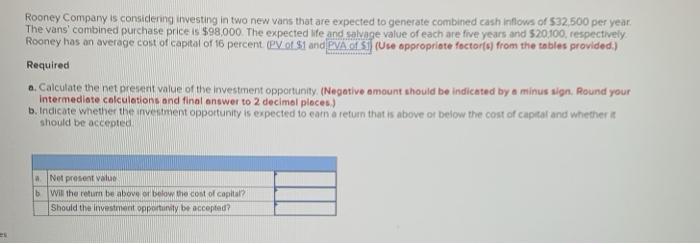

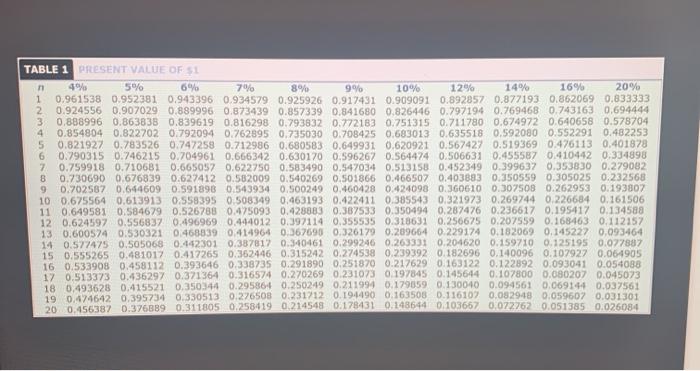

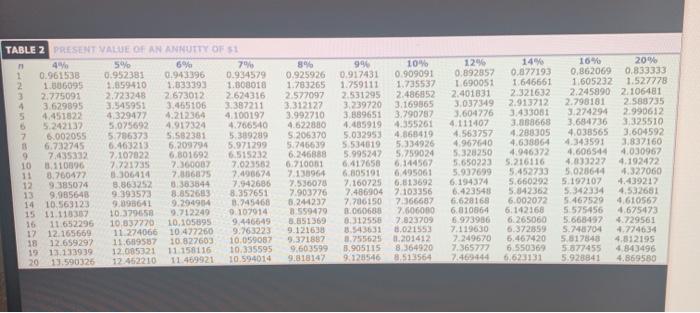

Rooney Company is considering investing in two new vans that are expected to generate combined cash inflows of 532.500 per year, The vans combined purchase price is $98.000 The expected ife and salvage value of each are five years and S20100, respectively Rooney has on average cost of capital of 16 percent. PV of $1 and PVA Si (Use appropriate foctor(s) from the tables provided) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your b. Indicate whether the investment opportunity is expected to com a return that is above or below the cost of capital and whether should be accepted Net present Value b Will the return babove or below the cost of capital? Should the investment opportunity be accepted? 8% TABLE 1 PRESENT VALUE OF SL n 4% 5% 6% 7% 9% 10% 129 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996, 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0,694444 3 0,888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399632 0.353830 0.279082 8 0.730690 0.676839 0.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0.305025 0.232568 9 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0.193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226684 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0.112157 13 0.600574 0.530321 0.468839 0:414964 0.167690 0.326179 0.289664 0.229174 0.182069 0.145227 0,093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.125195 0.027887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.1631220.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0.145644 0.107800 0.080207 0.045073 18 0,493628 0.415521 0.350.44 0.295864 0.250249 0.211994 0.179059 0.130040 0.094561 0.069144 0.037561 19 0.474642 0.395734 0.330513 0.276508 0.231212 0.194490 0.163508 0.116102 0,082948 0.059607 0.031301 20 0.456387 0.376689 0.311805 0,258419 0.214548 0.178431 0.148644 0.103667 0,0727620.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF 51 4 6% 79 1 0.961538 0.952381 0.943396 0.934579 12 1.306095 1.659410 1.833393 1.308010 2.775091 2.723248 2673012 2.624316 4 3.629895 3.545951 3.465106 3:387211 4.451822 4.329472 4.212364 4100197 5 5.242132 5.025692 4.912324 4.766540 7 6.002055 5:786373 5.582381 5.389209 3 6.732745 6.463213 6.209794 5.971299 9 7.43532 7.107822 6.801692 6.5152) 10 3.110096 7.721735 7.36000 7.023562 3.760472 8.306414 7.306875 2.490674 12 9.385074 8.863252 0.383544 7.542686 13 9.985648 9393573 8.852683 8.357651 14 10.563123 9.093641 9.294904 3.745468 15 11.110307 10.379658 9.712249 0.107914 16 11.652296 10.837270 10.105895 9.446649 17 12.165669 11 274066 10.427260 9.763223 18 12.659297 11.609587 10.827603 10.059087 19 13.133939 12.005321 11.158116 10.335595 20 13.590326 12.452210 11469921 10.594014 99% 0.925926 1.783265 2.577097 3.312127 3.992710 4.622880 5.205370 5:746639 6.246888 6.710001 7.138964 7.536078 7.903796 8.244237 8.559479 8.351369 9.121638 9.371887 9.603599 91818147 994 0.917431 1.759111 2.531295 3.239720 3 889651 4.485919 5.03295 5.534619 5.995242 6.417658 6.805191 7.160223 2.486904 7.706150 3.060680 0.312550 8.543631 3.755625 3.905115 9.128546 10 0.909091 1.735537 2.486852 3.169865 3.790287 4.355261 4.560.419 5.334926 5.759024 6.144567 6.495061 6.813692 7:103356 7366687 7.606000 7.823709 8.021553 01.201412 8.364920 8.513564 12% 0.892857 1 690051 2.401831 3.037349 3.604776 4.111407 4.563757 4.967640 5:328250 5.650223 5.937699 6.194374 6.423540 6.628168 6.810064 5.973986 7.119630 7.249670 7365727 74-16944 14 0.877193 1646661 2.321632 2.913712 3.433081 3.888668 4.288305 4.638064 4.946372 5.216116 5.452733 5.660292 5.342362 6.002072 6.142168 6.265060 6.372859 6.467420 6.550369 6.623131 16% 20% 0,862069 0.833333 1.605232 1.527778 2.245890 2.106481 2.798181 2.588735 3274294 2.990612 3.684736 3325510 4.038565 3.604592 4.343591 3.837160 4,606544 4.030962 4.033227 4.192472 5.028644 4.327060 5.197107 4.439212 5.342334 4.532681 5.462529 4.610562 5 575456 4.675473 5.668457 4.729561 5.740704 4.774634 5.817848 4.812195 5877455 4.943496 5.928841 4.869580