Answered step by step

Verified Expert Solution

Question

1 Approved Answer

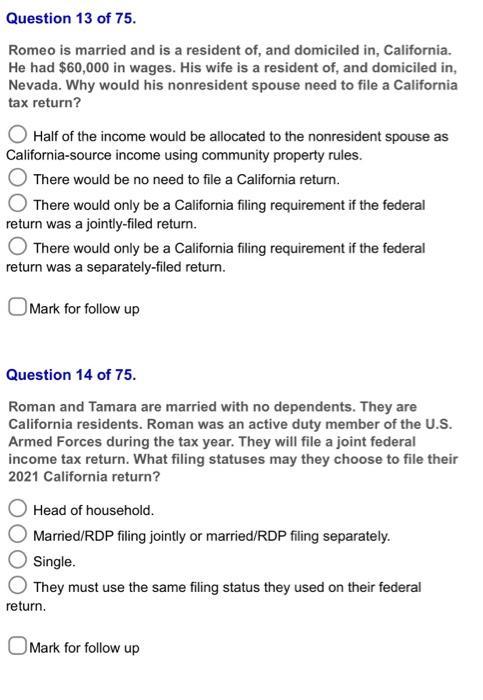

Question 13 of 75. Romeo is married and is a resident of, and domiciled in, California. He had $60,000 in wages. His wife is

Question 13 of 75. Romeo is married and is a resident of, and domiciled in, California. He had $60,000 in wages. His wife is a resident of, and domiciled in, Nevada. Why would his nonresident spouse need to file a California tax return? Half of the income would be allocated to the nonresident spouse as California-source income using community property rules. There would be no need to file a California return. There would only be a California filing requirement if the federal return was a jointly-filed return. There would only be a California filing requirement if the federal return was a separately-filed return. Mark for follow up Question 14 of 75. Roman and Tamara are married with no dependents. They are California residents. Roman was an active duty member of the U.S. Armed Forces during the tax year. They will file a joint federal income tax return. What filing statuses may they choose to file their 2021 California return? Head of household. Married/RDP filing jointly or married/RDP filing separately. Single. They must use the same filing status they used on their federal return. Mark for follow up

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 13 a Half of the income would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started