"Ron and Janice Mawson are now both 55 years old but Ron was disabled for eight years which resulted in excess medical costs so they had to refinance the house. The current mortgage is $150,000 and the house has a market value of $800,000. They also have two children aged 12 and 14 and they continue to work in their current positions.

They currently have no liabilities other than the mortgage and they continue to invest in their RRSPs on a monthly basis. Ron has grown his RRSP to $300,000 and Janice has $350,000 in her RRSP. They each contribute $800 per month to these plans and will continue to do so until their planned retirement at age 65. These registered plans are currently invested 30% income and 70% equity."

And these are the questions:

Assuming 6% annual compound growth, what will the value of Ron and Janice's RRSPs be at age 65? Show these amounts separately for both Ron and Janice. (4 Marks)

If they leave their asset allocation the same and continue to earn 6% per year what income could they each pay themselves from these plans at age 65 without encroaching on capital? Assume a 5% withdrawal rate. (4 Marks)

If they convert their RRSPs to a RRIF what is the minimum payment required based on their age 65? What is the minimum if they wait to withdraw the funds at age 72? (2 Marks)

I've answered the first question:

1.With RRSPs accounts containing $300,000.00 and $350,000 respectively, at 55 years of age, plus their monthly investment of $800.00 each, at 6% compounded annually, Ron and Janice's investments will be worth $667,233.06 and $756,775.45 after 10 years (at age 65). Ron will have total interest earned of $271,233.06 and Janice, $310,775.45.

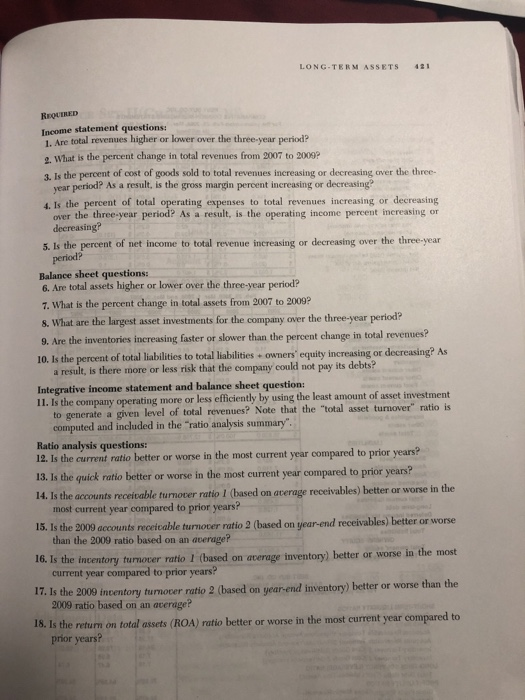

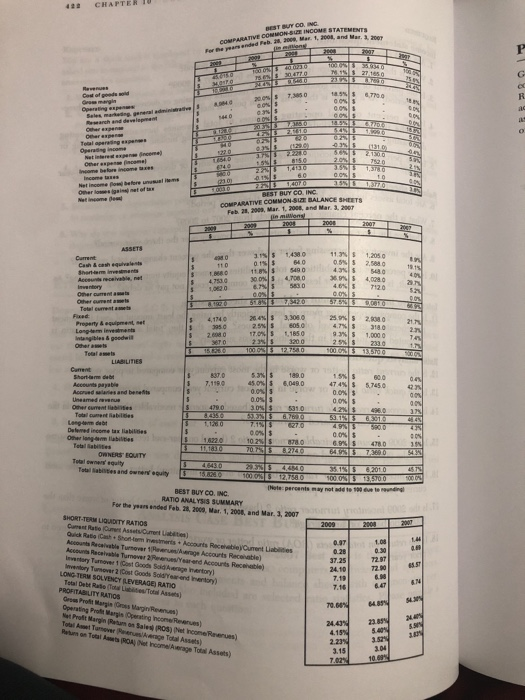

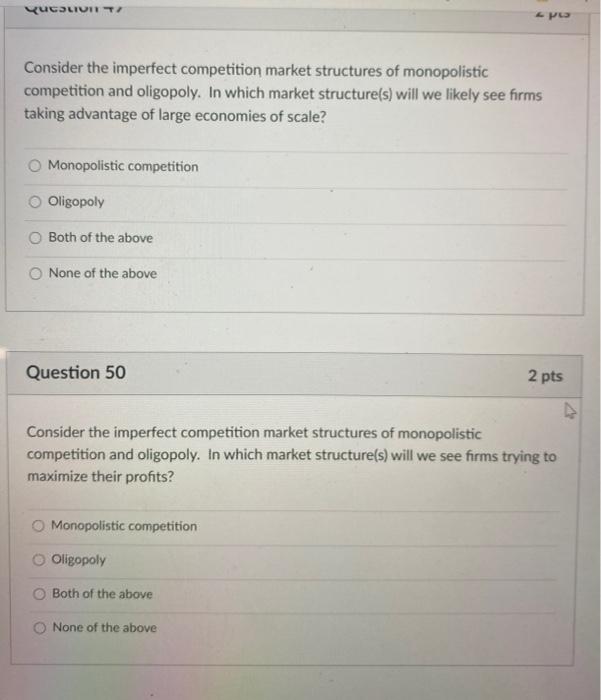

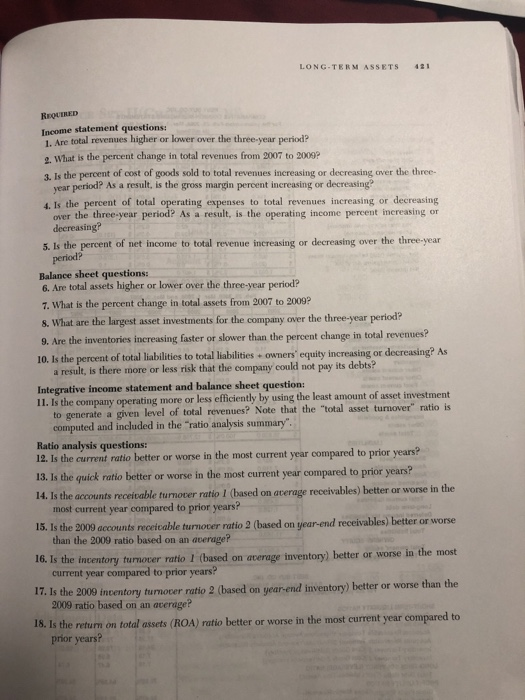

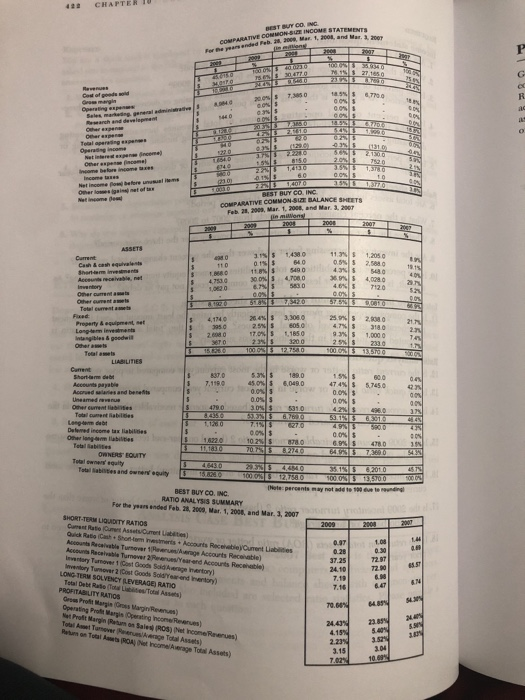

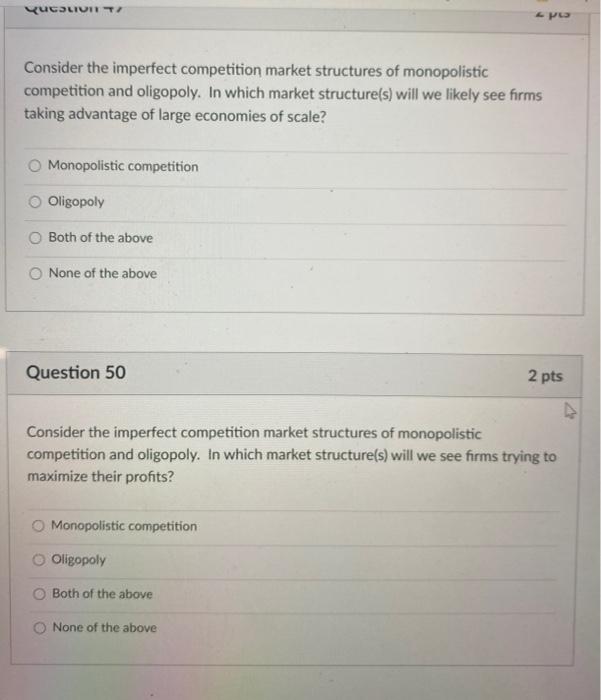

LONG-TERM ASSETS 121 REQUIRED Income statement questions: 1. Are total revenues higher or lower over the three-year period? 2. What is the percent change in total revenues from 2007 to 2009? 3. Is the percent of cost of goods sold to total revenues increasing or decreasing over the three- year period? As a result, is the gross margin percent increasing or decreasing" 4. Is the percent of total operating expenses to total revenues increasing or decreasing over the three-year period? As a result, is the operating income percent increasing or decreasing? 5. Is the percent of net income to total revenue increasing or decreasing over the three-year period? Balance sheet questions: 6. Are total assets higher or lower over the three-year period? 7. What is the percent change in total assets from 2007 to 2009? 8. What are the largest asset investments for the company over the three-year period? 9. Are the inventories increasing faster or slower than the percent change in total revenues? 10. Is the percent of total liabilities to total liabilities + owners' equity increasing or decreasing? As a result, is there more or less risk that the company could not pay its debts? Integrative income statement and balance sheet question: 1 1. Is the company operating more or less efficiently by using the least amount of asset investment to generate a given level of total revenues? Note that the "total asset turnover" ratio is computed and included in the "ratio analysis summary". Ratio analysis questions: 12. Is the current ratio better or worse in the most current year compared to prior years? 13. Is the quick ratio better or worse in the most current year compared to prior years? 14. Is the accounts receivable turnover ratio I (based on average receivables) better or worse in the most current year compared to prior years? 15. Is the 2009 accounts receivable turnover ratio 2 (based on year-end receivables) better or worse than the 2009 ratio based on an average? 16. Is the inventory turnover ratio I (based on average inventory) better or worse in the most current year compared to prior years? 17. Is the 2009 inventory turnover ratio 2 (based on year-end inventory) better or worse than the 2009 ratio based on an average? 18. Is the return on total assets (ROA) ratio better or worse in the most current year compared to prior years?CHAPTER BEST BUT CO. ING. COMPARATIVE COMMON-BUT INCOME STATEMENTS I De pearsended Feb. H Hop, Mar 1, Itg), and Her. $. For God of ponds gold Be march ind developrant 1131 0 213010 8150 1, 370 BEST BUY CO INC COMPARATIVE COMMON-BUT BALANCE SHEETS Feb. 21, 1903, Mar. 1, 2908, and Mar. J. NOT in miWongi ASSETS Current 11.8 9 30 04 4.024 0 Insuntory 10130 TIZO Oner cumnl itabs Talal commit ain't Fond Property A equipment, Fit 4.7% 318 0 1. 185 0 Invinny bles I poodail 1.0010 100 03 5 13 7910 LIABILITIES Short-form that 7. 178.0 8,049.0 47AN 30%$ 531.0 2710 4 79 On lined Income tax listitnon 1.4220 10 2% OWNERS EQUITY Total camps' equity Foul Nabilities and careers equity 314 5 63010 10ON 8 12 7580 100.05 4 1275100 BEST BUY CO. INC IHole- percents may not add to The hat to RATIO ANALYSIS SUMMARY For the yours anded Fab. 28, 2009, Mar, 1, 2010, and Mar. 3, 3907 SHORT-TEAM LIQUIDITY RATIOS 2080 Quick Ratio Cinch + Shortom Insulmints + Account Rych biel Curent Liabilities 1.09 Ancouch Recaleable Turnover 1 Haverun Average Accounts Recunable] /Yearend Accounts Reophable) 37.25 Inwwwtory Turnover 2 [Cost Goods Bold/fair-and Inantory) LONG-TERM SOLVENCY (LEVERAGE) RATIO 7.1 Total Debt Rule (Toul Libifyou Tool Anmetal 7.10 PROFITABILITY RATIOS Grow Prof Bugin (Crops Magin Revrun) Operating Profit Margin Operating Income Revenues Net Profit Margin [Barn on Sales) (803) [het hcome Revenues) 24.AJK Tokill Anget Turnover Pierces/Average Total Assets) 4.15% Butum on Total Arts (RCA) (Net heamalAwrage Total Assets) 2.23% 3.15 1.04 7.02% 10 89YUGOLIVIIT / & PL Consider the imperfect competition market structures of monopolistic competition and oligopoly. In which market structure(s) will we likely see firms taking advantage of large economies of scale? O Monopolistic competition O Oligopoly O Both of the above O None of the above Question 50 2 pts Consider the imperfect competition market structures of monopolistic competition and oligopoly. In which market structure(s) will we see firms trying to maximize their profits? O Monopolistic competition Oligopoly O Both of the above O None of the aboveQUESTION 30 1. Table 23-6 The table below contains data for the country of Batterland, which produces only waffles an d pancakes. The base year is 2013. Year Price of Quantity of Price of Quantity of Waffles Waffles Pancakes Pancakes 2010 $2.00 80 $1.00 100 2011 $2.00 100 $2.00 120 2012 $2.00 120 $3.00 150 2013 $4.00 150 $3.00 200 Refer to Table 23-6. In 2010, this country's nominal GDP was $260 $440 $620 $760 QUESTION 31 Sheri, a U.S. citizen, works only in Germany. The value she adds to production in Germany i +'s included in both German GDP and U.S. GDP in German GDP, but is not included in U.S. GDP ET C in U.S. GDP, but is not included in German GDP in neither German GDP nor U.S. GDP QUESTION 32 Disposable personal income is the income that "households have left after paying taxes and non-tax payments to the government businesses have left after paying taxes and non-tax payments to the government households and noncorporate businesses have left after paying taxes and non- tax payments to the government households and businesses have left after paying taxes and non- tax payments to the government QUESTION 33 Gross domestic product adds together many different kinds of goods and services into a singl e measure of the value of economic activity. To do this, GDP makes use of C market prices " statistical estimates of the value of goods and services to consumers. prices based on the assumption that producers make no profits the maximum amount consumers would be willing to payQUESTION 37 Depreciation on printing machines 1. Cost of goods manufactured schedule. 2. Income statement. O 3. Balance sheet. QUESTION 38 Finished goods inventory, 12/31/2008 1. Cost of goods manufactured schedule O 2. Income statement. O 3. Balance sheet. QUESTION 39 Raw materials inventory, 1/1/2008 1. Cost of goods manufactured schedule 2. Income statement. 3. Balance sheet QUESTION 40 Cost of goods manufactured 1. Cost of goods manufactured schedule. 2. Income statement. O 3. Balance sheet. QUESTION 41 Work in process, 1/1/2008 1. Cost of goods manufactured schedule 2. Income statement. 3. Balance sheet Click Save and Submit to save and submit. Click Save All Ans