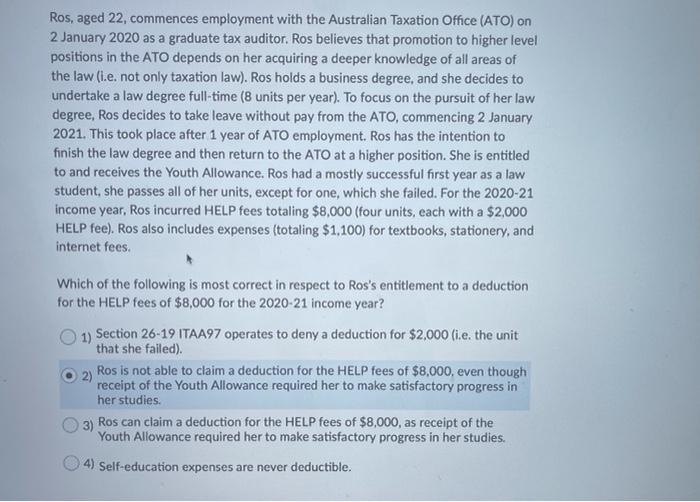

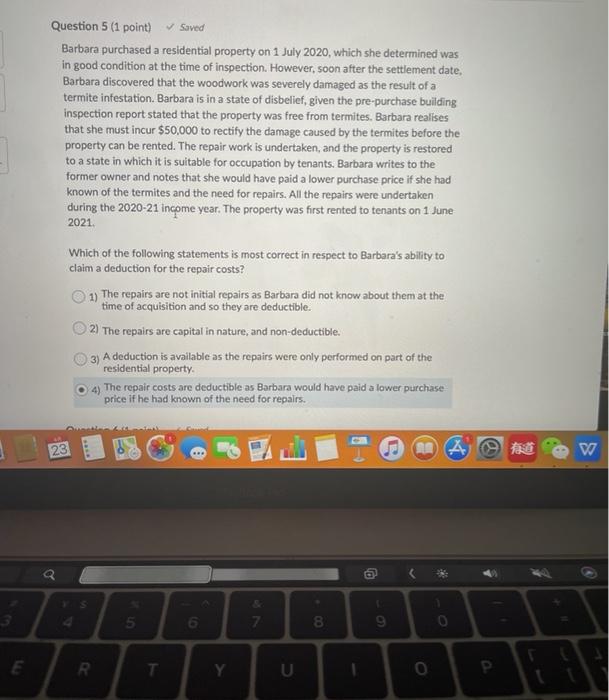

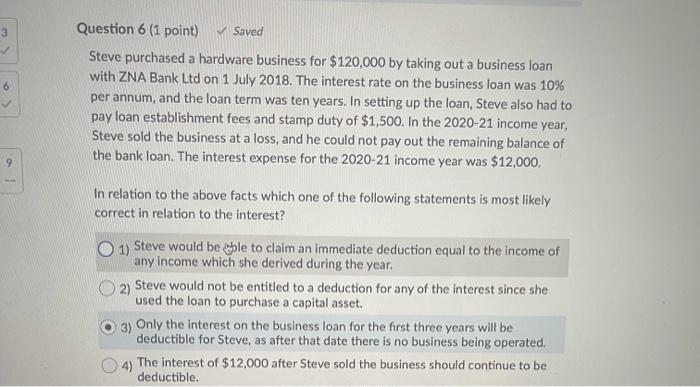

Ros, aged 22, commences employment with the Australian Taxation Office (ATO) on 2 January 2020 as a graduate tax auditor. Ros believes that promotion to higher level positions in the ATO depends on her acquiring a deeper knowledge of all areas of the law (i.e. not only taxation law). Ros holds a business degree, and she decides to undertake a law degree full-time (8 units per year). To focus on the pursuit of her law degree, Ros decides to take leave without pay from the ATO, commencing 2 January 2021. This took place after 1 year of ATO employment. Ros has the intention to finish the law degree and then return to the ATO at a higher position. She is entitled to and receives the Youth Allowance. Ros had a mostly successful first year as a law student, she passes all of her units, except for one, which she failed. For the 2020-21 income year, Ros incurred HELP fees totaling $8,000 (four units, each with a $2,000 HELP fee). Ros also includes expenses (totaling $1.100) for textbooks, stationery, and internet fees. Which of the following is most correct in respect to Ros's entitlement to a deduction for the HELP fees of $8,000 for the 2020-21 income year? 1) Section 26-19 ITAA97 operates to deny a deduction for $2,000 (i.e. the unit that she failed). 2) Ros is not able to claim a deduction for the HELP fees of $8.000, even though receipt of the Youth Allowance required her to make satisfactory progress in her studies. 3) Ros can claim a deduction for the HELP fees of $8,000, as receipt of the Youth Allowance required her to make satisfactory progress in her studies. 4) Self-education expenses are never deductible. Question 5 (1 point) Saved Barbara purchased a residential property on 1 July 2020, which she determined was in good condition at the time of inspection. However, soon after the settlement date, Barbara discovered that the woodwork was severely damaged as the result of a termite infestation. Barbara is in a state of disbelief, given the pre-purchase building inspection report stated that the property was free from termites. Barbara realises that she must incur $50,000 to rectify the damage caused by the termites before the property can be rented. The repair work is undertaken, and the property is restored to a state in which it is suitable for occupation by tenants. Barbara writes to the former owner and notes that she would have paid a lower purchase price if she had known of the termites and the need for repairs. All the repairs were undertaken during the 2020-21 income year. The property was first rented to tenants on 1 June 2021 Which of the following statements is most correct in respect to Barbara's ability to claim a deduction for the repair costs? 1) The repairs are not initial repairs as Barbara did not know about them at the time of acquisition and so they are deductible. 2) The repairs are capital in nature, and non-deductible. 3) A deduction is available as the repairs were only performed on part of the residential property 4) The repair costs are deductible as Barbara would have paid a lower purchase price if he had known of the need for repairs. A W 5 6 7 8 9 0 E R. T T U O 3 Saved 6 Question 6 (1 point) Steve purchased a hardware business for $120,000 by taking out a business loan with ZNA Bank Ltd on 1 July 2018. The interest rate on the business loan was 10% per annum, and the loan term was ten years. In setting up the loan, Steve also had to pay loan establishment fees and stamp duty of $1,500. In the 2020-21 income year, Steve sold the business at a loss, and he could not pay out the remaining balance of the bank loan. The interest expense for the 2020-21 income year was $12,000. 9 In relation to the above facts which one of the following statements is most likely correct in relation to the interest? 1) Steve would be able to claim an immediate deduction equal to the income of any income which she derived during the year. 2) Steve would not be entitled to a deduction for any of the interest since she used the loan to purchase a capital asset. 3) Only the interest on the business loan for the first three years will be deductible for Steve, as after that date there is no business being operated. 4) The interest of $12,000 after Steve sold the business should continue to be deductible