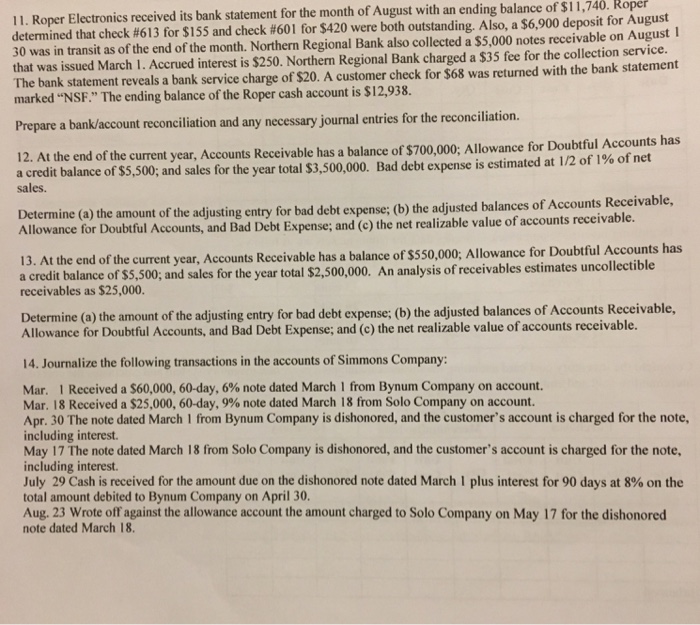

Roper Electronics received its bank statement for the month of August with an ending balance of $ 11, 740. Roper determined that check #613 for $155 and check #601 for $420 were both outstanding. Also, a $6, 900 deposit for August 30 was in transit as of the end of the month. Northern Regional Bank also collected a $5, 000 notes receivable on August that was issued March I. Accrued interest is $250. Northern Regional Bank charged a $35 fee for the collection service. The bank statement reveals a bank service charge of $20. A customer check for $68 was returned with the bank statement marked "NSF." The ending balance of the Roper cash account is $12, 938. Prepare a bank/account reconciliation and any necessary journal entries for the reconciliation. At the end of the current year. Accounts Receivable has a balance of $700, 000; Allowance for Doubtful Accounts has a credit balance of $5, 500; and sales for the year total $3, 500, 000. Bad debt expense is estimated at 1/2 of 1% of net sales. Determine (a) the amount of the adjusting entry for bad debt expense; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable. At the end of the current year, Accounts Receivable has a balance of $550, 000; Allowance for Doubtful Accounts has a credit balance of $5, 500; and sales for the year total $2, 500, 000. An analysis of receivables estimates uncollectible receivables as $25, 000. Determine (a) the amount of the adjusting entry for bad debt expense; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable. Journalize the following transactions in the accounts of Simmons Company: Mar. I Received a $60, 000, 60-day, 6% note dated March I from Bynum Company on account. Mar. 18 Received a $25.000, 60-day, 9% note dated March 18 from Solo Company on account. Apr. 30 The note dated March I from Bynum Company is dishonored, and the customer's account is charged for the note, including interest. May 17 The note dated March 18 from Solo Company is dishonored, and the customer's account is charged for the note including interest. July 29 Cash is received for the amount due on the dishonored note dated March I plus interest for 90 days at 8% on the, . total amount debited to Bynum Company on April 30. Aug. 23 Wrote off against the allowance account the amount charged to Solo Company on May 17 for the dishonored note dated March 18