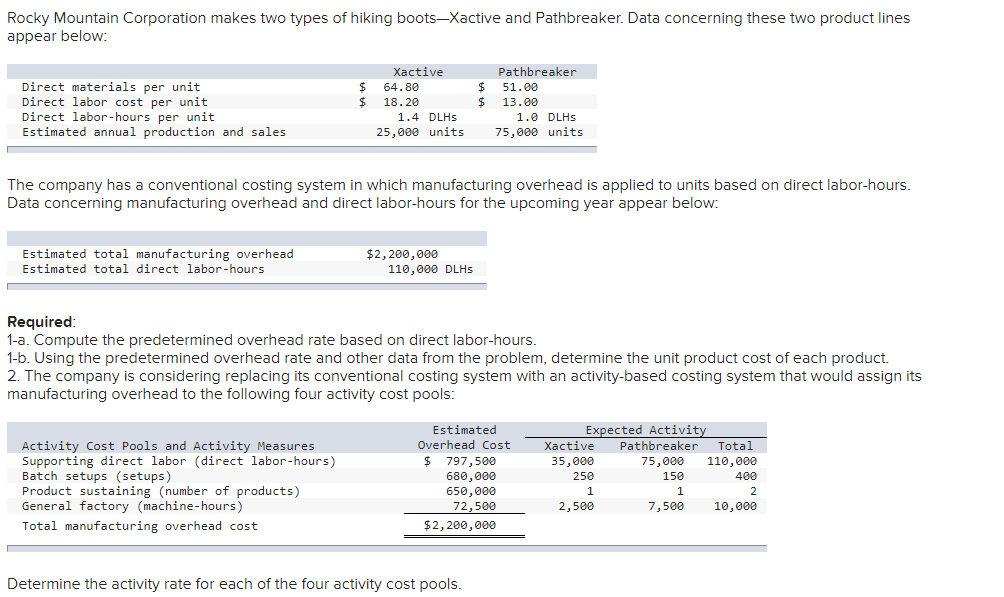

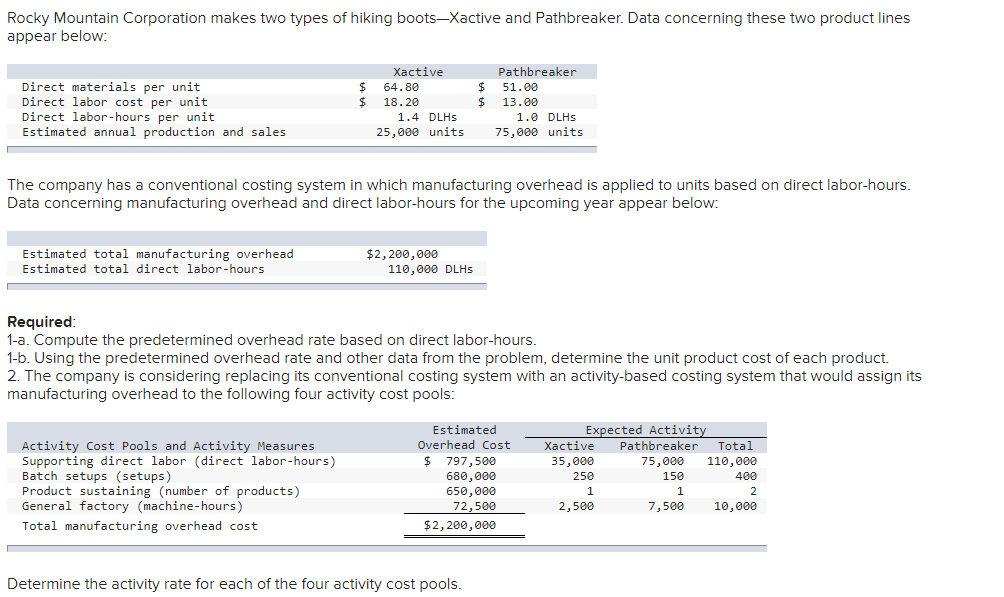

Rocky Mountain Corporation makes two types of hiking bootsXactive and Pathbreaker. Data concerning these two product lines appear below: Xactive Pathbreaker Direct materials per unit $ 64.80 $ 51.00 Direct labor cost per unit $ 18.20 $ 13.00 Direct labor-hours per unit 1.4 DLHs 1.0 DLHs Estimated annual production and sales 25,000 units 75,000 units The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead $2,200,000 Estimated total direct labor-hours 110,000 DLHs Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools.

Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: $ $ Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Xactive 64.80 18.20 1.4 DLHS 25,000 units Pathbreaker $ 51.00 $ 13.00 1.0 DLHS 75,000 units The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $2,200,000 110,000 DLHs Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Activity Cost Pools and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost Estimated Overhead Cost $ 797,500 680,000 650,000 72,500 $2,200,000 Expected Activity Xactive Pathbreaker Total 35,000 75,000 110,000 250 150 400 1 1 2 2,500 7,500 10,000 Determine the activity rate for each of the four activity cost pools. Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: $ $ Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Xactive 64.80 18.20 1.4 DLHS 25,000 units Pathbreaker $ 51.00 $ 13.00 1.0 DLHS 75,000 units The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead Estimated total direct labor-hours $2,200,000 110,000 DLHs Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Activity Cost Pools and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost Estimated Overhead Cost $ 797,500 680,000 650,000 72,500 $2,200,000 Expected Activity Xactive Pathbreaker Total 35,000 75,000 110,000 250 150 400 1 1 2 2,500 7,500 10,000 Determine the activity rate for each of the four activity cost pools