Answered step by step

Verified Expert Solution

Question

1 Approved Answer

roctoring Enabled: MH Lab 3: Relevant Costing (i) 13 Santosh Plastics Inc. purchased a new machine one year ago at a cost of $69,000. Although

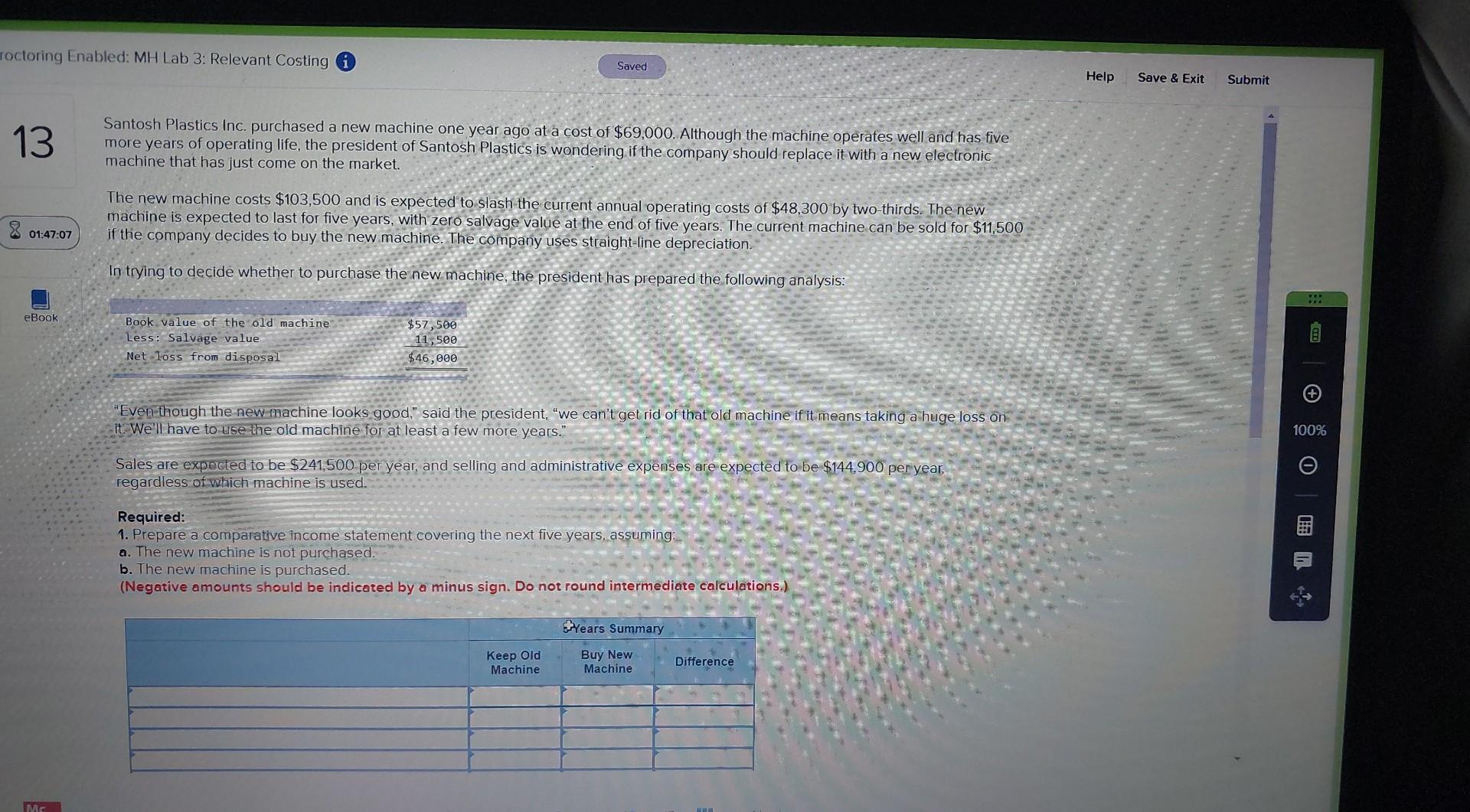

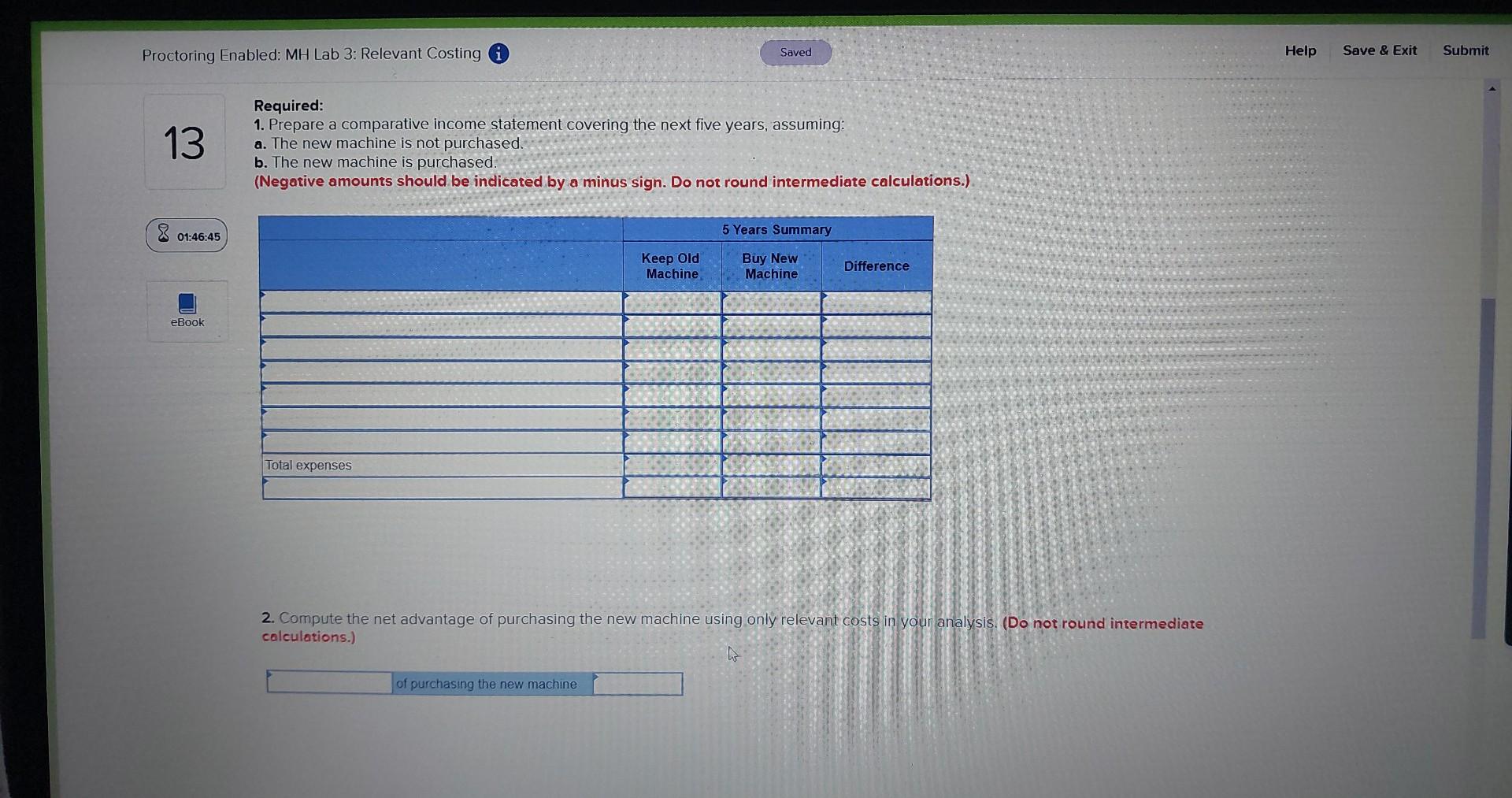

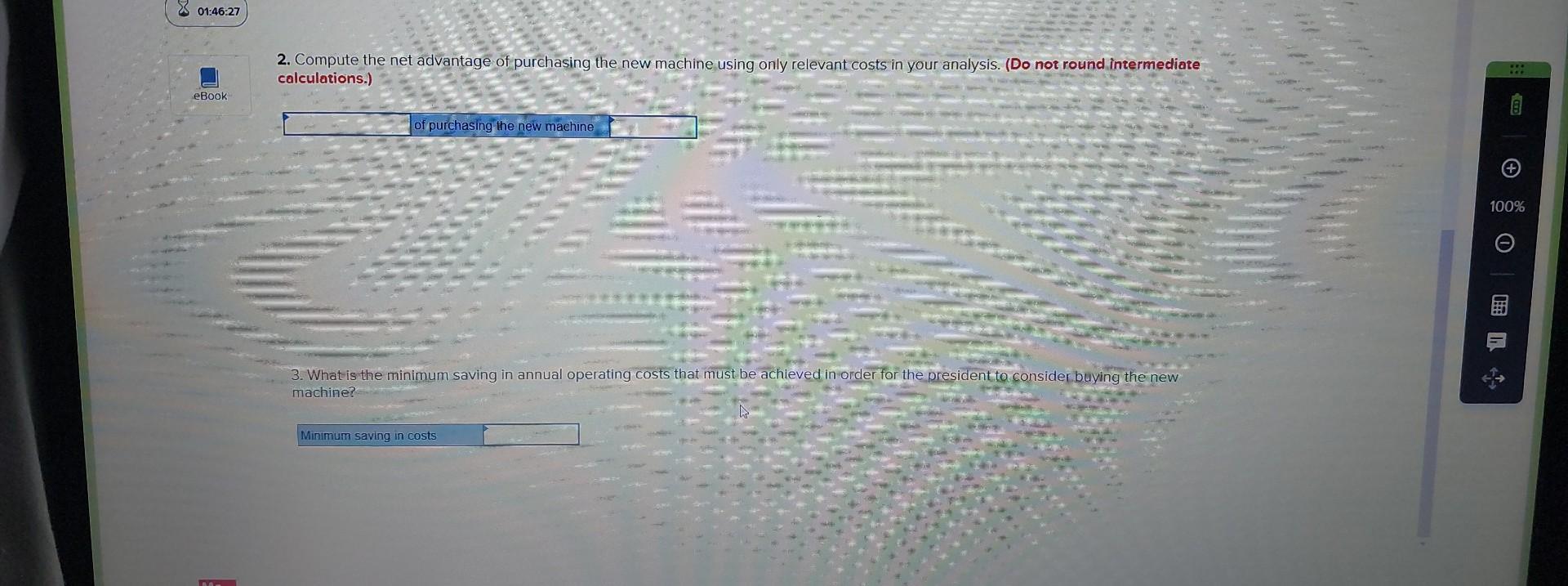

roctoring Enabled: MH Lab 3: Relevant Costing (i) 13 Santosh Plastics Inc. purchased a new machine one year ago at a cost of $69,000. Although the machine operates well and has five more years of operating life, the president of Santosh Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market. The new machine costs $103,500 and is expected to slash the current annual operating costs of $48,300 by two-thirds. The new machine is expected to last for five years, with zero salvage value at the end of five years. The current machine can be sold for $11,500 if the company decides to buy the new machine. The company uses straight-line depreciation. In trying to decide whether to purchase the new machine, the president has prepared the following analysis: "Eventhough the new machine looks good," said the president, "we can't get rid of that old machine if it means taking a huge loss on it. We'l have to tse the old machine for at least a few more years." Sales are expected to be $241,500 per year, and selling and administrative expenses are expected to be $144,900 per year, regardless of which machine is used. Required: 1. Prepare a comparative income statement covering the next five years, assuming: a. The new machine is not purchased. b. The new machine is purchased. (Negative amounts should be indicated by o minus sign. Do not round intermediate calculations.) Required: 1. Prepare a comparative income statement covering the next five years, assuming a. The new machine is not purchased b. The new machine is purchased (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) 801:46:45 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis, (Do not round intermediate calculations.) of purchasing the new machine 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis. (Do not round intermediate calculations.) roctoring Enabled: MH Lab 3: Relevant Costing (i) 13 Santosh Plastics Inc. purchased a new machine one year ago at a cost of $69,000. Although the machine operates well and has five more years of operating life, the president of Santosh Plastics is wondering if the company should replace it with a new electronic machine that has just come on the market. The new machine costs $103,500 and is expected to slash the current annual operating costs of $48,300 by two-thirds. The new machine is expected to last for five years, with zero salvage value at the end of five years. The current machine can be sold for $11,500 if the company decides to buy the new machine. The company uses straight-line depreciation. In trying to decide whether to purchase the new machine, the president has prepared the following analysis: "Eventhough the new machine looks good," said the president, "we can't get rid of that old machine if it means taking a huge loss on it. We'l have to tse the old machine for at least a few more years." Sales are expected to be $241,500 per year, and selling and administrative expenses are expected to be $144,900 per year, regardless of which machine is used. Required: 1. Prepare a comparative income statement covering the next five years, assuming: a. The new machine is not purchased. b. The new machine is purchased. (Negative amounts should be indicated by o minus sign. Do not round intermediate calculations.) Required: 1. Prepare a comparative income statement covering the next five years, assuming a. The new machine is not purchased b. The new machine is purchased (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) 801:46:45 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis, (Do not round intermediate calculations.) of purchasing the new machine 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started