Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rosanna Co. is a multinational export-import company based in Melbourne. Recently, Rosanna Co. signed two contracts. In the first contract, Rosanna Co. will purchase

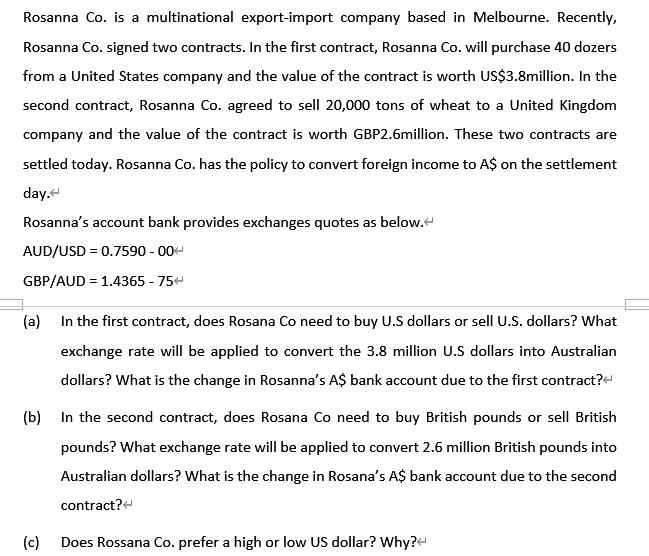

Rosanna Co. is a multinational export-import company based in Melbourne. Recently, Rosanna Co. signed two contracts. In the first contract, Rosanna Co. will purchase 40 dozers from a United States company and the value of the contract is worth US$3.8million. In the second contract, Rosanna Co. agreed to sell 20,000 tons of wheat to a United Kingdom company and the value of the contract is worth GBP2.6million. These two contracts are settled today. Rosanna Co. has the policy to convert foreign income to A$ on the settlement day. Rosanna's account bank provides exchanges quotes as below. AUD/USD = 0.7590-00- GBP/AUD 1.4365-75- (a) In the first contract, does Rosana Co need to buy U.S dollars or sell U.S. dollars? What exchange rate will be applied to convert the 3.8 million U.S dollars into Australian dollars? What is the change in Rosanna's A$ bank account due to the first contract? (b) In the second contract, does Rosana Co need to buy British pounds or sell British pounds? What exchange rate will be applied to convert 2.6 million British pounds into Australian dollars? What is the change in Rosana's A$ bank account due to the second contract? (c) Does Rossana Co. prefer a high or low US dollar? Why?

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a In the first contract Rosanna Co needs to buy US dollars to fulfill its payment obligation to the United States company To convert the US38 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started