Answered step by step

Verified Expert Solution

Question

1 Approved Answer

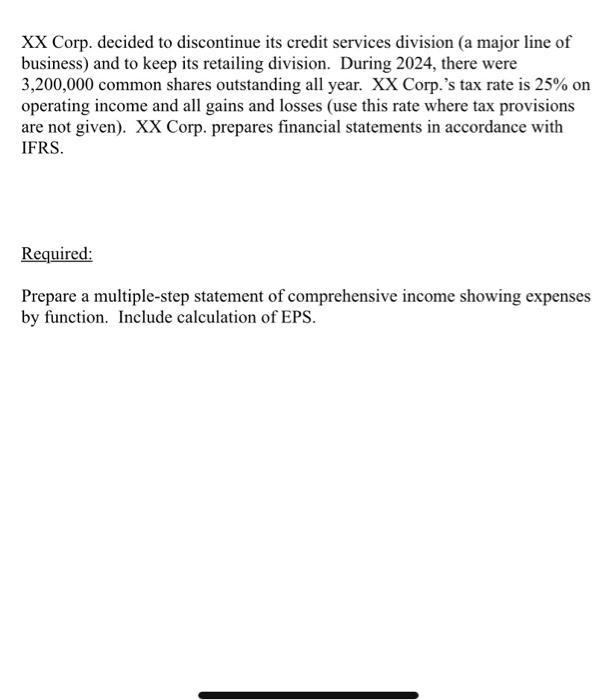

Rory has run a successful proprietorship for the past four years 12 stay in Protected View Information for XX Corporation for 2024 follows: stay in

Rory has run a successful proprietorship for the past four years 12 stay in Protected View Information for XX Corporation for 2024 follows:

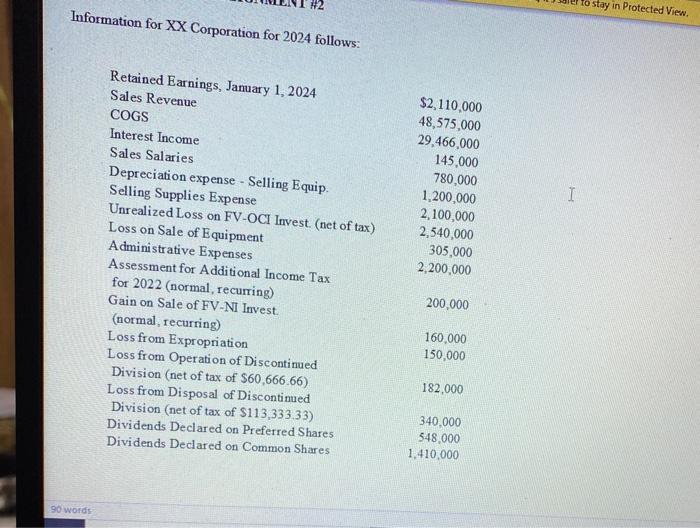

stay in Protected View, # 2 Information for XX Corporation for 2024 follows: Retained Earnings, January 1, 2024 $2,110,000 48,575,000 29,466,000 145,000 Sales Revenue COGS Interest Income Sales Salaries 780,000 Depreciation expense - Selling Equip. Selling Supplies Expense Unrealized Loss on FV-OCI Invest (net of tax) Loss on Sale of Equipment A dministrative Expenses 1,200,000 2,100,000 2,540,000 305,000 2,200,000 Assessment for Additional Income Tax for 2022 (normal, recurring) Gain on Sale of FV-NI Invest. 200,000 160,000 150,000 (normal, recurring) Loss from Expropriation Loss from Operati on of Discontinued Division (net of tax of $60,666.66) Loss from Disposal of Discontimued Division (net of tax of $113,333.33) 182,000 340,000 548,000 1,410,000 Dividends Declared on Preferred Shares Dividends Declared on Common Shares 90 words

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Sales Revenue 48575000 Less Cost of Goods Sold 29466000 Gross Profit 19109000 Less Selling and Admin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started