Answered step by step

Verified Expert Solution

Question

1 Approved Answer

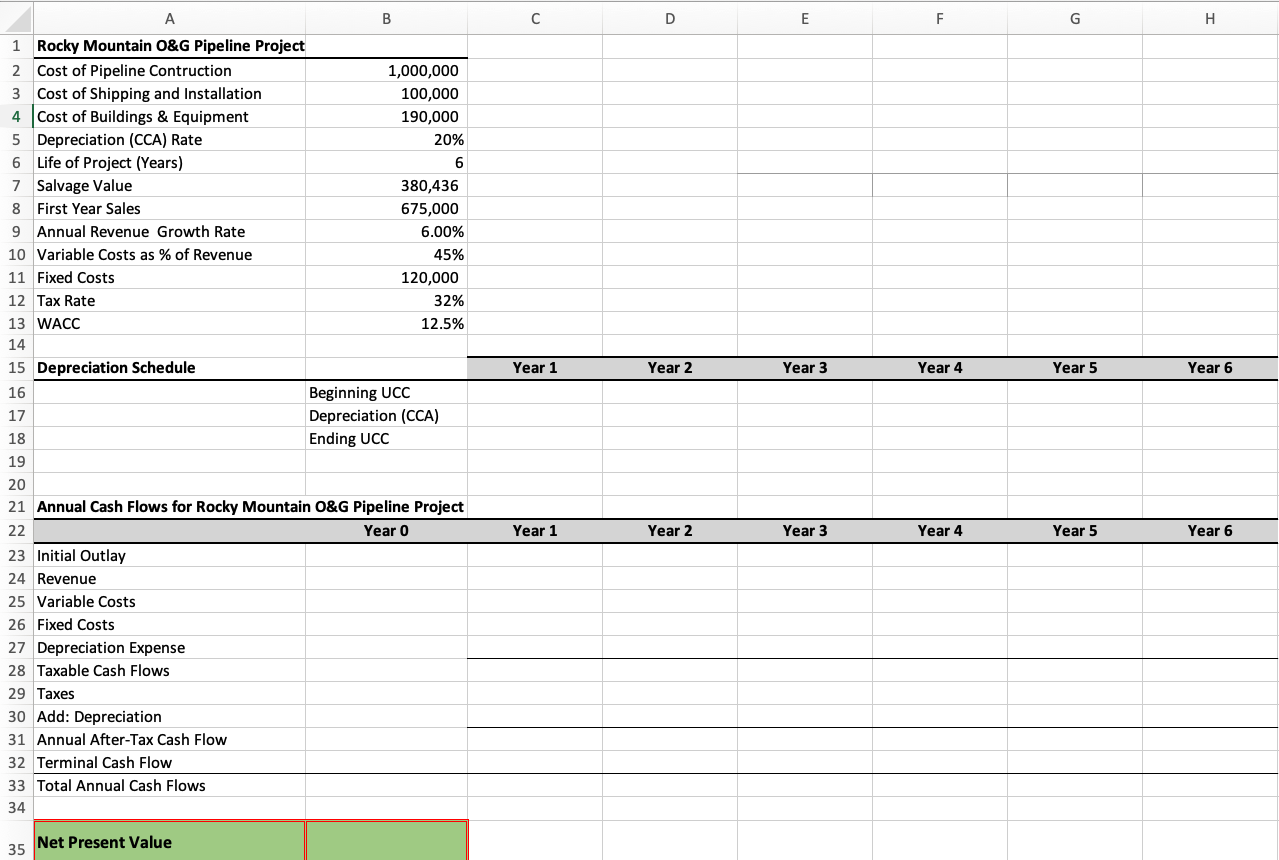

Rocky Mountain Oil and Gas Corp is considering building a pipeline from a remote source of natural gas with only a 6 year supply of

Rocky Mountain Oil and Gas Corp is considering building a pipeline from a remote source of natural gas with only a year supply of reserves. The pipeline will cost $ plus installation costs of $; accompanying buildings will cost another $

Both the pipeline and the buildings qualify for a CCA depreciation rate of Important: The halfyear rule applies. only half of the fullyear depreciation is taken in the first year

Rocky Mountain Oil and Gas expects that revenue from the pipeline in the first year will be $ which will grow at rate of per year for the year life of the project. Variable costs each year are estimated to be of revenue and fixed costs are estimated to be $ per year. In years, the buildings and pipeline will be able to be sold for $after environmental cleanup costs

Rocky Mountain Oil and Gas has a tax rate of and its cost of capital is They have hired you as a consultant to determine whether or not Rocky Mountain Oil and Gas should build the pipeline? Please see attached spreadsheet to answer the questions. What is the depreciation for the first year? What is the aftertax cash flow for the second year Year What is the NPV of the Pipeline project? Should Rocky Mountain Oil and Gas take the project YesNoRocky Mountain Oil and Gas estimates that if they increase fixed costs to $an extra $ a year on marketing they will be able to raise the annual growth rate in sales to What would the NPV be if the company did this? Should the company increase fixed costs to $ in order to raise the annual growth rate in sales to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started