Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rooney Corporation estimated its overhead costs would be $23.700 per month except for January when it pays the $130,140 annual Insurance premium on the manufacturing

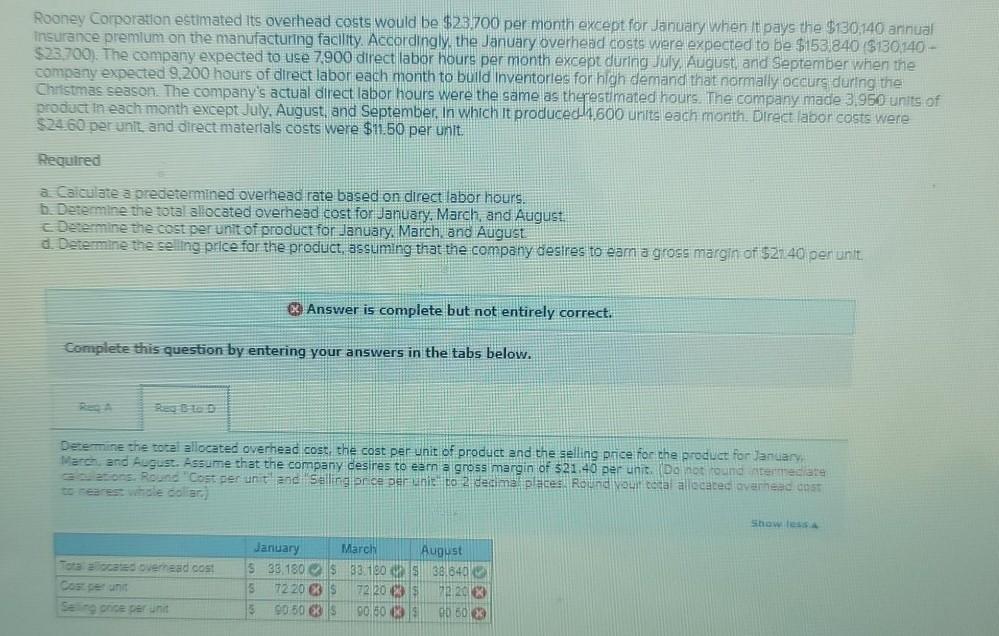

Rooney Corporation estimated its overhead costs would be $23.700 per month except for January when it pays the $130,140 annual Insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $1531840 ($130 140 - $23.700). The company expected to use 7.900 dtrect labor hours per month except during July August and September when the company expected 9,200 hours of direct labor each month to build Inventortes for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as therestimated hours. The company made 3.960 units of product in each month except July, August, and September. In which it produced 4,600 units each month Direct labor costs were 524 60 per unit and direct materials costs were $11.50 per unit. Required a Calculate a predetermined overhead rate based on direct labor hours. b Determine the total allocated overhead cost for January, March, and August Determine the cost per unit of product for January, March and August a. Determine the selling price for the product, assuming that the company desires to eam a gross margin of $21.40 perunit Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Determine the total allocated overhead cost, the cost per unit of product and the selling prce for the product for January March and August. Assume that the company desires to earn a gross margin of $21.40 per unit. Do not ouma termediate sons. Round "Cost per unit and selling once per nie to 2 decimal place Round your conta allocated overhead cost Show less Tota a cated overhead cost Cos de unt Se noce per unit January March August S 38.180 s 3a 180 S 38.640 13 72 20 72120 B 2013 3 90 50 83 90.80 00603

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started