Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ron's Squash Inc.'s net income for the year ended December 31, 2021, was $140,000. Ron had 60,000 ordinary shares outstanding at the beginning of the

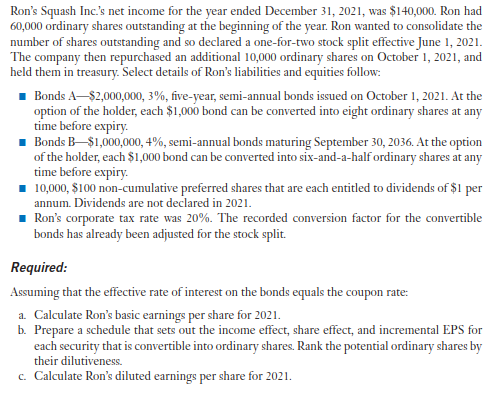

Ron's Squash Inc.'s net income for the year ended December 31, 2021, was $140,000. Ron had 60,000 ordinary shares outstanding at the beginning of the year. Ron wanted to consolidate the number of shares outstanding and so declared a one-for-two stock split effective June 1, 2021. The company then repurchased an additional 10,000 ordinary shares on October 1, 2021, and held them in treasury. Select details of Ron's liabilities and equities follow: - Bonds A- $2,000,000,3%, five-year, semi-annual bonds issued on October 1, 2021. At the option of the holder, each $1,000 bond can be converted into eight ordinary shares at any time before expiry. - Bonds B- $1,000,000,4%, semi-annual bonds maturing September 30, 2036. At the option of the holder, each $1,000 bond can be converted into six-and-a-half ordinary shares at any time before expiry. - 10,000,$100 non-cumulative preferred shares that are each entitled to dividends of $1 per annum. Dividends are not declared in 2021. - Ron's corporate tax rate was 20%. The recorded conversion factor for the convertible bonds has already been adjusted for the stock split. Required: Assuming that the effective rate of interest on the bonds equals the coupon rate: a. Calculate Ron's basic earnings per share for 2021. b. Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank the potential ordinary shares by their dilutiveness. c. Calculate Ron's diluted earnings per share for 2021

Ron's Squash Inc.'s net income for the year ended December 31, 2021, was $140,000. Ron had 60,000 ordinary shares outstanding at the beginning of the year. Ron wanted to consolidate the number of shares outstanding and so declared a one-for-two stock split effective June 1, 2021. The company then repurchased an additional 10,000 ordinary shares on October 1, 2021, and held them in treasury. Select details of Ron's liabilities and equities follow: - Bonds A- $2,000,000,3%, five-year, semi-annual bonds issued on October 1, 2021. At the option of the holder, each $1,000 bond can be converted into eight ordinary shares at any time before expiry. - Bonds B- $1,000,000,4%, semi-annual bonds maturing September 30, 2036. At the option of the holder, each $1,000 bond can be converted into six-and-a-half ordinary shares at any time before expiry. - 10,000,$100 non-cumulative preferred shares that are each entitled to dividends of $1 per annum. Dividends are not declared in 2021. - Ron's corporate tax rate was 20%. The recorded conversion factor for the convertible bonds has already been adjusted for the stock split. Required: Assuming that the effective rate of interest on the bonds equals the coupon rate: a. Calculate Ron's basic earnings per share for 2021. b. Prepare a schedule that sets out the income effect, share effect, and incremental EPS for each security that is convertible into ordinary shares. Rank the potential ordinary shares by their dilutiveness. c. Calculate Ron's diluted earnings per share for 2021 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started