Question

Rooney Manufacturing started in Year 2 with the following account balances. Cash $5,700 Common stock $4,877 Retained earnings $5,300 Raw materials $1,600 Work in process

Rooney Manufacturing started in Year 2 with the following account balances.

| Cash | $5,700 |

| Common stock | $4,877 |

| Retained earnings | $5,300 |

| Raw materials | $1,600 |

| Work in process inventory | $820 |

| Finished goods inventory (340 units @ $6.05 each) | $2,057 |

Transactions during Year 2

1. Purchased $2,920 of raw materials with cash.

2. Transferred $3,830 of raw materials to the production department.

3. Incurred and paid cash for 240 hours of direct labor @ $15.20 per hour.

4. Applied overhead costs to the Work in Process Inventory account. The predetermined overhead rate is $16.50 per direct labor hour.

5. Incurred actual overhead costs of $4,000 cash.

6. Completed work on 1,240 units for $5.60 per unit.

7. Paid $1,150 in selling and administrative expenses in cash.

8. Sold 1,240 units for $10,500 cash revenue (assume FIFO cost flow).

9. Rooney charges overapplied or underapplied overhead directly to Cost of Goods Sold.

Required

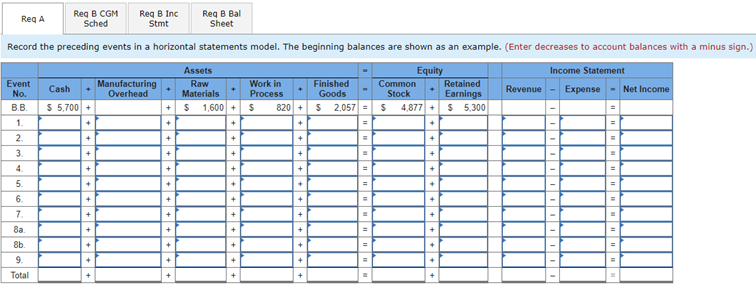

a. Record the preceding events in a horizontal statements model. The beginning balances are shown as an example.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started