Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Roger Company completed the following transactions during Year 1. Roger's fiscal year ends on December 31 . January 8 Purchased merchandise for resale on account.

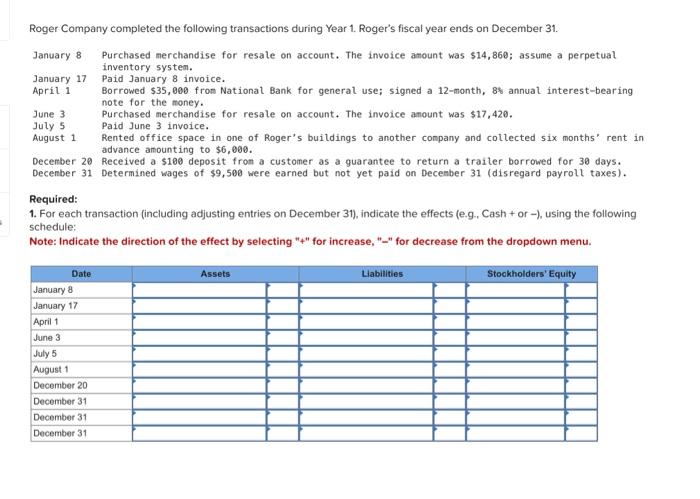

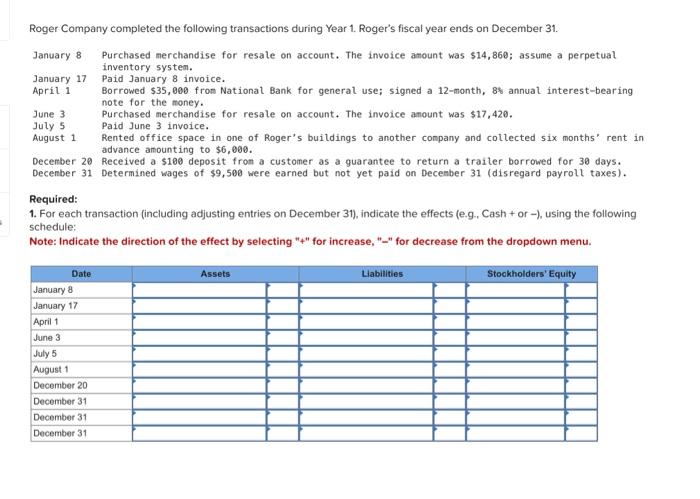

Roger Company completed the following transactions during Year 1. Roger's fiscal year ends on December 31 . January 8 Purchased merchandise for resale on account. The invoice amount was $14,860; assume a perpetual inventory system. January 17 Paid January 8 invoice. April 1 Borrowed $35,000 from National Bank for general use; signed a 12-month, 8\$ annual interest-bearing note for the money. Purchased merchandise for resale on account. The invoice amount was $17,420. June3July5PurchasedmerchandisePaidJune3invoice. August 1 Rented office space in one of Roger's buildings to another company and collected six months ' rent in advance anounting to $6,000. December 20 Received a $100 deposit from a customer as a guarantee to return a trailer borrowed for 30 days. Decenber 31 Determined wages of $9,500 were earned but not yet paid on Decenber 31 (disregard payroll taxes). Required: 1. For each transaction (including adjusting entries on December 31), indicate the effects (e.g., Cash + or - ), using the following schedule: Note: Indicate the direction of the effect by selecting "4" for increase, "-" for decrease from the dropdown menu

Roger Company completed the following transactions during Year 1. Roger's fiscal year ends on December 31 . January 8 Purchased merchandise for resale on account. The invoice amount was $14,860; assume a perpetual inventory system. January 17 Paid January 8 invoice. April 1 Borrowed $35,000 from National Bank for general use; signed a 12-month, 8\$ annual interest-bearing note for the money. Purchased merchandise for resale on account. The invoice amount was $17,420. June3July5PurchasedmerchandisePaidJune3invoice. August 1 Rented office space in one of Roger's buildings to another company and collected six months ' rent in advance anounting to $6,000. December 20 Received a $100 deposit from a customer as a guarantee to return a trailer borrowed for 30 days. Decenber 31 Determined wages of $9,500 were earned but not yet paid on Decenber 31 (disregard payroll taxes). Required: 1. For each transaction (including adjusting entries on December 31), indicate the effects (e.g., Cash + or - ), using the following schedule: Note: Indicate the direction of the effect by selecting "4" for increase, "-" for decrease from the dropdown menu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started