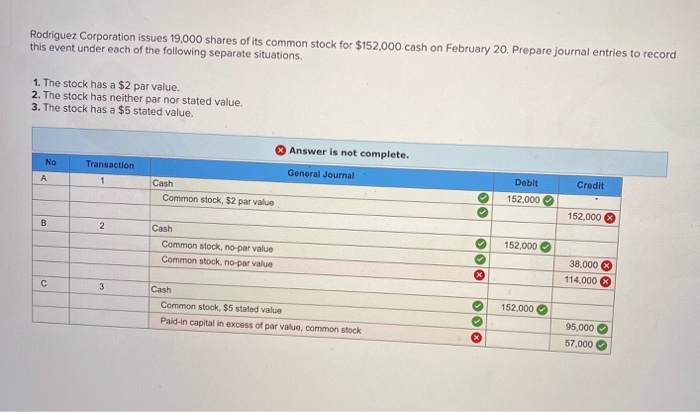

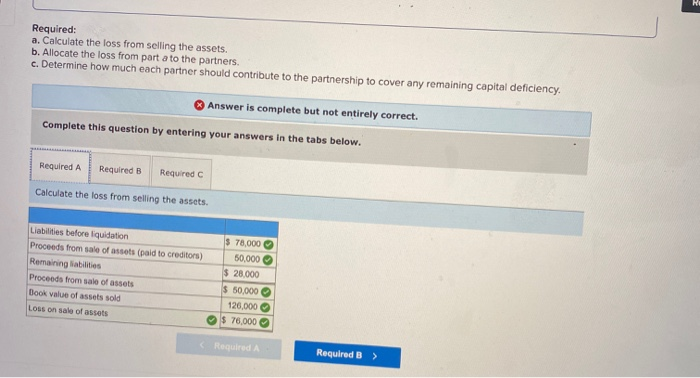

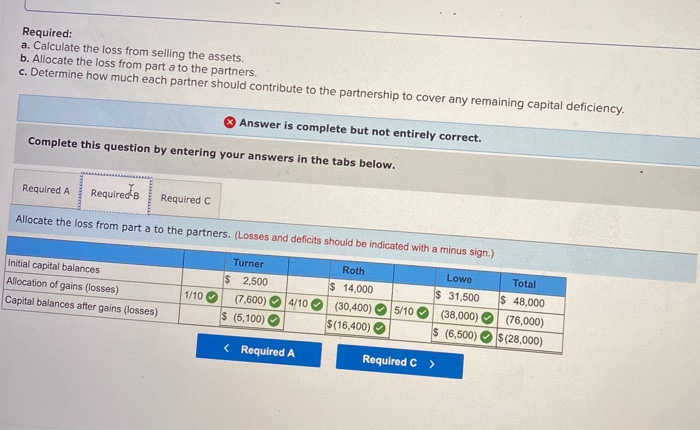

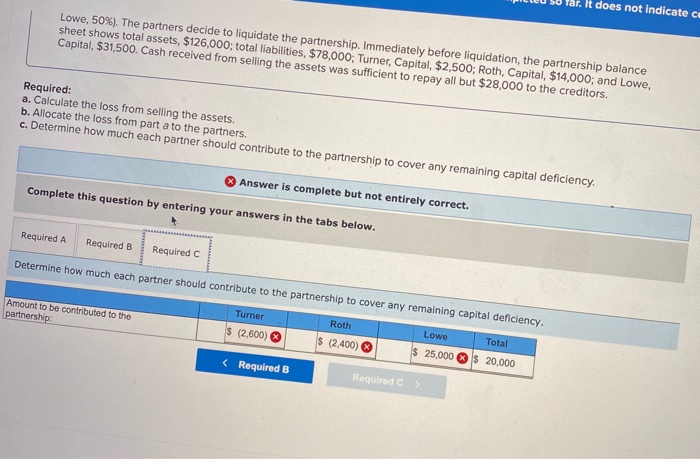

Rodriguez Corporation issues 19,000 shares of its common stock for $152,000 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The stock has a $2 par value. 2. The stock has neither par nor stated value. 3. The stock has a $5 stated value. Answer is not complete. No Transaction General Journal 1 Credit Cash Common stock, $2 par value Debit 152.000 152,000 2. Cash Common stock, no-par value Common stock, no par value oo 152,000 38.000 114,000 C 3 Cash Common stock, $5 stated value Pald-in capital in excess of par value, common stock 152.000 95.000 57.000 Required: a. Calculate the loss from selling the assets. b. Allocate the loss from part a to the partners. c. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required c Calculate the loss from selling the assets. Liabilities before liquidation Proceeds from sale of assets paid to creditors) Remaining abilities Proceeds from sale of assets Book value of assets sold Loss on sale of assets 78.000 50,000 $ 28.000 $ 50.000 126.000 $ 76,000 Required Required B> Required: a. Calculate the loss from selling the assets. b. Allocate the loss from part a to the partners. c. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required Required c Allocate the loss from part a to the partners. (Losses and deficits should be indicated with a minus sign.) Initial capital balances Allocation of gains (losses) Capital balances after gains (losses) 1/10 Turner $ 2,500 (7.600) $ (5,100) 4/10 Roth $ 14,000 (30,400) $(16,400) 5/10 Lowe $ 31,500 (38,000) $ (6,500) Total $ 48,000 (76,000) $(28,000) It does not indicate ce Lowe, 50%). The partners decide to liquidate the partnership. Immediately before liquidation, the partnership balance sheet shows total assets, $126,000; total liabilities, $78,000; Turner, Capital, $2,500; Roth, Capital, $14,000; and Lowe, Capital, $31,500. Cash received from selling the assets was sufficient to repay all but $28,000 to the creditors. Required: a. Calculate the loss from selling the assets. b. Allocate the loss from part a to the partners. c. Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required Determine how much each partner should contribute to the partnership to cover any remaining capital deficiency. Amount to be contributed to the partnership Turner $ 2,600) Roth $ (2.400) Lowe $ 25,000 Total $ 20,000