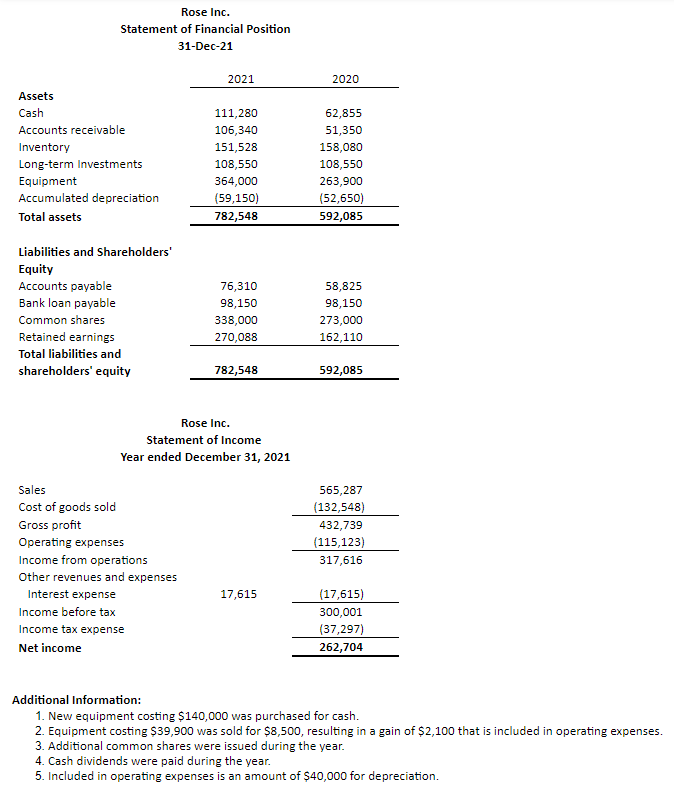

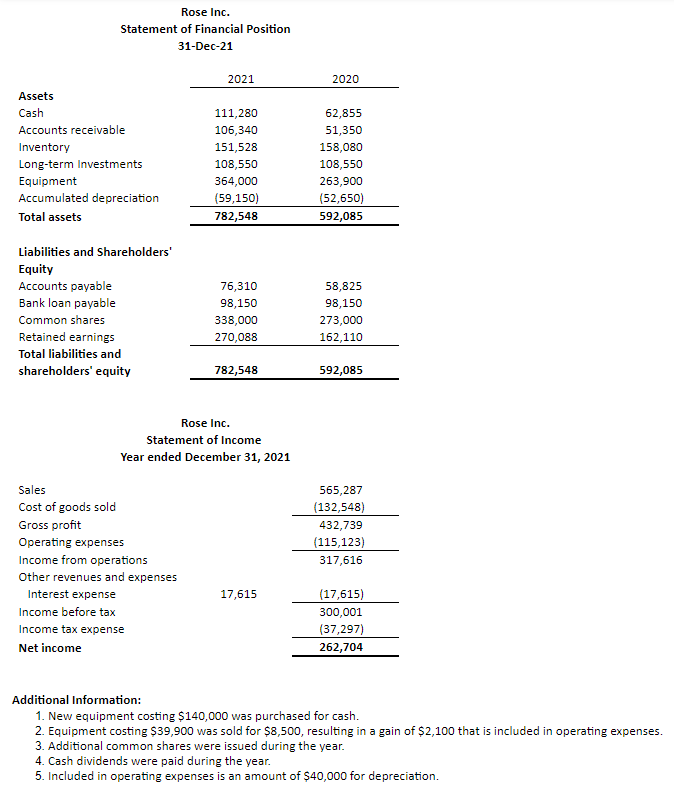

Rose Inc. Statement of Financial Position 31-Dec-21 2021 2020 Assets Cash Accounts receivable Inventory Long-term Investments Equipment Accumulated depreciation Total assets 111,280 106,340 151,528 108,550 364,000 (59,150) 782,548 62,855 51,350 158,080 108,550 263,900 (52,650) 592,085 Liabilities and Shareholders' Equity Accounts payable Bank loan payable Common shares Retained earnings Total liabilities and shareholders' equity 76,310 98,150 338,000 270,088 58,825 98,150 273,000 162, 110 782,548 592,085 Rose Inc. Statement of Income Year ended December 31, 2021 565,287 (132,548) 432,739 (115,123) 317,616 Sales Cost of goods sold Gross profit Operating expenses Income from operations Other revenues and expenses Interest expense Income before tax Income tax expense Net income 17,615 (17,615) 300,001 (37,297) 262,704 Additional Information: 1. New equipment costing $140,000 was purchased for cash. 2. Equipment costing $39,900 was sold for $8,500, resulting in a gain of $2,100 that is included in operating expenses. 3. Additional common shares were issued during the year. 4. Cash dividends were paid during the year. 5. Included in operating expenses is an amount of $40,000 for depreciation. Rose Inc. Statement of Financial Position 31-Dec-21 2021 2020 Assets Cash Accounts receivable Inventory Long-term Investments Equipment Accumulated depreciation Total assets 111,280 106,340 151,528 108,550 364,000 (59,150) 782,548 62,855 51,350 158,080 108,550 263,900 (52,650) 592,085 Liabilities and Shareholders' Equity Accounts payable Bank loan payable Common shares Retained earnings Total liabilities and shareholders' equity 76,310 98,150 338,000 270,088 58,825 98,150 273,000 162, 110 782,548 592,085 Rose Inc. Statement of Income Year ended December 31, 2021 565,287 (132,548) 432,739 (115,123) 317,616 Sales Cost of goods sold Gross profit Operating expenses Income from operations Other revenues and expenses Interest expense Income before tax Income tax expense Net income 17,615 (17,615) 300,001 (37,297) 262,704 Additional Information: 1. New equipment costing $140,000 was purchased for cash. 2. Equipment costing $39,900 was sold for $8,500, resulting in a gain of $2,100 that is included in operating expenses. 3. Additional common shares were issued during the year. 4. Cash dividends were paid during the year. 5. Included in operating expenses is an amount of $40,000 for depreciation