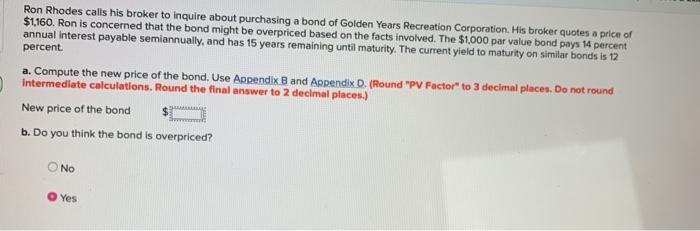

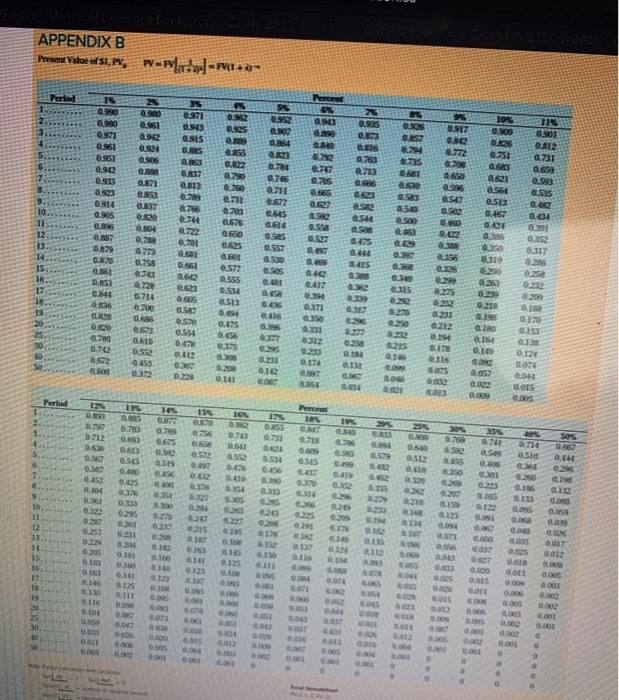

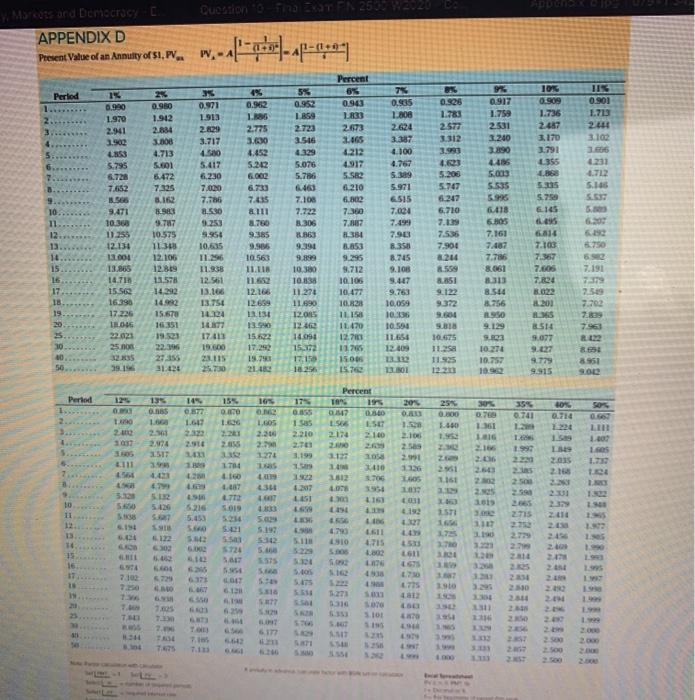

Ron Rhodes calls his broker to inquire about purchasing a bond of Golden Years Recreation Corporation. His broker quotes a price of $1,160. Ron is concerned that the bond might be overpriced based on the facts involved. The $1,000 par value bond pays 14 percent annual interest payable semiannually, and has 15 years remaining until maturity. The current yield to maturity on similar bonds is 12 percent a. Compute the new price of the bond. Use Appendix B and Appendix D. (Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) New price of the bond b. Do you think the bond is overpriced? O No Yes APPENDIX B Present Value of S1, PV, W-PV Period 28 SE 0050 19670 AN 09 0925 . 0.90 9 0912 ION OLVO PALO ZONO 0.971 090 0.915 O.RS OR ORIZ 13 BW 72 O.R22 0.92 0924 0.906 Q.BR 0871 0853 0837 0.820 6.299 er 0.25 0.76 0.766 2 073 0.50 0812 0.731 0.6A QL523 OS 070 0.980 0.990 0.97 0.961 0.951 0.912 0.923 0903 0914 0.90s O.RS 0.887 0.829 OZO 0.361 0.853 0731 564 0.513 946 0766 0.744 0:56 55 0547 050 0.490 0940 0575 GEO 0.51 0.04 0991 . 0,7 00 0.701 317 0.50 50 150 0230 319 02 0.45 UNE 0.38 0.3.0 e115 15 16 O. ODS 1 02 27 2017 0.3 0.534 0.51 0.714 0200 0.556 DON 46 0.312 BIO Waro 050 LO 2211 0.212 QUIS 120 OS 042 0.56 0.375 OTHO 0377 0.610 0. 1 0.164 10 0.215 0.554 07 0,412 0.30 32 15 124 BED 0.52 0. De 0.141 1200 1100 Stop 056 LUD 001 Cle 0.00 Period 13 14% OS VE ro DRI LW 0.712 070 0.79 DE OTO 0.7 0. 0.50 3. DS 0.50 OR 9444 02. 0519 DANT . G. OS TOLD SO 0.410 154 RE LIS LEO PICO 1961 01 19 NO 200 03 0.0 Is os STO 195 12 13 IG 0231 004 14 100 . Oto SLOW 120 10 Core 2100 GO 016 0.10 Sau SAD 010 ID 110 re 1010 150 Shoe 12 BLOOD 68.26 0 0.01 TO 0 Question to the ATEN Mots and Democracy C APPENDIX D Present Value of an Annulty of S1, PV -p-4791 PV. EX Percent 0% 0.943 14 Period 55 0.952 SII 1050 1.970 291 1.902 L. 2.775 3.630 4.452 5.242 0.917 1.759 2.531 1240 2.723 3.546 4.329 5.076 5.786 2577 3.312 3.580 4.23 5.200 5.747 0.909 1.736 2.457 3.170 1.791 4355 86 5.335 5.758 1.713 2.1 3.100 1.606 4231 TL2 5.166 5.795 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.000 7.706 8.530 9.253 5.956 10.635 TL 6 11.336 12.561 13.166 13.756 1 10 11 12. 0.950 1.912 2.834 3.00 4.713 5.601 6.472 725 B. B.SE 9.77 10.575 1133 12.106 12 BS 13.578 14,292 1492 15.670 16351 6.733 7.435 8111 8.750 9.385 9.95 10.563 11.LIB 7.100 7.722 3.305 8863 7 0.905 1.00 2.624 3.387 4100 4.763 5.389 5.971 6515 7.024 7.199 7.90 8.358 8.785 9.10 5.447 9.769 10.059 10.06 10.594 1165 12.09 6.710 7.1 7.536 7.901 8.214 2.673 2.465 4.212 4.917 5.52 6.210 6.802 7.360 7.887 8.354 8.853 9.995 8.712 10.105 10,477 16,823 1118 11470 12.70 1175 15.00 157 9.TI 10:36 11.25 12.134 132.00 13.866 14.711 15.50 16.390 17.226 TILO 44 5.003 5.535 59 6.418 5.05 7.161 7.461 7.7M 8.061 33 8.544 8.756 ASSO 695 6.314 7.103 6.50 1666 7.191 10 15 16 17 18 19 7.606 7224 SEE 6152 10,380 10.838 11 274 11.890 12.0115 1210 14.05 15. 12.166 12.699 13.134 HO 15.122 17.292 15.79 LETTI EIT 21 00061 8851 9.122 9.372 9.604 SUBIS 10.575 112 11.935 2201 BES B514 5.027 30 25. 22.396 9.23 10274 10.757 10.99 50 31.128 25.730 182 13.301 9.779 9.915 1959 2105 Period 155 135 . 20 ma 000 16% . 1.COS Percent TAN 195 DUM 1.566 L.5LT 2124 21.00 355 0.741 25% 200 1.660 OSTE 1.647 2.32 2.16 1.636 US 1.95 2.210 2.Te 10% 0.714 2220 20 1. 20 2074 2517 30% 0.78 13:36 10 2.16 2016 LEIL CER 1274 SOT 1.199 2058 SEZ 21 1 1. 3123 1 1812 11 1704 4.160 443 16 BLE SOY ST ZZE Tar 3706 1167 19 GE S2 520 LTT 4000 CCT 163 ca 10 11 5.60 1615 5210 IST 5591 KIT STI es 2715 Z. ES 27 15 SO 5.69 5.190 5142 11 CE ES 55 1910 27 630 ETIS LO 5.000 L611 LS 16 15 16 17 18 IN 38 SUS 0151 6.12 775 4 2 20 2 123 LS 07 30 THE MET 2.31 2. 20 2 TS 1553 ME 2.00 2. S. AM 11 IH TY 3 co TI 7:47 2500 1000