Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rooney Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity - based costing.

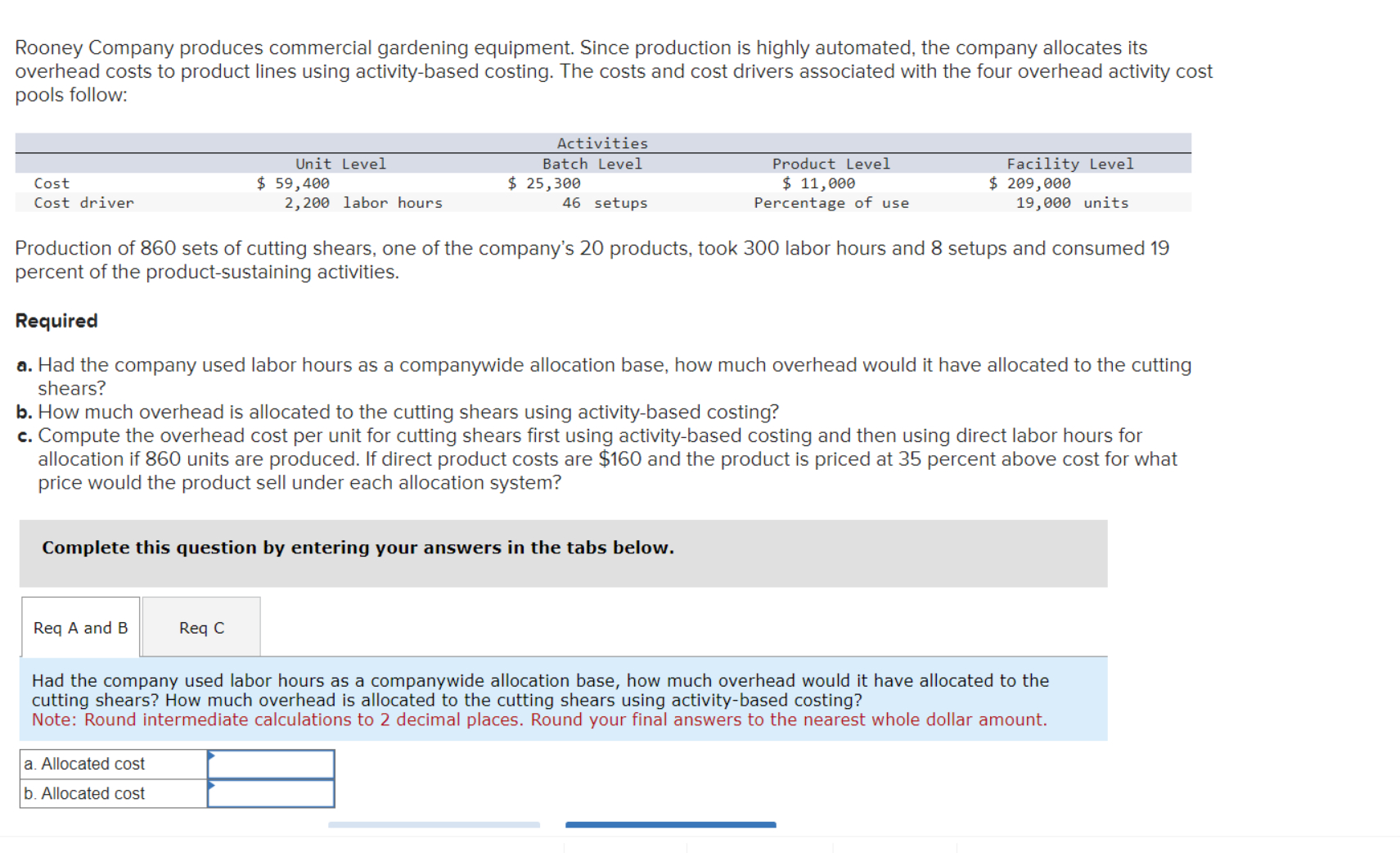

Rooney Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activitybased costing. The costs and cost drivers associated with the four overhead activity cost pools follow:

Activities

Unit Level Batch Level Product Level Facility Level

Cost $ $ $ $

Cost driver labor hours setups Percentage of use units

Production of sets of cutting shears, one of the companys products, took labor hours and setups and consumed percent of the productsustaining activities.

Required

Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears?

How much overhead is allocated to the cutting shears using activitybased costing?

Compute the overhead cost per unit for cutting shears first using activitybased costing and then using direct labor hours for allocation if units are produced. If direct product costs are $ and the product is priced at percent above cost for what price would the product sell under each allocation system?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started