Answered step by step

Verified Expert Solution

Question

1 Approved Answer

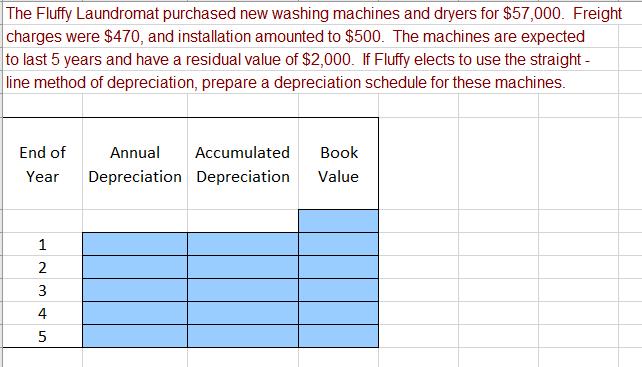

The Fluffy Laundromat purchased new washing machines and dryers for $57,000. Freight charges were $470, and installation amounted to $500. The machines are expected

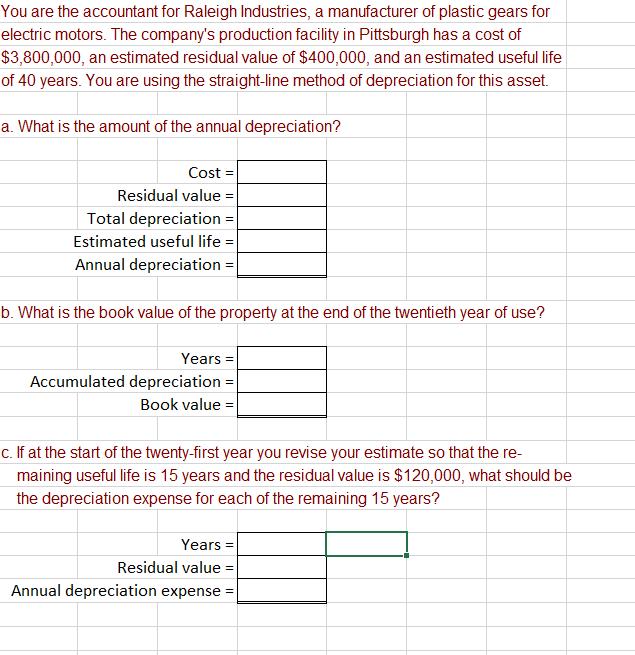

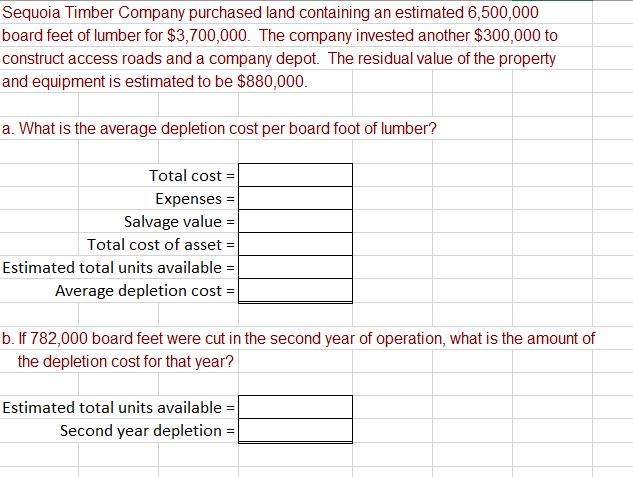

The Fluffy Laundromat purchased new washing machines and dryers for $57,000. Freight charges were $470, and installation amounted to $500. The machines are expected to last 5 years and have a residual value of $2,000. If Fluffy elects to use the straight- line method of depreciation, prepare a depreciation schedule for these machines. End of Year 1 2 3 4 5 Annual Accumulated Book Depreciation Depreciation Value You are the accountant for Raleigh Industries, a manufacturer of plastic gears for electric motors. The company's production facility in Pittsburgh has a cost of $3,800,000, an estimated residual value of $400,000, and an estimated useful life of 40 years. You are using the straight-line method of depreciation for this asset. a. What is the amount of the annual depreciation? Cost = Residual value = Total depreciation = Estimated useful life = Annual depreciation = b. What is the book value of the property at the end of the twentieth year of use? Years = Accumulated depreciation = Book value= c. If at the start of the twenty-first year you revise your estimate so that the re- maining useful life is 15 years and the residual value is $120,000, what should be the depreciation expense for each of the remaining 15 years? Years = Residual value = Annual depreciation expense = Sequoia Timber Company purchased land containing an estimated 6,500,000 board feet of lumber for $3,700,000. The company invested another $300,000 to construct access roads and a company depot. The residual value of the property and equipment is estimated to be $880,000. a. What is the average depletion cost per board foot of lumber? Total cost = Expenses = Salvage value Total cost of asset = Estimated total units available = Average depletion cost = = b. If 782,000 board feet were cut in the second year of operation, what is the amount of the depletion cost for that year? Estimated total units available = Second year depletion =

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation It refers to an accounting method used to allocate the cost of a tangible or physical a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started