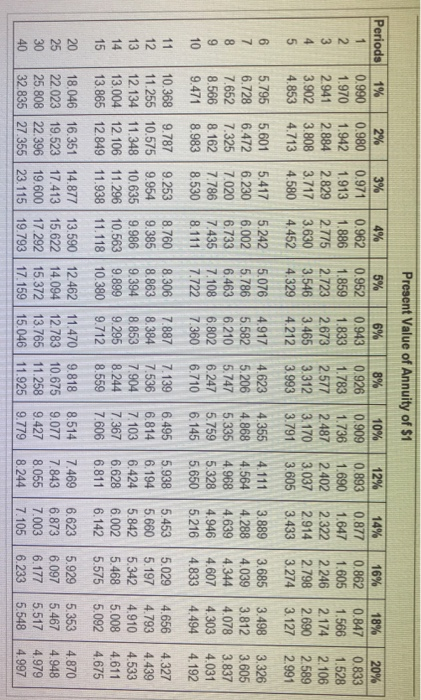

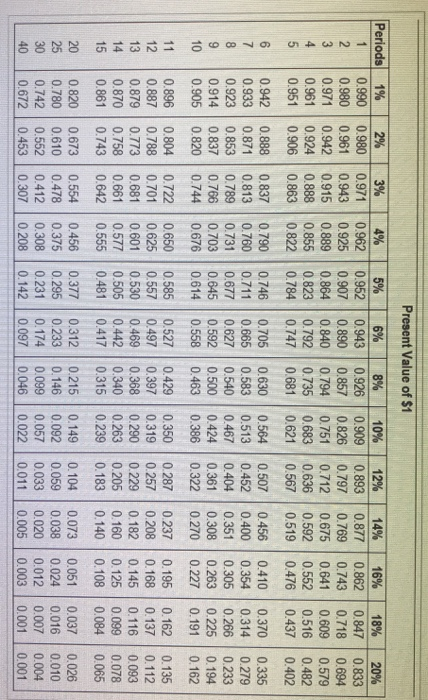

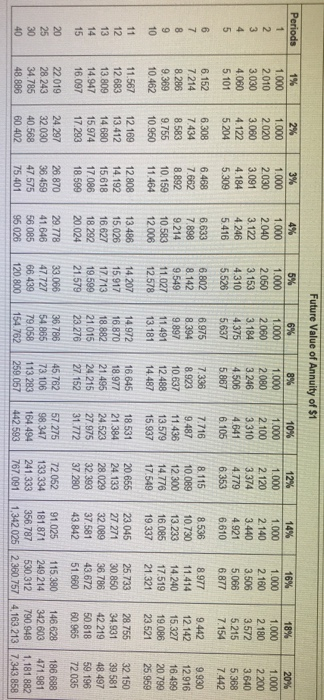

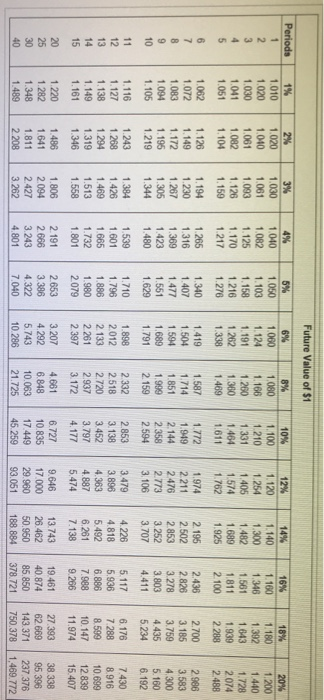

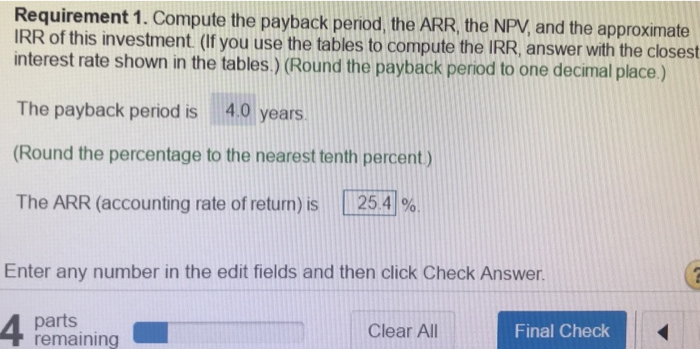

Roling Wave is considering purchasing a water park in Miami, Florida, for $2,100,000. The new facility will generate annual net cash inflows of $530.000 for eight years Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation. Its owners want payback in less than five years and an ARR of 10% or more. Management uses a 12% hurdle rate on investments of this nature (Cick the con to view th (Cick the icon to view the present value annuity table.) (Click the icon to view the fulture value annuty table) EClick the icon to view th 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables) 2. Recommend whether the company should invest in this project 0%-egg $25 105 sse 001 200 005 83 001 102 32 400 53 011 67 70 8 9 007 01222 33344 44444 4444 764 8-S161 480 2 0 7 10122 3 33444 44455 5555 6% 002 005 24 198 27 68 009 34 007 83 29 197 34 400 75 009 007 77 23 901 10122 3 34444 55555 5666 394 82692 4 8 10122 3 34445 55566 6677 2% 996 600 400 007 005 111 SA 998 $50 SOB 194 24 eas 011 400 ces 24 IST | 0% 009 750 997 170 201 996 ese 45 195 014 103 997 006 STA 07 42 i -5%-$25 res 57 012 ses $25 200 VAT 24 71 130 $30 004 24 sse 250 $25 101233 44455 56666 7788 595 54376 4 481 01233 44556 66777 8999 770 96 01233 45566 77788 9011 0 352 7202 74352 91 4770 29 01234 45667 78899 1235 ese -5% 997 999 23 sag $20 006 ess 34 999 360 400 004 012 150 76 86 63 08 22 3 07417 3838 01234 55677 8899 10 12 11 4% 002 998 con asp 202 002 73 $25 111 40 1 2 3 4 56678 700 ses 996 ses 18 sso 202 193 89901 1179 2 2235-056 5%-71 013 009 17 SSO 41 200 000 198 $30 750-000 200 SOB BFF 013 600 15 9987 011 4793 2% 980 012 004 008 zys 13 02523 8 001 $25 102 ses 198 $25 996 ass 4319 0122 6927 01234 56788 9 1% 99 97 94 776 01233 8 12345 67891 12345 20 25 30 40 79 33 94 62 35 12 93 86 60 04 01 200000 00000 00000 0000 2 67 04651 7671 6% 002 74 sse 170 100000 400 350 006 003 27 195 198 45 125 08 osi 004 012 003 00000 00000 0000 9529 4-876 5 44332 2% 112 ese 997 sor ASL 104 001 012 201 250 220 201 193 04 ese ces 011 100000 00000 00000 0000 3746 927 100000 0000 0. 00000 0000 7805 5 54 50 46 433 34 3 21 09 04 t 6%-94 350 84 79 74 55 62 sse 55 59 69 4 1 7927 2 224 09 5%-95 007 004 23 84 74 1 6 5 4 ses 55 5 55 48 37 26 201 14 887 77 '1 35 3 4 00000 00000 00000 000 0. 0124 % 98 96 94 2 90 88888 80 7 7 7 7 6654 7901 0022 ri 1 2 3 4 5 67891 12345 Requirement 1. Compute the payback penod, the ARR, the NPV, and the approximate IRR of this investment (If you use the tables to compute the IRR, answer with the closest interest rate shown in the tables.) (Round the payback period to one decimal place ) The payback period is 4.0 years (Round the percentage to the nearest tenth percent) The ARR (accounting rate of return) is [.2541%. Enter any number in the edit fields and then click Check Answer. parts remaining Clear All Final Check