Answered step by step

Verified Expert Solution

Question

1 Approved Answer

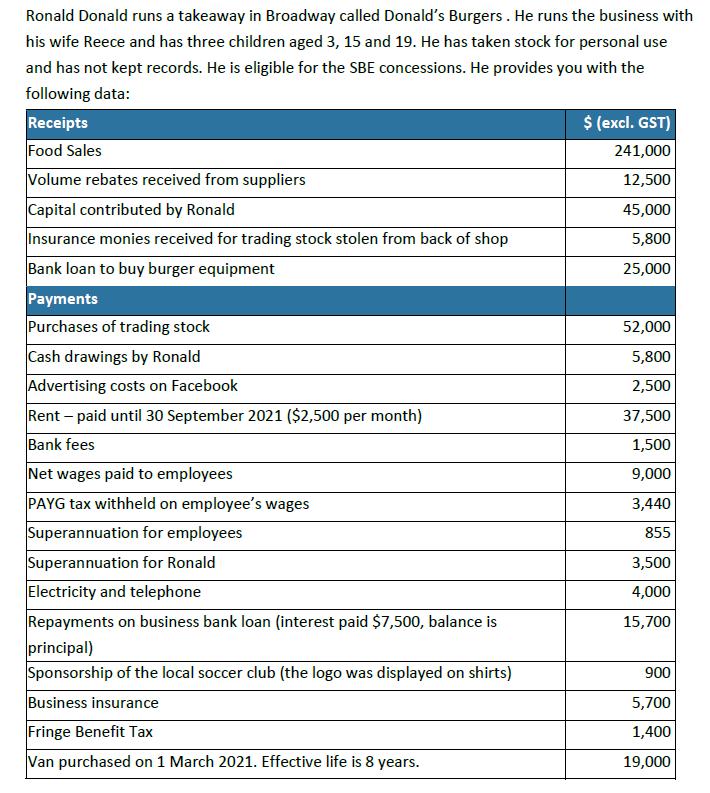

Ronald Donald runs a takeaway in Broadway called Donald's Burgers. He runs the business with his wife Reece and has three children aged 3,

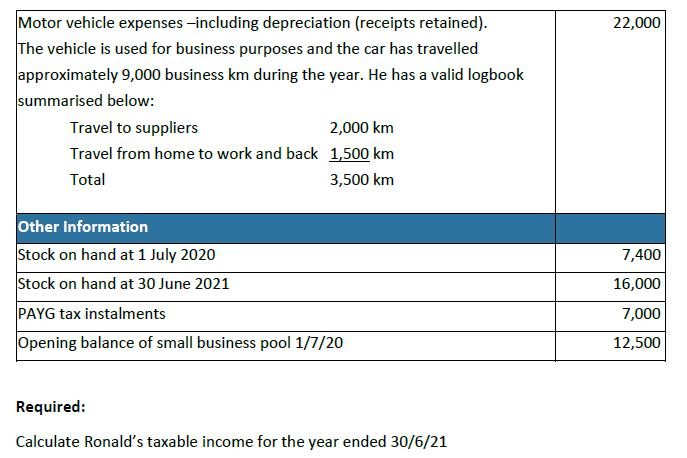

Ronald Donald runs a takeaway in Broadway called Donald's Burgers. He runs the business with his wife Reece and has three children aged 3, 15 and 19. He has taken stock for personal use and has not kept records. He is eligible for the SBE concessions. He provides you with the following data: Receipts Food Sales Volume rebates received from suppliers Capital contributed by Ronald Insurance monies received for trading stock stolen from back of shop Bank loan to buy burger equipment Payments Purchases of trading stock Cash drawings by Ronald Advertising costs on Facebook Rent - paid until 30 September 2021 ($2,500 per month) Bank fees Net wages paid to employees PAYG tax withheld on employee's wages Superannuation for employees Superannuation for Ronald Electricity and telephone Repayments on business bank loan (interest paid $7,500, balance is principal) Sponsorship of the local soccer club (the logo was displayed on shirts) Business insurance Fringe Benefit Tax Van purchased on 1 March 2021. Effective life is 8 years. $ (excl. GST) 241,000 12,500 45,000 5,800 25,000 52,000 5,800 2,500 37,500 1,500 9,000 3,440 855 3,500 4,000 15,700 900 5,700 1,400 19,000 Motor vehicle expenses -including depreciation (receipts retained). The vehicle is used for business purposes and the car has travelled approximately 9,000 business km during the year. He has a valid logbook summarised below: Travel to suppliers 2,000 km Travel from home to work and back 1,500 km Total 3,500 km Other Information Stock on hand at 1 July 2020 Stock on hand at 30 June 2021 PAYG tax instalments Opening balance of small business pool 1/7/20 Required: Calculate Ronald's taxable income for the year ended 30/6/21 22,000 7,400 16,000 7,000 12,500

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Ronalds taxable income for the year ended 30621 consider the income and expenses related to his business Donalds Burgers Lets break down ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started