Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rogers AG company had the following transactions and investments in securities during 2022. a. Jan. 1, 2022 b. Feb. 1, 2022 c. April 1,

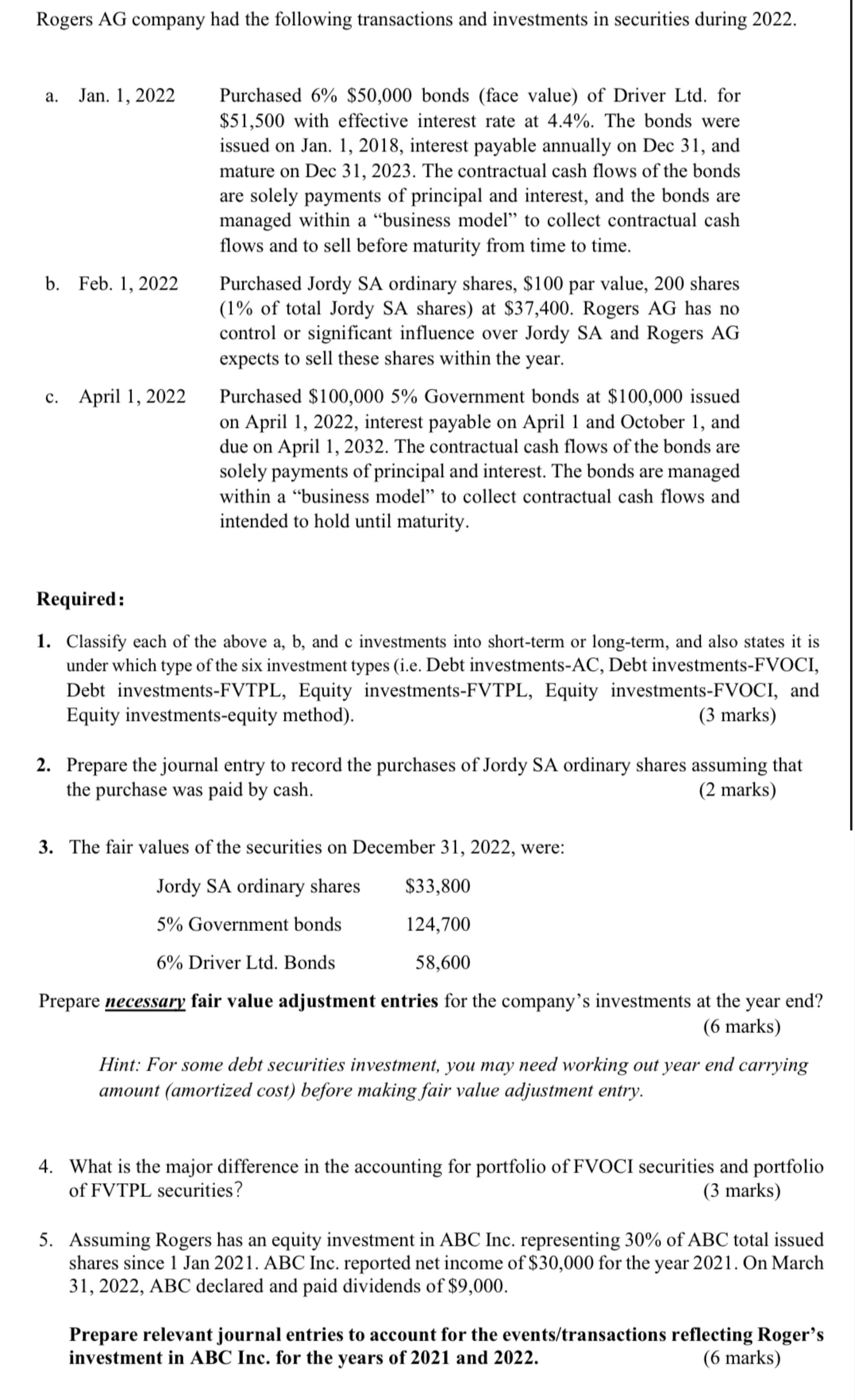

Rogers AG company had the following transactions and investments in securities during 2022. a. Jan. 1, 2022 b. Feb. 1, 2022 c. April 1, 2022 Purchased 6% $50,000 bonds (face value) of Driver Ltd. for $51,500 with effective interest rate at 4.4%. The bonds were issued on Jan. 1, 2018, interest payable annually on Dec 31, and mature on Dec 31, 2023. The contractual cash flows of the bonds are solely payments of principal and interest, and the bonds are managed within a "business model" to collect contractual cash flows and to sell before maturity from time to time. Purchased Jordy SA ordinary shares, $100 par value, 200 shares (1% of total Jordy SA shares) at $37,400. Rogers AG has no control or significant influence over Jordy SA and Rogers AG expects to sell these shares within the year. Purchased $100,000 5% Government bonds at $100,000 issued on April 1, 2022, interest payable on April 1 and October 1, and due on April 1, 2032. The contractual cash flows of the bonds are solely payments of principal and interest. The bonds are managed within a "business model" to collect contractual cash flows and intended to hold until maturity. Required: 1. Classify each of the above a, b, and c investments into short-term or long-term, and also states it is under which type of the six investment types (i.e. Debt investments-AC, Debt investments-FVOCI, Debt investments-FVTPL, Equity investments-FVTPL, Equity investments-FVOCI, and Equity investments-equity method). (3 marks) 2. Prepare the journal entry to record the purchases of Jordy SA ordinary shares assuming that the purchase was paid by cash. (2 marks) 3. The fair values of the securities on December 31, 2022, were: Jordy SA ordinary shares 5% Government bonds $33,800 124,700 58,600 6% Driver Ltd. Bonds Prepare necessary fair value adjustment entries for the company's investments at the year end? (6 marks) Hint: For some debt securities investment, you may need working out year end carrying amount (amortized cost) before making fair value adjustment entry. 4. What is the major difference in the accounting for portfolio of FVOCI securities and portfolio of FVTPL securities? (3 marks) 5. Assuming Rogers has an equity investment in ABC Inc. representing 30% of ABC total issued shares since 1 Jan 2021. ABC Inc. reported net income of $30,000 for the year 2021. On March 31, 2022, ABC declared and paid dividends of $9,000. Prepare relevant journal entries to account for the events/transactions reflecting Roger's investment in ABC Inc. for the years of 2021 and 2022. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started