Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Roof interest rates approximation mothod) The CFO of your firm has asked you for an approximate answer to this question: What was the increase in

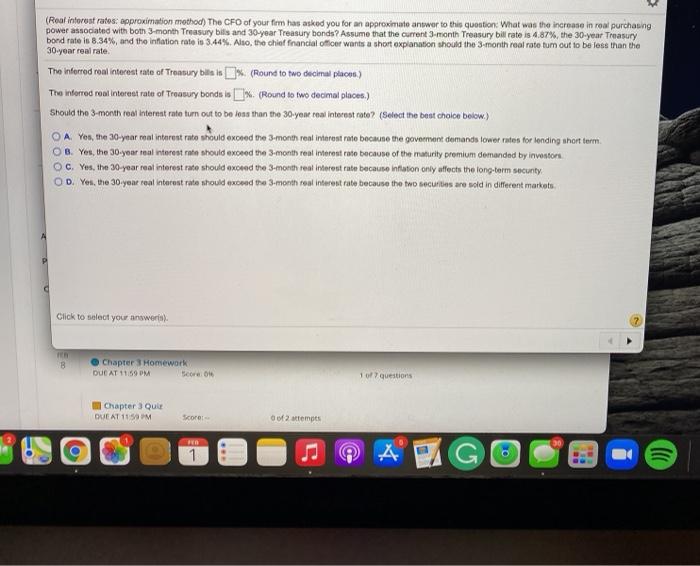

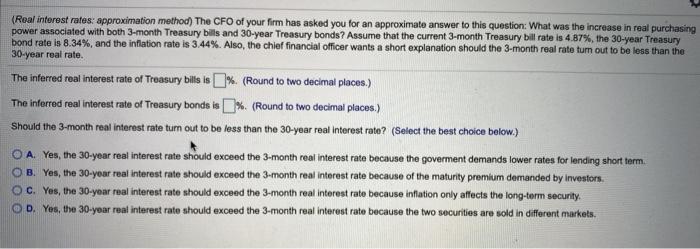

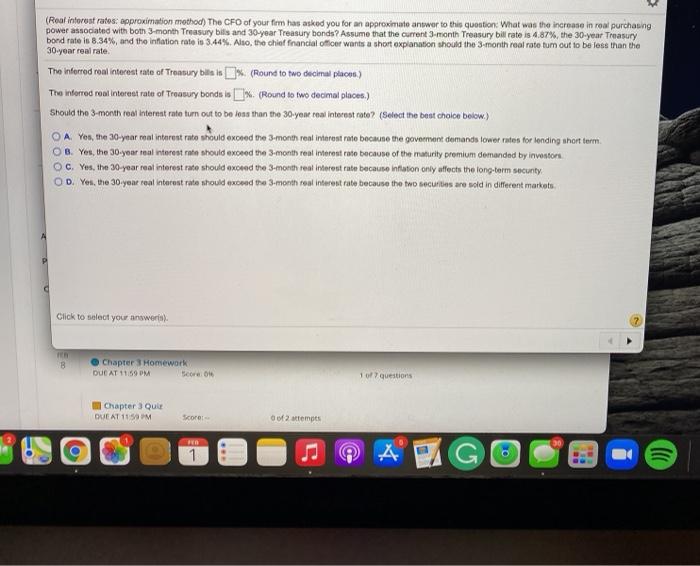

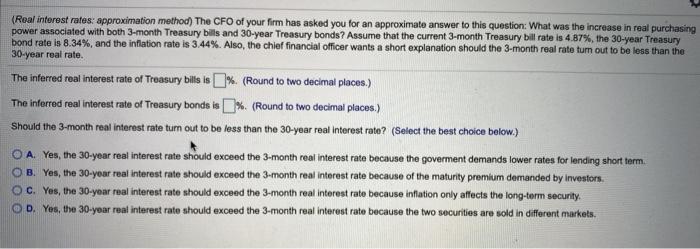

(Roof interest rates approximation mothod) The CFO of your firm has asked you for an approximate answer to this question: What was the increase in real purchasing power associated with both 3-month Treasury bits and 30 year Treasury bonds? Assume that the current 3-month Treasury bill rate is 4.87%, the 30-year Treasury bond rate is 8.34%, and the inflation rate is 3.44%. Also, the chief fnancial officer wants a short explanation should the 3-month real rate tum out to be less than the 30.year real rate The Inferred roal interest rate of Treasury bills is % (Round to two decimal plant) The inferred roal interest rate of Treasury bonds is (Round to two decimal places.) Should the 3-month real interest rate turn out to be less than the 30-yone real interest rato? (Select the best choice below.) OA. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the goverment demands tower rates for lending short term. OB. Yes, the 30-year real interest rate should exceed the 3-month rent interest rate because of the maturity premium demanded by investors OC. Yes, the 30 year reat interest rate should exceed the 3-month rent interest rate because inflation only affects the long-term secunty OD. Yes, the 30-yont real interest rate should exceed the 3-month roal interest rate because the two securities are sold in different markets P Click to select your answer. Chapter 3 Homework DUBAT 11:59PM Score 1 of questions | Chapter 3 QUE CHEAT 11 PM Score of 2 temps G lcd (Real interest rates: approximation method) The CFO of your firm has asked you for an approximate answer to this question: What was the increase in real purchasing power associated with both 3-month Treasury bills and 30-year Treasury bonds? Assume that the current 3-month Treasury bill rate is 4.87%, the 30-year Treasury bond rate is 8.34%, and the inflation rate is 3.44%. Also, the chief financial officer wants a short explanation should the 3-month real rate turn out to be less than the 30-year real rate. The inferred real interest rate of Treasury bills is % (Round to two decimal places.) The inferred real interest rate of Treasury bonds is % (Round to two decimal places.) Should the 3-month real interest rate tum out to be less than the 30-year real Interest rate? (Select the best choice below.) A. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the goverment demands lower rates for lending short term. B. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because of the maturity premium demanded by investors. OC. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because inflation only affects the long-term security OD. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the two securities are sold in different markets

(Roof interest rates approximation mothod) The CFO of your firm has asked you for an approximate answer to this question: What was the increase in real purchasing power associated with both 3-month Treasury bits and 30 year Treasury bonds? Assume that the current 3-month Treasury bill rate is 4.87%, the 30-year Treasury bond rate is 8.34%, and the inflation rate is 3.44%. Also, the chief fnancial officer wants a short explanation should the 3-month real rate tum out to be less than the 30.year real rate The Inferred roal interest rate of Treasury bills is % (Round to two decimal plant) The inferred roal interest rate of Treasury bonds is (Round to two decimal places.) Should the 3-month real interest rate turn out to be less than the 30-yone real interest rato? (Select the best choice below.) OA. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the goverment demands tower rates for lending short term. OB. Yes, the 30-year real interest rate should exceed the 3-month rent interest rate because of the maturity premium demanded by investors OC. Yes, the 30 year reat interest rate should exceed the 3-month rent interest rate because inflation only affects the long-term secunty OD. Yes, the 30-yont real interest rate should exceed the 3-month roal interest rate because the two securities are sold in different markets P Click to select your answer. Chapter 3 Homework DUBAT 11:59PM Score 1 of questions | Chapter 3 QUE CHEAT 11 PM Score of 2 temps G lcd (Real interest rates: approximation method) The CFO of your firm has asked you for an approximate answer to this question: What was the increase in real purchasing power associated with both 3-month Treasury bills and 30-year Treasury bonds? Assume that the current 3-month Treasury bill rate is 4.87%, the 30-year Treasury bond rate is 8.34%, and the inflation rate is 3.44%. Also, the chief financial officer wants a short explanation should the 3-month real rate turn out to be less than the 30-year real rate. The inferred real interest rate of Treasury bills is % (Round to two decimal places.) The inferred real interest rate of Treasury bonds is % (Round to two decimal places.) Should the 3-month real interest rate tum out to be less than the 30-year real Interest rate? (Select the best choice below.) A. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the goverment demands lower rates for lending short term. B. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because of the maturity premium demanded by investors. OC. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because inflation only affects the long-term security OD. Yes, the 30-year real interest rate should exceed the 3-month real interest rate because the two securities are sold in different markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started