Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rohis Corp issued 5.55% coupon bonds in 2015 with a maturity date of 07/17/2045. The par value of the bonds is $1,000. Coupon is paid

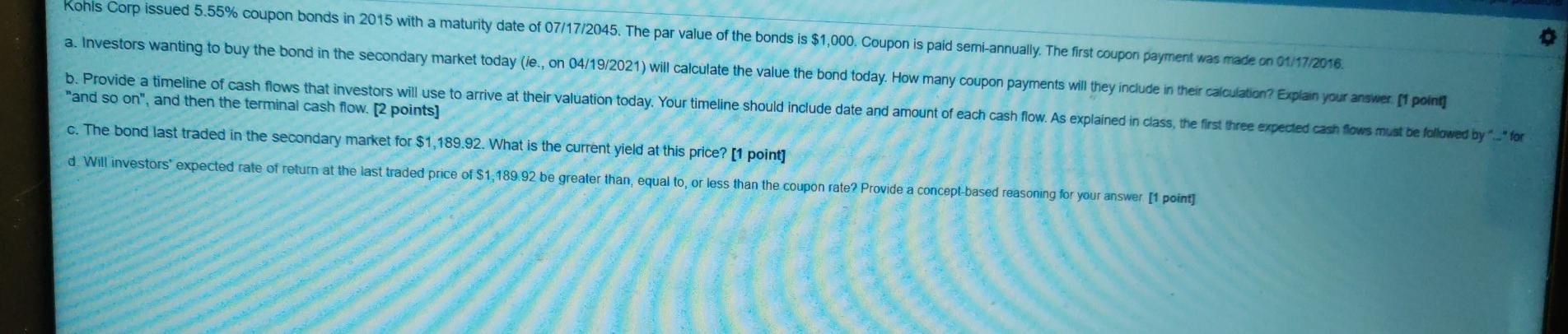

Rohis Corp issued 5.55% coupon bonds in 2015 with a maturity date of 07/17/2045. The par value of the bonds is $1,000. Coupon is paid semi-annually. The first coupon payment was made on 01/17/2016. a. Investors wanting to buy the bond in the secondary market today (ie., on 04/19/2021) will calculate the value the bond today. How many coupon payments will they include in their calculation? Explain your answer. [t point b. Provide a timeline of cash flows that investors will use to arrive at their valuation today. Your timeline should include date and amount of each cash flow. As explained in class, the first three expected cash fows must be followed by..." for "and so on", and then the terminal cash flow. [2 points) c. The bond last traded in the secondary market for $1,189.92. What is the current yield at this price? [1 point] d. Will investors' expected rate of return at the last traded price of $1,189.92 be greater than, equal to, or less than the coupon rate? Provide a concept-based reasoning for your answer [1 point] Rohis Corp issued 5.55% coupon bonds in 2015 with a maturity date of 07/17/2045. The par value of the bonds is $1,000. Coupon is paid semi-annually. The first coupon payment was made on 01/17/2016. a. Investors wanting to buy the bond in the secondary market today (ie., on 04/19/2021) will calculate the value the bond today. How many coupon payments will they include in their calculation? Explain your answer. [t point b. Provide a timeline of cash flows that investors will use to arrive at their valuation today. Your timeline should include date and amount of each cash flow. As explained in class, the first three expected cash fows must be followed by..." for "and so on", and then the terminal cash flow. [2 points) c. The bond last traded in the secondary market for $1,189.92. What is the current yield at this price? [1 point] d. Will investors' expected rate of return at the last traded price of $1,189.92 be greater than, equal to, or less than the coupon rate? Provide a concept-based reasoning for your answer [1 point]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started