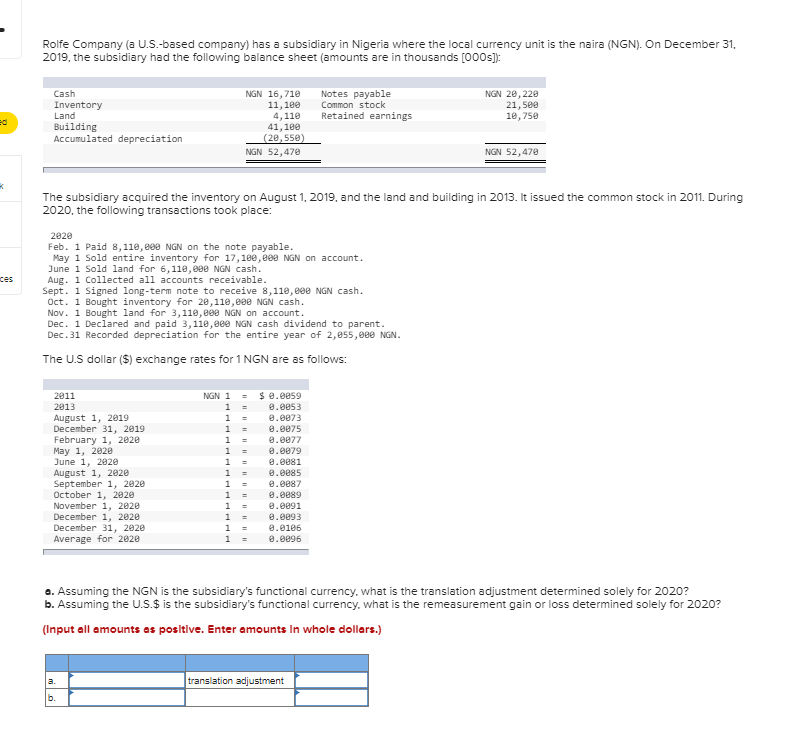

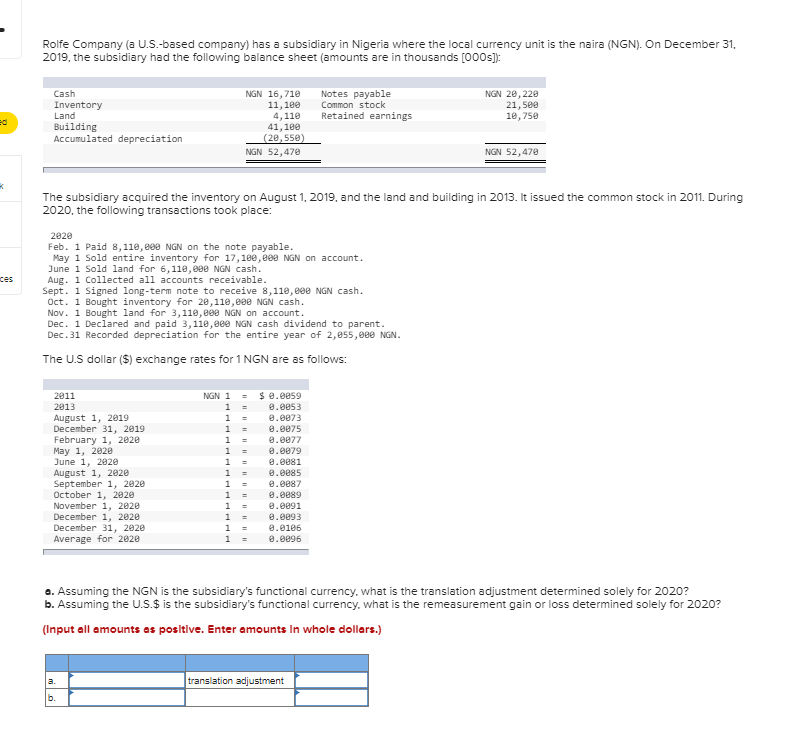

Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31 , 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020 , the following transactions took place: 202 Feb. I Paid 8,110,600 NGN on the note payable. May 1 Sold entire inventory for 17,180,800 NGN on account. June 1 sold land for 6,110,600 NGN cash. Aug. 1 collected all accounts receivable. Sept. 1 signed long-term note to receive 8,110,600 NGN cash. oct. 1 Bought inventory for 20,110,60 NGN cash. Nov. 1 Bought land for 3,110,0 NGN on account. Dec. 1 Declared and paid 3,110,60NGN cash dividend to parent. Dec.31 Recorded depreciation for the entire year of 2,855, 900NGN. The U.S dollar (\$) exchange rates for 1NGN are as follows: a. Assuming the NGN is the subsidiary's functional currency, what is the translation adjustment determined solely for 2020 ? b. Assuming the U.S.\$ is the subsidiary's functional currency, what is the remeasurement gain or loss determined solely for 2020 ? (Input all amounts as positive. Enter amounts In whole dollers.) Rolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31 , 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020 , the following transactions took place: 202 Feb. I Paid 8,110,600 NGN on the note payable. May 1 Sold entire inventory for 17,180,800 NGN on account. June 1 sold land for 6,110,600 NGN cash. Aug. 1 collected all accounts receivable. Sept. 1 signed long-term note to receive 8,110,600 NGN cash. oct. 1 Bought inventory for 20,110,60 NGN cash. Nov. 1 Bought land for 3,110,0 NGN on account. Dec. 1 Declared and paid 3,110,60NGN cash dividend to parent. Dec.31 Recorded depreciation for the entire year of 2,855, 900NGN. The U.S dollar (\$) exchange rates for 1NGN are as follows: a. Assuming the NGN is the subsidiary's functional currency, what is the translation adjustment determined solely for 2020 ? b. Assuming the U.S.\$ is the subsidiary's functional currency, what is the remeasurement gain or loss determined solely for 2020 ? (Input all amounts as positive. Enter amounts In whole dollers.)