Answered step by step

Verified Expert Solution

Question

1 Approved Answer

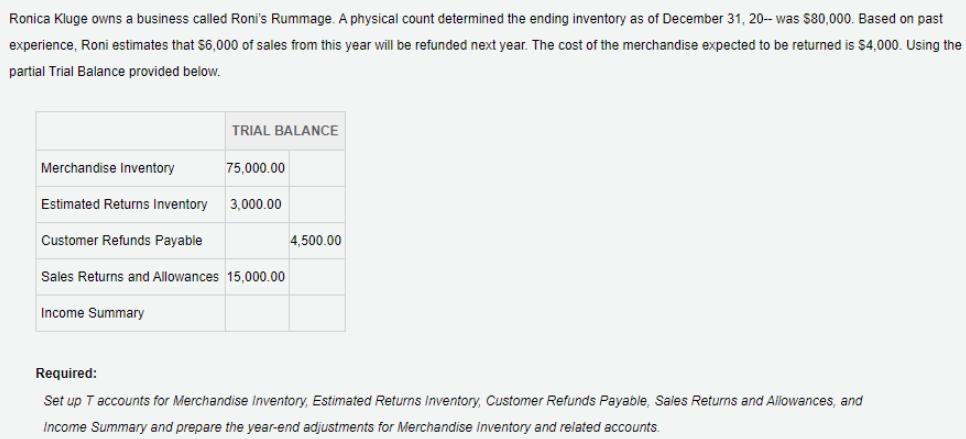

Ronica Kluge owns a business called Roni's Rummage. A physical count determined the ending inventory as of December 31, 20- was $80,000. Based on

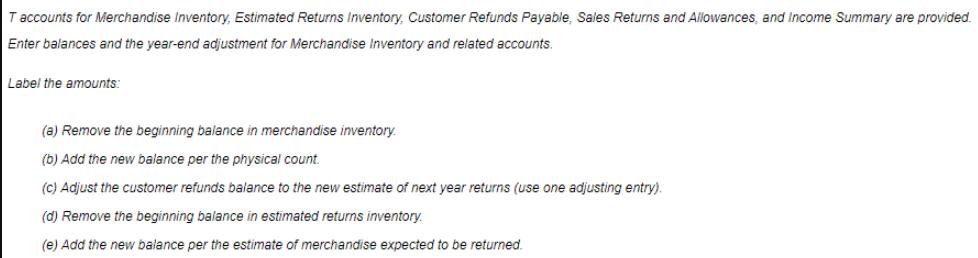

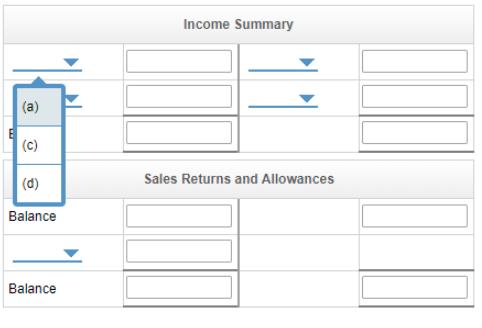

Ronica Kluge owns a business called Roni's Rummage. A physical count determined the ending inventory as of December 31, 20- was $80,000. Based on past experience, Roni estimates that $6,000 of sales from this year will be refunded next year. The cost of the merchandise expected to be returned is $4,000. Using the partial Trial Balance provided below. TRIAL BALANCE Merchandise Inventory 75.000.00 Estimated Returns Inventory 3,000.00 Customer Refunds Payable 4,500.00 Sales Returns and Allowances 15,000.00 Income Summary Required: Set up T accounts for Merchandise Inventory, Estimated Returns Inventory, Customer Refunds Payable, Sales Returns and Allowances, and Income Summary and prepare the year-end adjustments for Merchandise Inventory and related accounts. Taccounts for Merchandise Inventory, Estimated Returns Inventory. Customer Refunds Payable, Sales Returns and Allowances, and Income Summary are provided. Enter balances and the year-end adjustment for Merchandise Inventory and related accounts. Label the amounts: (a) Remove the beginning balance in merchandise inventory. (b) Add the new balance per the physical count. (c) Adjust the customer refunds balance to the new estimate of next year returns (use one adjusting entry). (d) Remove the beginning balance in estimated returns inventory. (e) Add the new balance per the estimate of merchandise expected to be returned. Income Summary (a) (c) (d) Sales Returns and Allowances Balance Balance TAccounts InstruUctions Merchandise Inventory Balance Balance Estimated Returns Inventory Balance Balance Customer Refunds Payabie Balance Balance

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

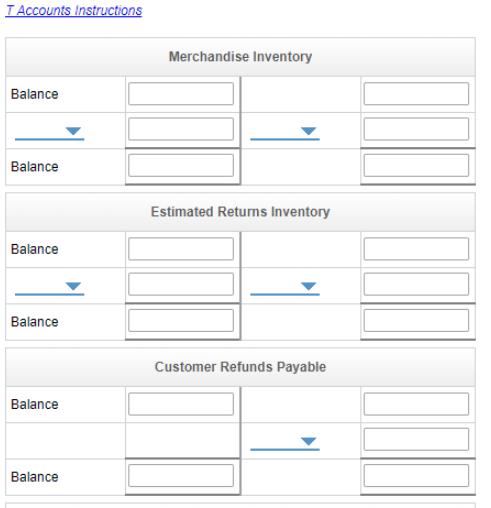

A B D 1 Merchandise Inventory Debit S 7500000 8000000 311220Adju...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started