Answered step by step

Verified Expert Solution

Question

1 Approved Answer

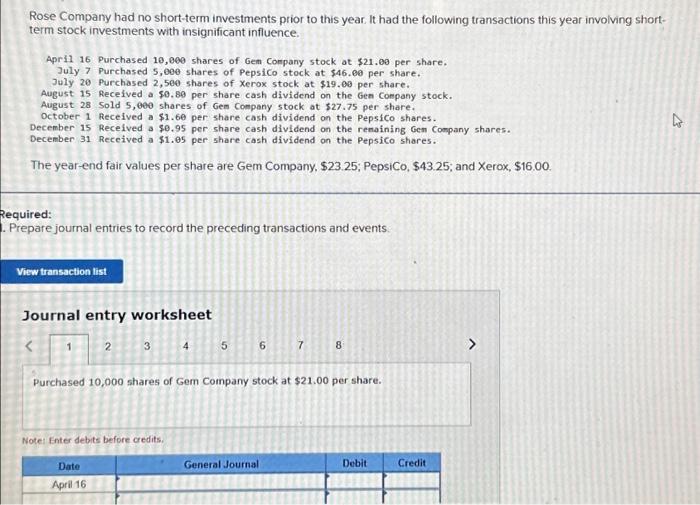

Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence.

Rose Company had no short-term investments prior to this year. It had the following transactions this year involving short- term stock investments with insignificant influence. April 16 Purchased 10,000 shares of Gem Company stock at $21.00 per share. July 20 July 7 Purchased 5,000 shares of PepsiCo stock at $46.00 per share. Purchased 2,500 shares of Xerox stock at $19.00 per share. August 15 Received a $0.80 per share cash dividend on the Gem Company stock. August 28 Sold 5,000 shares of Gem Company stock at $27.75 per share. October 1 Received a $1.60 per December 15 Received a $0.95 per share cash dividend on the remaining Gem Company shares. December 31 Received a $1.05 per share cash dividend on the PepsiCo shares. share cash dividend on the PepsiCo shares. The year-end fair values per share are Gem Company, $23.25; PepsiCo, $43.25; and Xerox, $16.00. Required: 1. Prepare journal entries to record the preceding transactions and events. View transaction list Journal entry worksheet 1 2 3 Date April 16 Note: Enter debits before credits. 4 5 6 Purchased 10,000 shares of Gem Company stock at $21.00 per share. General Journal 7 8 Debit Credit 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started