant forever. The company's last paid dividend (Do) was $1.15. If the required rate return on Rocky is 13.4%, what is the value of the stock today? Round intermediate calculations to at least four decimal places. Question 3 (5 points) Which of the following is False? (HINT: Slides 9-11) For the constant growth model to hold, a firm's cost of equity (rs) needs to be greater than its constant dividend growth rate (i.e., rs > g). From the constant growth model, if the constant dividend growth rate is equal to zero, a firm's share price is equal to the constant dividend divided by the cost of equity (i.e., g=0). For the constant growth model to hold, a firm's cost of equity (rs) needs to be smaller than its constant dividend growth rate (i.e., rs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started