Question

Ronnie Arthur is a serial entrepreneur from Saginaw, MI, who is trying to decide whether to spend his time and investment capital on his barbershop

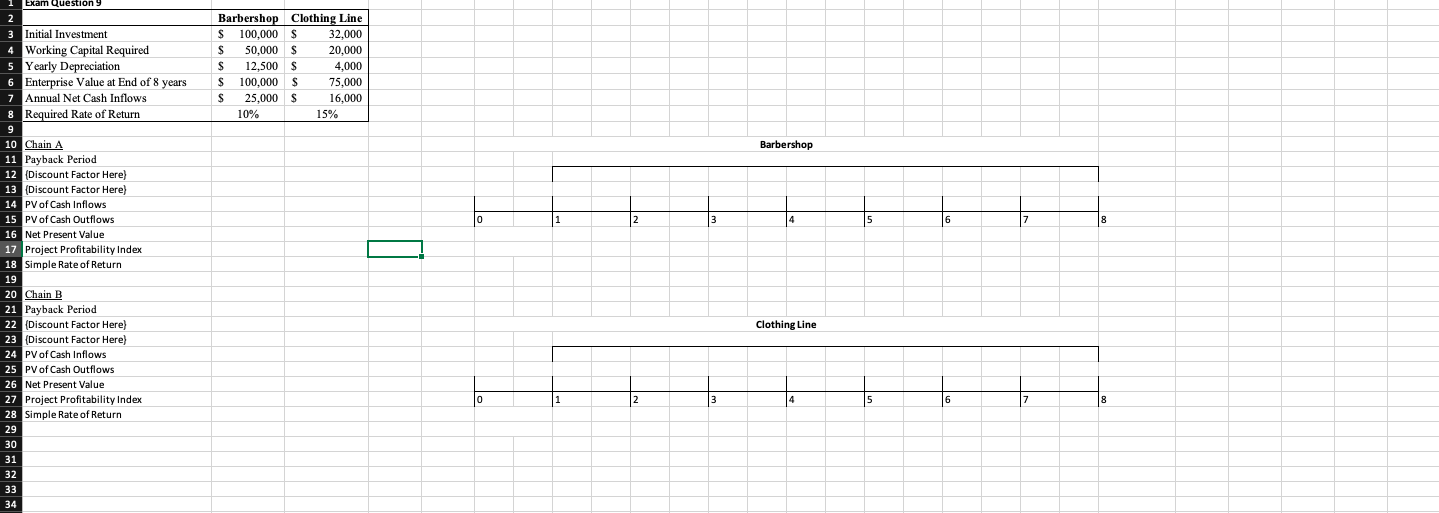

Ronnie Arthur is a serial entrepreneur from Saginaw, MI, who is trying to decide whether to spend his time and investment capital on his barbershop or on his clothing line. He has decided to engage in some capital budgeting analysis in order to help him make this decision. Ronnie has determined the following predicted costs and benefits of devoting his resources to each business:

| Barbershop | Clothing Line | |

| Initial Investment | $ 100,000 | $ 32,000 |

| Working Capital Required | $ 50,000 | $ 20,000 |

| Yearly Depreciation | $ 12,500 | $ 4,000 |

| Enterprise Value at End of 8 years | $ 100,000 | $ 75,000 |

| Annual Net Cash Inflows | $ 25,000 | $ 16,000 |

| Required Rate of Return | 10% | 15% |

What is the payback period for each chain? (1 point)

What is the Net Present Value of each chain? (9 points)

What is the Project Profitability Index of each chain? (1 point)

What is each chains simple rate of return? (1 points)

in Barbershop Clothing Line S 100,000 $ 32,000 S 50,000 $ 20.000 12,500 $ 4,000 S 100,000 S 75,000 $ 25,000 $ 16,000 10% 15% Barbershop 10 1 2 3 4 15 6 7 18 Exam Question 2 3 Initial Investment 4 Working Capital Required 5 Yearly Depreciation Enterprise Value at End of 8 years 7 Annual Net Cash Inflows 8 Required Rate of Return 9 10 Chain A 11 Payback Period 12 (Discount Factor Here) 13 (Discount Factor Here) 14 PV of Cash Inflows 15 PV of Cash Outflows 16 Net Present Value 17 Project Profitability Index 18 Simple Rate of Return 19 20 Chain B 21 Payback Period 22 (Discount Factor Here) 23 (Discount Factor Here) 24 PV of Cash Inflows 25 PV of Cash Outflows 26 Net Present Value 27 Project Profitability Index 28 Simple Rate of Return 29 30 31 32 33 34 Clothing Line 0 1 2 3 4 5 6 7 8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started