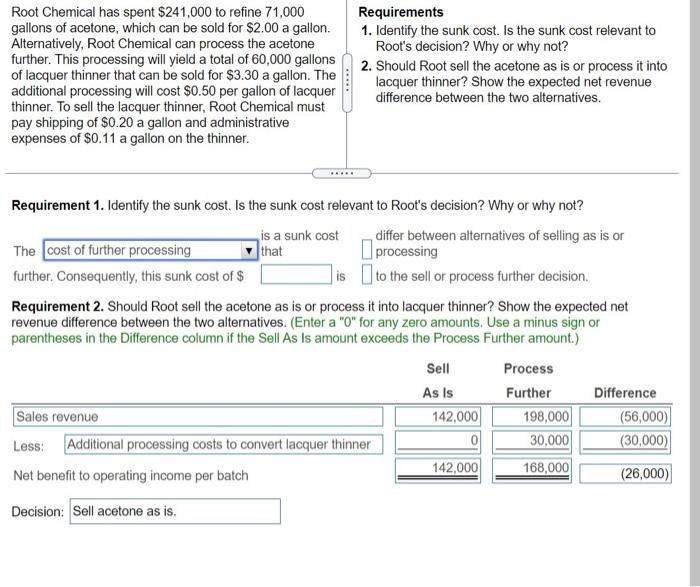

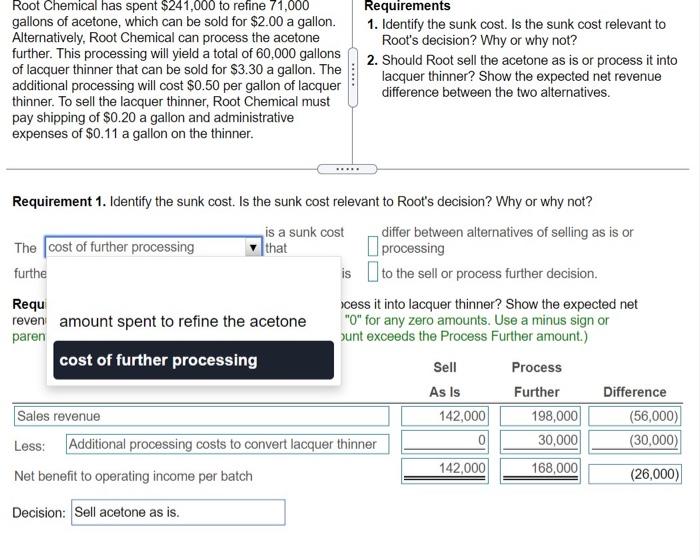

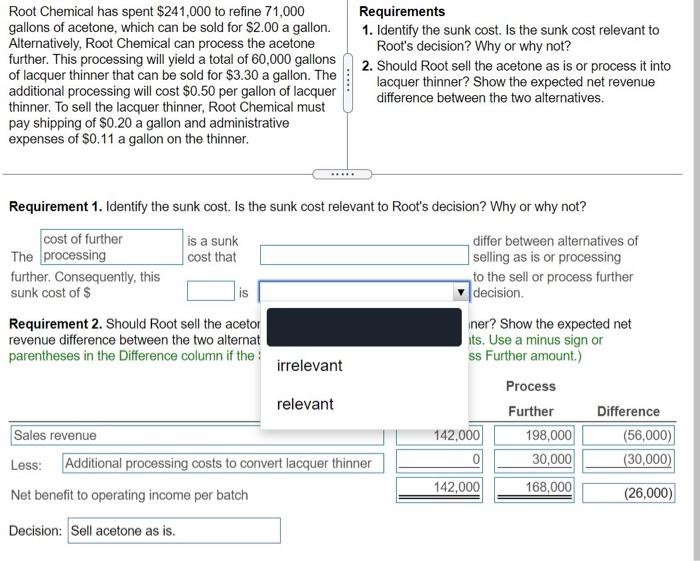

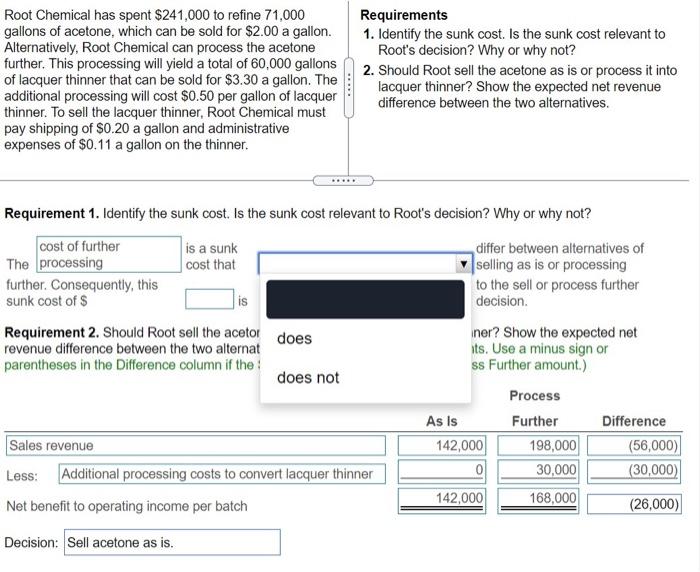

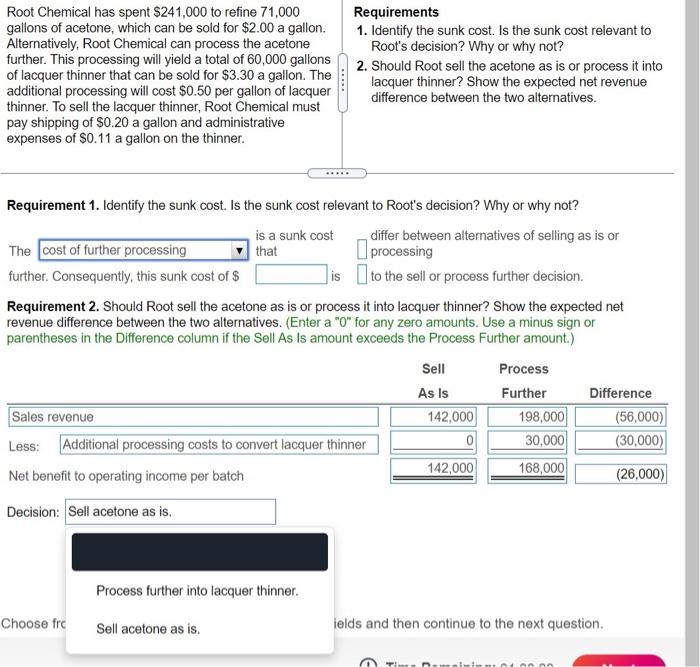

Root Chemical has spent $241,000 to refine 71,000 gallons of acetone, which can be sold for $2.00 a gallon. Alternatively, Root Chemical can process the acetone further. This processing will yield a total of 60,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.50 per gallon of lacquer thinner. To sell the lacquer thinner, Root Chemical must pay shipping of $0.20 a gallon and administrative expenses of $0.11 a gallon on the thinner. Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? is a sunk cost differ between alternatives of selling as is or The cost of further processing that processing further. Consequently, this sunk cost of $ is to the sell or process further decision. Requirement 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. (Enter a "0" for any zero amounts. Use a minus sign or parentheses in the Difference column if the Sell As is amount exceeds the Process Further amount.) Sell Process As Is Further Difference Sales revenue 142,000 198,000 (56,000) 30,000 (30,000) Less: Additional processing costs to convert lacquer thinner 142,000 168,000 (26,000) Net benefit to operating income per batch Decision: Sell acetone as is. Root Chemical has spent $241,000 to refine 71,000 gallons of acetone, which can be sold for $2.00 a gallon. Alternatively, Root Chemical can process the acetone further. This processing will yield a total of 60,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.50 per gallon of lacquer thinner. To sell the lacquer thinner, Root Chemical must pay shipping of $0.20 a gallon and administrative expenses of $0.11 a gallon on the thinner. Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. ... Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? is a sunk cost differ between alternatives of selling as is or The cost of further processing that processing furthe is to the sell or process further decision. Requ scess it into lacquer thinner? Show the expected net reven amount spent to refine the acetone "O" for any zero amounts. Use a minus sign or paren sunt exceeds the Process Further amount.) cost of further processing Sell Process As is Further Difference Sales revenue 142,000 198,000 (56,000) Less: Additional processing costs to convert lacquer thinner 30,000 (30,000) 142,000 168,000 Net benefit to operating income per batch (26,000) 0 Decision: Sell acetone as is. Root Chemical has spent $241,000 to refine 71,000 gallons of acetone, which can be sold for $2.00 a gallon. Alternatively, Root Chemical can process the acetone further. This processing will yield a total of 60,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.50 per gallon of lacquer thinner. To sell the lacquer thinner, Root Chemical must pay shipping of $0.20 a gallon and administrative expenses of $0.11 a gallon on the thinner. Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. IS Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? cost of further is a sunk differ between alternatives of The processing cost that selling as is or processing further. Consequently, this to the sell or process further sunk cost of $ decision. Requirement 2. Should Root sell the acetor ner? Show the expected net revenue difference between the two alternat its. Use a minus sign or parentheses in the Difference column if the : ss Further amount.) irrelevant Process relevant Further Difference Sales revenue 142,000 198,000 (56,000) Additional processing costs to convert lacquer thinner 30,000 Less: (30,000) 142,000 168,000 Net benefit to operating income per batch (26,000) Decision: Sell acetone as is. Root Chemical has spent $241,000 to refine 71.000 gallons of acetone, which can be sold for $2.00 a gallon. Alternatively, Root Chemical can process the acetone further. This processing will yield a total of 60,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.50 per gallon of lacquer thinner. To sell the lacquer thinner, Root Chemical must pay shipping of $0.20 a gallon and administrative expenses of $0.11 a gallon on the thinner. Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? cost of further is a sunk differ between alternatives of The processing cost that selling as is or processing further. Consequently, this to the sell or process further sunk cost of $ is decision. Requirement 2. Should Root sell the acetor does ner? Show the expected net revenue difference between the two alternat its. Use a minus sign or parentheses in the Difference column if the : ss Further amount.) does not Process As Is Further Difference Sales revenue 142,000 198,000 (56,000) Less: Additional processing costs to convert lacquer thinner 30,000 (30,000) 142,000 Net benefit to operating income per batch 168,000 (26,000) Decision: Sell acetone as is. Root Chemical has spent $241,000 to refine 71,000 gallons of acetone, which can be sold for $2.00 a gallon. Alternatively, Root Chemical can process the acetone further. This processing will yield a total of 60,000 gallons of lacquer thinner that can be sold for $3.30 a gallon. The additional processing will cost $0.50 per gallon of lacquer thinner. To sell the lacquer thinner, Root Chemical must pay shipping of $0.20 a gallon and administrative expenses of $0.11 a gallon on the thinner. Requirements 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. Requirement 1. Identify the sunk cost. Is the sunk cost relevant to Root's decision? Why or why not? is a sunk cost differ between alternatives of selling as is or The cost of further processing that processing further. Consequently, this sunk cost of $ is to the sell or process further decision. Requirement 2. Should Root sell the acetone as is or process it into lacquer thinner? Show the expected net revenue difference between the two alternatives. (Enter a "0" for any zero amounts. Use a minus sign or parentheses in the Difference column if the Sell As Is amount exceeds the Process Further amount.) Sell Process As Is Further Difference Sales revenue 142,000 198,000 (56,000) Less: Additional processing costs to convert lacquer thinner 30,000 (30,000) 142,000 168,000 Net benefit to operating income per batch (26,000) Decision: Sell acetone as is. Process further into lacquer thinner. Choose frc Sell acetone as is. ields and then continue to the next