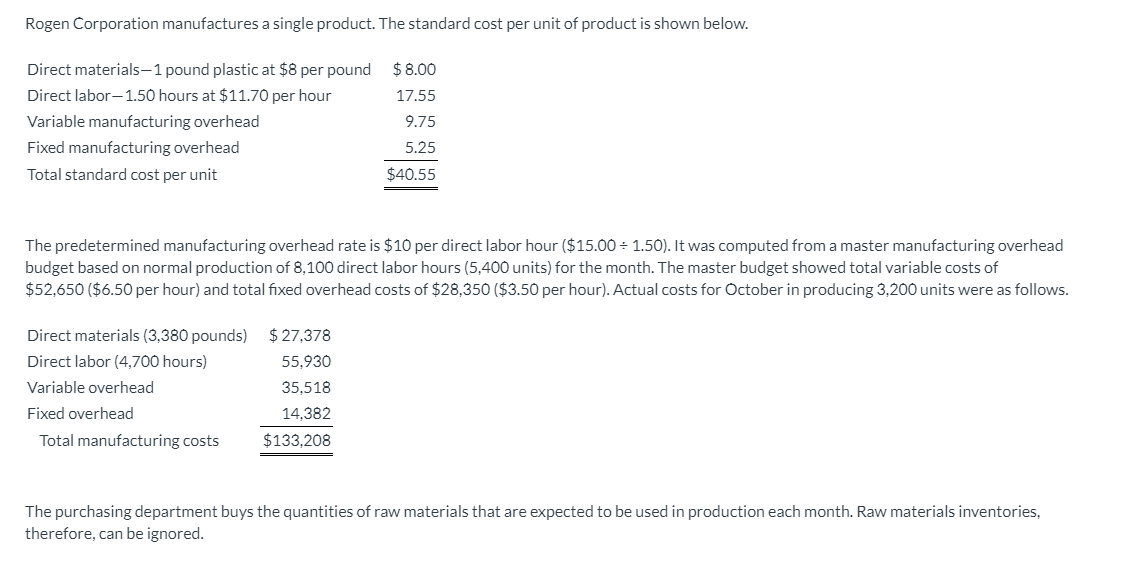

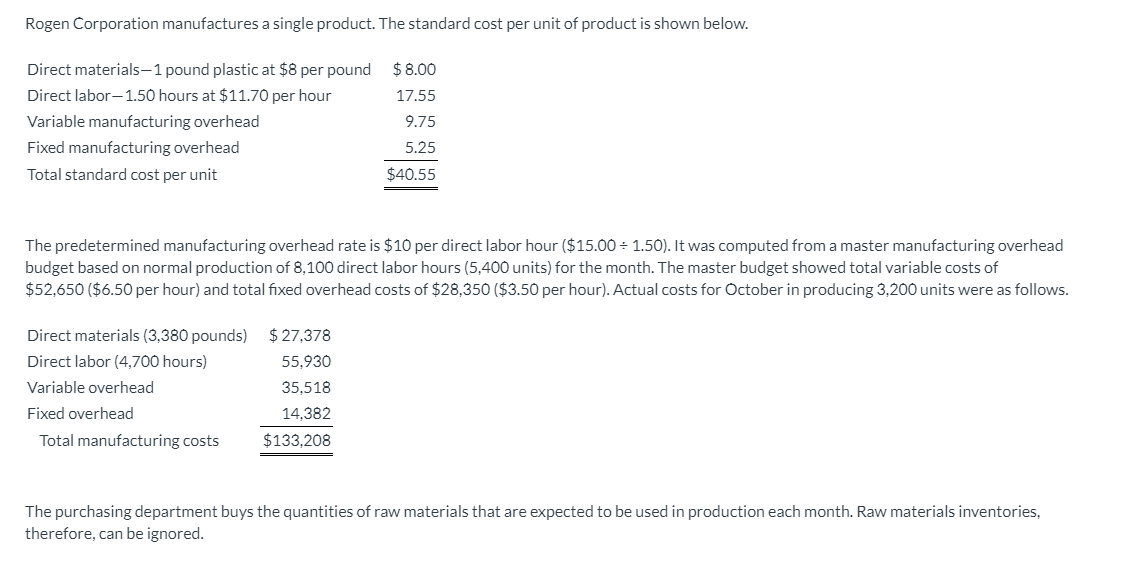

Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-1 pound plastic at $8 per pound Direct labor-1.50 hours at $11.70 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit $8.00 17.55 9.75 5.25 $40.55 The predetermined manufacturing overhead rate is $10 per direct labor hour ($15.00 = 1.50). It was computed from a master manufacturing overhead budget based on normal production of 8,100 direct labor hours (5,400 units) for the month. The master budget showed total variable costs of $52,650 ($6.50 per hour) and total fixed overhead costs of $28,350 ($3.50 per hour). Actual costs for October in producing 3.200 units were as follows. Direct materials (3,380 pounds) Direct labor (4,700 hours) Variable overhead Fixed overhead Total manufacturing costs $27,378 55,930 35,518 14,382 $133,208 The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored. Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below. Direct materials-1 pound plastic at $8 per pound Direct labor-1.50 hours at $11.70 per hour Variable manufacturing overhead Fixed manufacturing overhead Total standard cost per unit $8.00 17.55 9.75 5.25 $40.55 The predetermined manufacturing overhead rate is $10 per direct labor hour ($15.00 = 1.50). It was computed from a master manufacturing overhead budget based on normal production of 8,100 direct labor hours (5,400 units) for the month. The master budget showed total variable costs of $52,650 ($6.50 per hour) and total fixed overhead costs of $28,350 ($3.50 per hour). Actual costs for October in producing 3.200 units were as follows. Direct materials (3,380 pounds) Direct labor (4,700 hours) Variable overhead Fixed overhead Total manufacturing costs $27,378 55,930 35,518 14,382 $133,208 The purchasing department buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored